Compare other products

We currently don't have that product, but here are others to consider:

How we picked thesePersonal loan interest rates tend to be peresonalised. That means the rate you'll get depends on factors like your credit score, income, liabilities and other factors. The lowest personal loan rates are for borrowers with excellent credit scores taking out secured personal loans.

But whatever your personal situation is, there are ways to get a lower rate and save money on a personal loan.

- Lowest unsecured personal loan rate: Harmoney Unsecured Personal Loan: 5.76% (comparison rate 6.55%).

- Lowest secured personal loan rate: MoneyPlace Secured Personal Loan: 5.67% (comparison rate 7.14%).

- Average unsecured personal loan rate in Finder's database: 10.35% p.a.

- The average Australian with a personal loan borrows $10,664 with a 3 year term according to Finder's data.

How much can you save with a low rate personal loan?

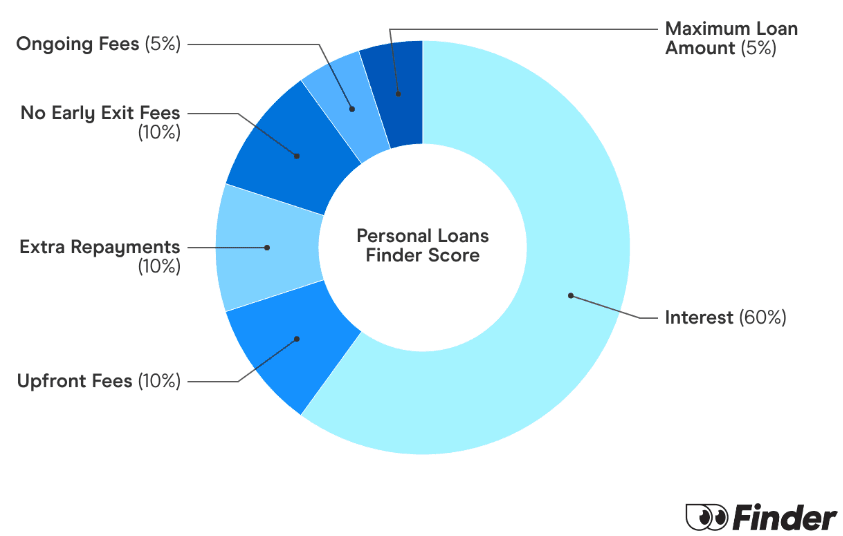

While fees are important too, it's the interest rate that has the biggest impact on most personal loans.

A lower rate means lower monthly repayments and less interest paid over the life of the loan.

Let's compare loans to see how a lower interest rate would impact the cost of the loan:

| Loan amount | Loan term | Interest rate (p.a.) | Monthly repayments | Total loan cost* |

|---|---|---|---|---|

| $15,000 | 1 year | 14.00% | $1,346 | $16,162 |

| $15,000 | 1 year | 19.00% | $1,382 | $16,588 |

| $15,000 | 1 year | 27.00% | $1,440 | $17,283 |

*For this simple example we've ignored loan fees, but it's important to factor in any upfront and ongoing fees.

"1. Check your credit score before you apply. A higher score usually unlocks better rates.

2. Compare rates from multiple lenders to make sure you're getting a more competitive offer.

3. Choose your loan length carefully: too long and you'll pay more interest, too short and your monthly repayments will be too high (use a calculator to check)."

How can I get a low interest personal loan?

Not every borrower will qualify the absolute lowest personal loan interest rate on offer, but there are things you can do to get a lower rate. Here are our six tips:

1. Improve your credit score

The best thing you can do to get a lower interest rate is improve your credit score. This means making regular payments on existing debts and making sure you don't have any missed payments or defaults. You could also lower your credit card limit and make sure you only have one card.

2. Offer security

Having an asset to act as collateral (like a car or house) can get you a lower rate. If you have an asset you can and are willing to secure, it's worth checking if you can use it even when applying for a loan advertised as unsecured. Just make sure you can comfortably afford the repayments so you don't risk losing that asset.

3. Borrow less

A smaller loan amount makes you a less risky borrower in a lender's eyes. And it may get you a slightly lower personal loan rate. Keep in mind that some lenders might reject a small loan application if the loan is under its minimum loan amount.

4. Compare your options

Don't just go to your bank and don't apply with the first lender you see. Compare personal loan rates, fees and features from multiple lenders. The market is competitive and you might find a great deal from an online lender. But remember that the minimum rate advertised isn't necessarily the one you'll end up with.

