Carpeesh is a unique car insurer because they use a driver safety app, which then tracks how you drive and can save you money if you're a good and safe driver.

Carpeesh car insurance has four comprehensive policies tailored to specific drivers. If you're a good driver, young driver, or you need your car for work or ridesharing, they have a policy designed for you. If you don't use your car for commuting to work, you might be able to get a cheaper policy.

Must read

What cover does Carpeesh Car Insurance offer?

Carpeesh has four available cover types. When you take out a policy, you will qualify for a cover type based on the information you provide in your application. The cover type you qualify for will be set out in your Policy Certificate. The four cover types are:

- Good driver.

- Private use. This cover is for cars where all listed drivers are aged 26 or older who use their car for social or domestic purposes. This does not include travel between home and work.

- Private and commuting use. This cover is for cars where all listed drivers are aged 26 or older who use their car for social or domestic purposes and for travel between work and home, or for limited business use of no more than four trips per month.

- Young driver.

- Private use. This cover is for drivers 25 years or younger who use their car for social or domestic purposes. This does not include travel between home and work.

- Private and commuting use. This cover is for drivers 25 years of age or younger who use their car for social or domestic purposes and for travel between work and home, or for limited business use of no more than four trips per month.

- Worker. This is for cars that are used for both work and domestic purposes. This can include full-time, part-time or casual work, but not ridesharing services.

- Rideshare. This is for cars used by listed drivers to perform the task of carrying passengers for payment for rideshare or carpooling app services, like Uber, as well as for their own domestic purposes and commuting. It's not designed for cars used exclusively for taxi or chauffeur services.

What do Carpeesh policies cover?

Here are some of the features you'll get with all Carpeesh policies.

- No excess where you're not at fault. You won't have to pay an excess for an incident where Carpeesh agrees that you or the driver of your car was not at fault.

- Cleaning and repair if your car is stolen and recovered. If your car is stolen but later recovered and Carpeesh haven't paid a claim for the theft, they will have your car cleaned for you and replace broken glass and other damage. No excesses apply to this benefit.

- Personal effects damaged in a collision will be replaced, up to a specified amount. Get up to $250 for damage to personal effects that were in your car.

- Cover for removal of debris at the site of an incident. Debris removal at the site of an incident covered up to a maximum of $350.

- Repair or replacement of roof or bicycle racks. Get up to $250 for the repair or replacement of roof racks or bicycle racks.

- New car changeover. If you buy a new car, they will cover your old car listed on your Policy Certificate for up to 14 days after you replace it.

- Emergency travel and accommodation cover. Get up to $100 per day and up to a total of $750 for emergency travel and accommodation expenses if you're more than 150km from home and your car is stolen or not drivable.

- Towing on non-driveable cars after an incident. Towing costs covered by a towing service approved by Carpeesh. A limit of up to $500 applies.

- Replacement keys if they're stolen. Up to $700 towards replacing, re-coding or re-keying locks. This does not include misplaced or lost keys.

- Trailer coverage. A limit of $500 for loss or damage to a trailer which is owned by you and is attached to your car and being used for private use only.

- Replacement new car after a total loss. Replacement of your car after total loss if your car was less than two years old at the time of the incident and you purchased it new

- Hire car after theft. They will pay for the hiring of a compact car, for 14 days up to a limit of $750 in total.

- Window glass replacement (an excess will likely apply). Cover for the replacement of a front windscreen and all window glass, regardless of the number of incidents that result in a claim.

- No excess window glass repair. If a windscreen or window glass is damaged in an incident covered by your policy and can be repaired, rather than replaced, no excess applies.

What else can I get with a comprehensive policy?

Depending on the policy you purchase, you might also be entitled to the following benefits. Otherwise it can be added-on to your policy.

- Recovery of injured wildlife. Carpeesh will cover you up to $100 towards animal road recovery by the local wildlife group if an animal that is not your pet is injured in an incident covered by your policy. If they can't retrieve the animal, they'll donate $100 towards a wildlife recovery centre in your state. This is included with most policies.

- Hire car benefit after an accident. This is included as a standard benefit with worker and rideshare cover types and an optional extra with good driver and young driver policies. It covers you for a hire car for up to 14 days, up to a limit of $750 after an insured event.

- Optional Windscreen benefit. You can reduce your excess for windscreen or window damage if you choose the Optional Windscreen benefit.

