0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

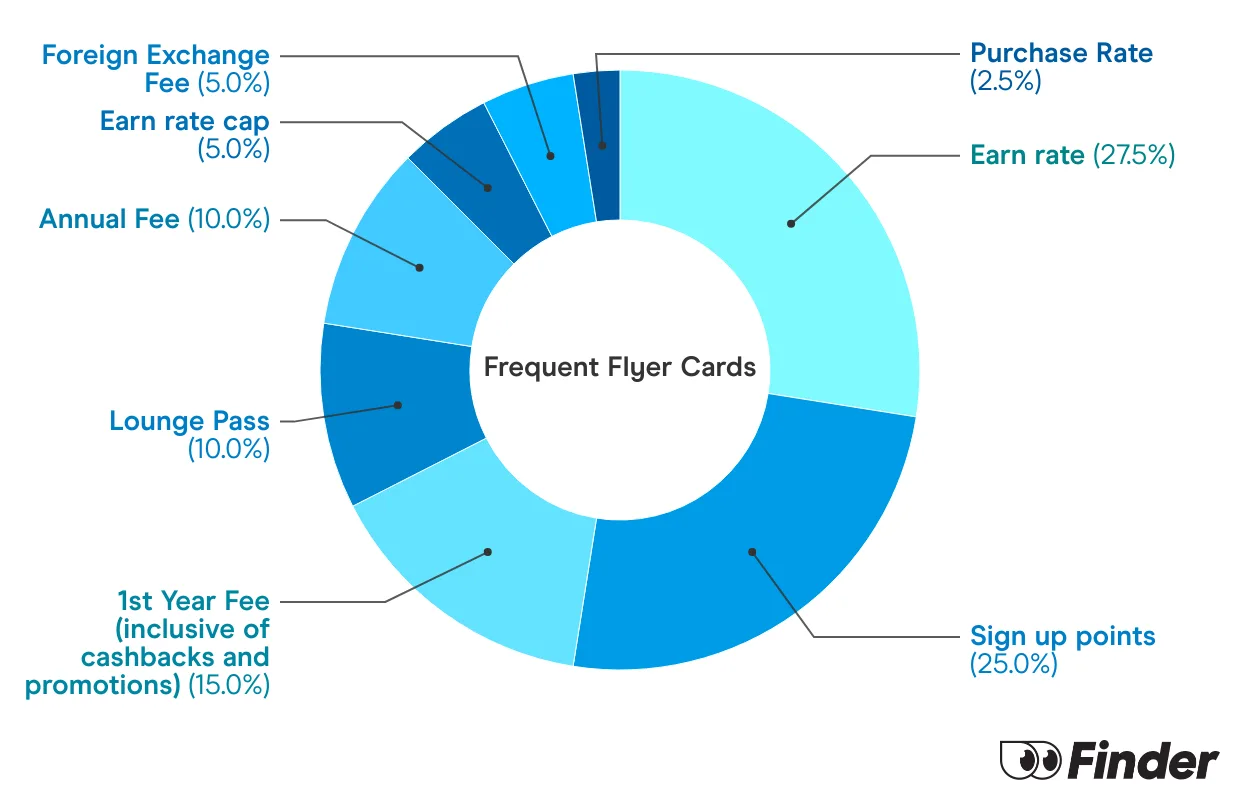

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

I received a Bendigo Bank Platinum Mastercard. Is this a credit card?

Hi Rachel,

If you are pertaining to Bendigo Bank Platinum Rewards Mastercard, this is a credit card.

This premium Mastercard offers complimentary enrolment in the Bendigo Bank Rewards program, earning 1.5 Bendigo Rewards points per $1 spent, with no points cap. In addition to these benefits, it offers up to 55 days interest-free on purchases and includes complimentary international travel insurance, purchase protection insurance and extended warranty covers.

With the bonus points qualification would you be able to pay via post billpay with the CC linked to Paypal? And then it wouldn’t count as a government body?

Hi Espresso22,

Technically, this is possible. However, terms and conditions vary extensively between credit cards. It would be best to check the T&C of the card you are planning to apply for and please make sure you also checked and meet the other eligibility requirements to receive the bonus points. Please click the ‘ Go to site ‘ button of the credit card that you have chosen to proceed with the application.

Can a person who has a supplementary Am Ex platinum credit card apply for the Qantas Frequent Flyer credit card and receive the 100,000 bonus Qantas Points when they achieve the minimum spend in three months?

Hi Greg!

Yes, one can apply for the Qantas Frequent Flyer credit card and receive 100,000 bonus Qantas Points when you apply online by 9 April 2018, are approved and spend $3,000 on your new Card within the first 3 months. This offer is available to new Card Members, as well as Bank-issued American Express companion cardholders.

I can’t get a Westpac credit card is it possible to get a debit card with Westpac and still receive points???

Hi,

I understand that you are asking about a Westpac debit card and still get points. Although you can not earn bonus points with Westpac debit cards, they have debit cards that offer rewards. You can refer to this page – https://www.finder.com.au/bank-accounts/reward-debit-cards

I was about to cancel Citi Bank CC because they still charge a high fee with less benefits. Can they knock me back if I the apply for a new card (fresh app) to get the 100,000 points

Hi David,

If you are planning to apply for any new credit card from the above list, you may do so provided that you meet all the eligibility criteria of the card. I don’t think the card company will not approve you if they can see that you meet the requirements or they find you eligible.

So before you submit your final application, best to check and review the requirements first, PDS of the card and its details/features before you consider the product is right for you.