5. Meet all the lending criteria

Before you apply for a loan, check the loan's terms and conditions carefully. Make sure you as a borrower meet the lender's requirements. Otherwise you'll get rejected, or end up on a higher rate.

6. Negotiate

You can sometimes ask the lender for a lower interest rate. If you find a lower rate elsewhere you could ask them to match, for example. This works if you already have a personal loan too.

Borrowers who already have personal loans can get lower rates too

The above point about negotiating with your lender applies to people who already have loans too. Let's say you've significantly improved your credit score since you took out the loan. Tell your lender and see if they can give you a lower rate.

And you can also refinance to a new low-rate personal loan. This is a good option if you find a better rate but your lender won't negotiate.

How your credit score affects your interest rate

Like we've already said, personal loans use risk-based pricing. The interest rate you're given is determined by your credit score, your income, your outstanding debts and the type of loan you're applying for.

This is why you'll see an interest rate range advertised, like:

- Interest rate: 8.49% p.a to 27.9% p.a.

The lowest possible rate you can get here is 8.49% p.a. That's if you have an excellent credit score and meet the lender's criteria. But if your credit score isn't so good, your rate could be as high as 27.9% p.a.

Before applying for any personal loan you should know what your credit score is. You can check your credit score for free through Finder in just minutes.

Check your credit score for free

Which personal loans have the lowest rates?

The type of personal loan you're looking for has an impact on the rate you can get.

- Secured loans. If you have an asset, usually a car or property, you can offer that as security for your lender. This means you'll get a lower rate compared to an unsecured personal loan.

- Risk-based personal loans (if you have excellent credit). Most lenders use risk-based pricing, meaning your rate is lower if you have a good or excellent credit score and meet the lender's criteria. If you have a strong credit score then a risk-based personal loan could offer a lower rate.

- Loans from online lenders. Online lenders have lower operating costs and often boast some of the market's lowest personal loan rates. But these days even the big banks offer quite competitive rates. That's why comparing all your options is so important.

Can I still get a competitive rate with an unsecured loan?

How do I compare to find a low interest personal loan?

A low rate personal loan can become expensive if it has high fees and a long loan term. It's also pointless if it's not the right loan for your needs.

These are the key things to look at in your comparison to finding the right loan:

- Interest rate. A solid start to finding that low rate personal loan is to look for the lowest advertised rate. Remember that this normally advertises the lowest rate the lender offers, so if you don't have a perfect credit score you will probably be offered a higher rate. Non-risk based loans do exist though, where everyone who is approved receives the same interest rate regardless of credit score.

- Comparison rate. The comparison rate gives you an idea of how expensive a loan is when you include monthly and establishment fees. This is an example based on a 'typical' loan, so it won't be exactly the same for you however it's still the easiest way to see how expensive the loan is at a glance.

- Loan features. If a personal loan lets you make extra repayments and allows you to pay off the loan early, you can save money by getting out of debt faster. Some loans may have a cap on how many extra repayment you can make in a year. Some may not allow it at all.

- Fees. Personal loan fees can be hefty. There's usually an application fee of more than $100, or a fee charged as a percentage of the loan amount. And there's often a small monthly fee too. Add up the cost of fees before you apply for a loan.

- Loan terms. If your loan has a long term (say, 5 years) your monthly repayments will be smaller. But you'll pay much more interest over 5 years. A shorter loan term works out cheaper because you'll pay less interest. However, your monthly repayments will be higher. So you need to find a balance between a short and long loan term.

- Loan purpose. Not every borrower needs a lump sum of cash right now. There are other loan types that might work out cheaper for you, even with a higher rate. If you have a series of expenses to cover over time then a line of credit might work better. Or a personal overdraft.

Frequently asked questions about low interest personal loans

Why compare personal loans with Finder?

Addicted to details - we know taking out a personal loan is something you'll be hooked up with for a while. That's why we put hours into research for this guide (and still do at least once a month).

Addicted to details - we know taking out a personal loan is something you'll be hooked up with for a while. That's why we put hours into research for this guide (and still do at least once a month).

Rates obsessed - lenders come in all shapes and sizes, that's why we don't just track the big banks, but all the digi folk too. Pretty much everyone but your parents to be honest.

Rates obsessed - lenders come in all shapes and sizes, that's why we don't just track the big banks, but all the digi folk too. Pretty much everyone but your parents to be honest.