What exclusions should I be aware of?

Every insurance policy has exclusions. The following list highlights some of the exclusions in Carpeesh's car insurance policies.

- Your car was used by an unacceptable driver e.g. the person in control of the car is not licensed or not complying with the conditions of their licence,

- Your car was used as a courier or delivery car, unless you have taken out the rideshare cover.

- Loss or damage as a result of any intentional or reckless act(s) or acts by you or an insured person.

- Loss or damage to the tools of trade of your business carried in your car.

- Loss or damage to your car if it is being used to store or transport dangerous goods.

- You damage your car by using incorrect fuel.

- If damage occurs by any driver excluded by age.

For a full list, be sure to read their product disclosure statement (PDS).

Compare other Australian car insurance providers

Compare other products

We currently don't have that product, but here are others to consider:

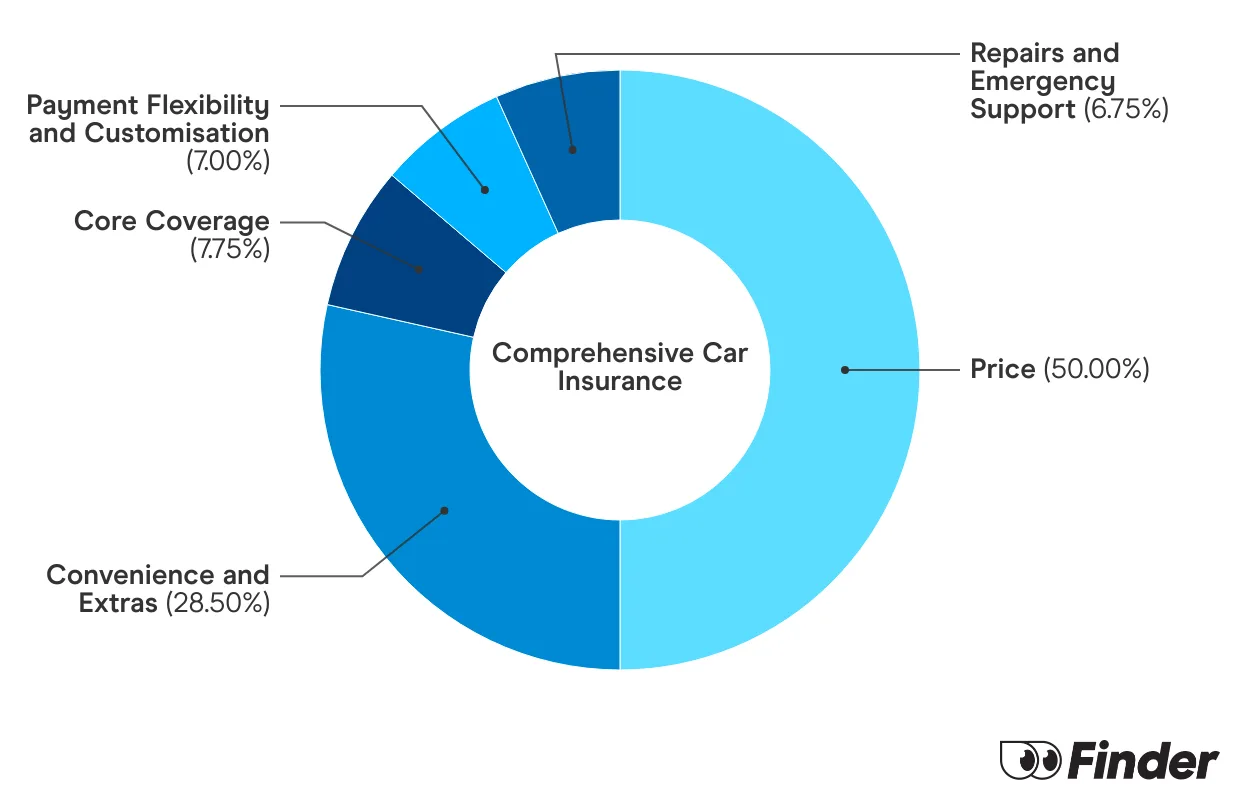

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Sources

More guides on Finder

-

NRMA roadside assistance options compared

NRMA offers 3 levels of roadside assistance. We’ve compared the pricing and features of them all in this article.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.