Cash for whatever you need - Lending rates verified from 180+ products day and night. Whether you're buying a car, rennovating your home or heck just ready to let loose with the spending - we got you.

Cash for whatever you need - Lending rates verified from 180+ products day and night. Whether you're buying a car, rennovating your home or heck just ready to let loose with the spending - we got you.

Sources

Ask a question

30 Responses

More guides on Finder

-

OurMoneyMarket Unsecured Low-Rate Personal Loan ($20,000-$100,000)

A marketplace personal loan with personalised interest rates.

-

Revolut Personal Loan

Borrow between $5,000 and $50,000 with an unsecured personal loan from Revolut, and don't pay any fees while you repay!

-

OurMoneyMarket Secured Personal Loan

Read Finder's review of OurMoneyMarket's Secured Personal Loan. See if this loan is right for you.

-

MoneyPlace personal loan

This secured loan may be used for any worthwhile purchase and requires security against a vehicle. It uses risk-based pricing, so your interest rate will be set based on your credit score and history.

-

NOW Finance Secured Personal Loan

A risk-based personal loan from one of Australia's biggest non-bank lenders. Get a personalised rate which rewards higher credit scores.

-

Plenti Personal Loans

Looking for a competitive rate? Plenti offers loans funded by investors with rates that are tailored to your personal circumstances.

-

ING Personal Loan

An ING personal loan offers certainty with fixed interest rates and fixed repayments over a set term.

-

Harmoney Personal Loan

An unsecured personal loan with interest rates tailored to your risk profile.

-

Joint Personal Loans

If you're wanting to bolster your application, buy an asset with your partner or apply for a loan you're not eligible for by yourself, you can consider a joint application personal loan.

-

Personal loans for temporary residents

Temporary Australian residents may be eligible to apply for personal loans, depending on the visa they hold.

Personal Loan

Hi Anwar,

Thanks for reaching out to Finder!

I see you’re interested in getting a personal loan. You can use our comparison table to help you find the lender that suits you. When you are ready, press the ‘Go to site’ button to apply. As a friendly reminder, review the eligibility criteria of the loan before applying to increase your chances of approval. Read up on the terms and conditions and product disclosure statement and contact the bank should you need any clarifications about the policy.

Hope this helps!

Best,

Nikki

Hi! When applying for a personal loan via this site, do the lenders only look at your credit score and report on finder as there are many different credit score sites that display different credit scores.

Thank you!

Hi Reb,

Thanks for getting in touch with finder. I hope all is well with you. :)

When you apply for a personal loan featured on our website, the lenders have their own way of assessing your eligibility. The credit score you get from our website is generated by Experian. There are a lot of lenders who use Experian, but there are also those that use other credit reporting bureaus.

In most cases, there is a small discrepancy between scores that you get from different bureaus. If the discrepancy is huge, then there could be an error that you need to fix.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers,

Joshua

Can I go for a loan?

Hi Lee,

Thanks for getting in touch with finder. I hope all is well with you. :)

Yes, you can go for a loan as long as you meet the eligibility requirements of your chosen lender. You can compare your options above by using our comparison table. You can compare based on interest rate, loan term, and fees, to name a few. Once you found the right one for you, click on the “Go to site” green button to learn more or initiate your application.

Please make sure that you’ve read the relevant T&Cs or PDS of the loan products before making a decision. Moreover, check the eligibility requirements as well and consider whether the product is right for you.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers,

Joshua

hi, I am looking for a medical dental done overseas and pay a small personal loan and a credit card ,probably make extra repayments so I can pay back the sooner I can I need to borrow 25000.

Hi Wilfredo,

Thank you for leaving a question.

This page gives you a comprehensive list of lenders that you could reach out to if you need to borrow money. Kindly review and compare your options on the table displaying the available providers. Once you have chosen a particular provider, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. Hope this helps!

Cheers,

Reggie

I want to buy land in Thailand with my Thai wife we are looking for $45000 can you suggest the best loan for this.

Hi Paul,

Thanks for your inquiry

Generally, Australian banks can’t take a foreign property as security for a home loan. However, they can help you fund your future investment plans if you have an existing property with enough equity. There are also a number of non-Australian owned international banks that may be able to help you with finance. A mortgage broker may be able to help you with this by getting touch with the branch themselves.

One important thing to note is that some countries limit you to borrowing 80% of the property value or Loan to Value Ratio (LVR).

Hope this information helps

Cheers,

Arnold