Compare Velocity credit cards

The cards in this table let you earn Velocity Points directly, or earn points in a reward program that you can convert to Velocity Points.Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseThis month's best Velocity credit card offers

- The American Express Velocity Platinum Card has a Finder Score of 9.9.

- The American Express Velocity Business Card has a Finder Score of 9.35.

- The Westpac Altitude Velocity Black has a Finder Score of 8.43.

Read more about how the Finder Score determines the best credit cards on the market.

Updated February 2026 by money editor, Richard Whitten.

What is a Velocity credit card?

A Velocity credit card lets you earn Velocity Points via Virgin Australia's Velocity frequent flyer program.

You can redeem these points for reward flights with Virgin or gift cards, hotels and other rewards.

There are 2 types of Velocity credit card:

- Credit cards that earn Velocity Points directly. These cards earn Velocity Points for every dollar you spend, which are added straight to your Velocity account. American Express, NAB, Virgin Money and Westpac offer these "direct earn" Velocity Frequent Flyer credit cards. Earning points directly with one of these cards is usually the best way to maximise your points earning potential.

- Reward cards that offer Velocity Points transfers. Some rewards credit cards let you transfer reward points from a credit card rewards program into your Velocity Frequent Flyer account. Some even offer an auto-transfer option. This method is very flexible because you can choose to keep points in your card's reward program or transfer them. And you sometimes get transfer bonuses for converting points.

Transfer rates

But the transfer rates usually result in fewer Velocity Points versus earning them directly. A typical transfer rate is 2 reward points to 1 Velocity Point. For example, if you had 50,000 CommBank Awards Points these would convert to 25,000 Velocity Points.

How do I earn points with a Velocity Frequent Flyer Points with a credit card?

You'll earn points in 2 ways.

- Spending. Every Velocity credit card has an earn rate. The best cards have earn rates of at least 1 point for every dollar you spend. So the more you spend the more points you earn. You earn points on most transactions but typically not on BPAY payments or gambling transactions.

- Bonus points. When you get a new credit card (especially if you're a new customer) you can earn bonus points. The best on the market right now give you between 30,000 and 200,000 Velocity Points this way. You need to spend a certain amount on the card in the first few months or hold the card for a year to get all the points. But the bonus points are an incredible way to boost your Velocity balance.

How to find the best credit card for earning Velocity Points

Here's what to look for when comparing cards:

- The annual fee. Frequent flyer cards that give you tons of points come with higher annual fees (around $300 or more). Make sure you get more value out of the points to offset this fee. The best cards pay for themselves very quickly, especially if you use Velocity Points for high value redemptions like reward flights or business class upgrades.

- The card earn rate. The higher the better, but 1 Velocity Point for every $1 you spend is good.

- The bonus points offer. When getting a new card you should plan to take advantage of the bonus points offer if there is one. This is the best way to earn a stack of points quickly.

- Complimentary insurance. Most frequent flyer cards give you complimentary travel insurance, and maybe other insurance policies like purchase protection insurance.

- Travel perks. Many Velocity cards also give you 2 Virgin Australia Lounge passes per year. Some give you flight credits which can cover the cost of the card annual fee.

- The purchase rate. If you don't repay your card spending in full each month you get charged interest on the unpaid balance. And the interest (or purchase) rate on a frequent flyer card is high, often around 20%

Must read: Not in your best interest

How many Velocity Points do I need for a flight?

You can get Virgin Australia Reward Seat flights from 5,900 Velocity Points, not including carrier charges. For example, this is enough for a one-way Tier 1 economy reward flight from Sydney to Melbourne.

Here are some other examples to give you an idea of the points you'd need for a return flight:

- Sydney to Melbourne in business class: 31,000 points (plus $86 in fees)

- Brisbane to Perth in economy: 53,800 points (plus $112 in fees)

- Sydney to Queenstown (NZ) in economy: 73,800 points (plus $433 in fees).

This means a competitive credit card bonus points offer will give you enough points for a reward flight (or flights).

"I chose Velocity Points over Qantas Points and went with a card that lets me earn Velocity Points directly. My main goal was domestic reward flights, and I shop at Coles more often than Woolies. Now I earn Velocity and Flybuys Points when I shop, and convert the Flybuys to Velocity Points. It pays for multiple domestic reward flights per year."

Calculate how much your Velocity Points are worth

Choose Velocity Frequent Flyer as the program and put the number of points into this calculator to get a dollar value for them.

Frequently asked questions

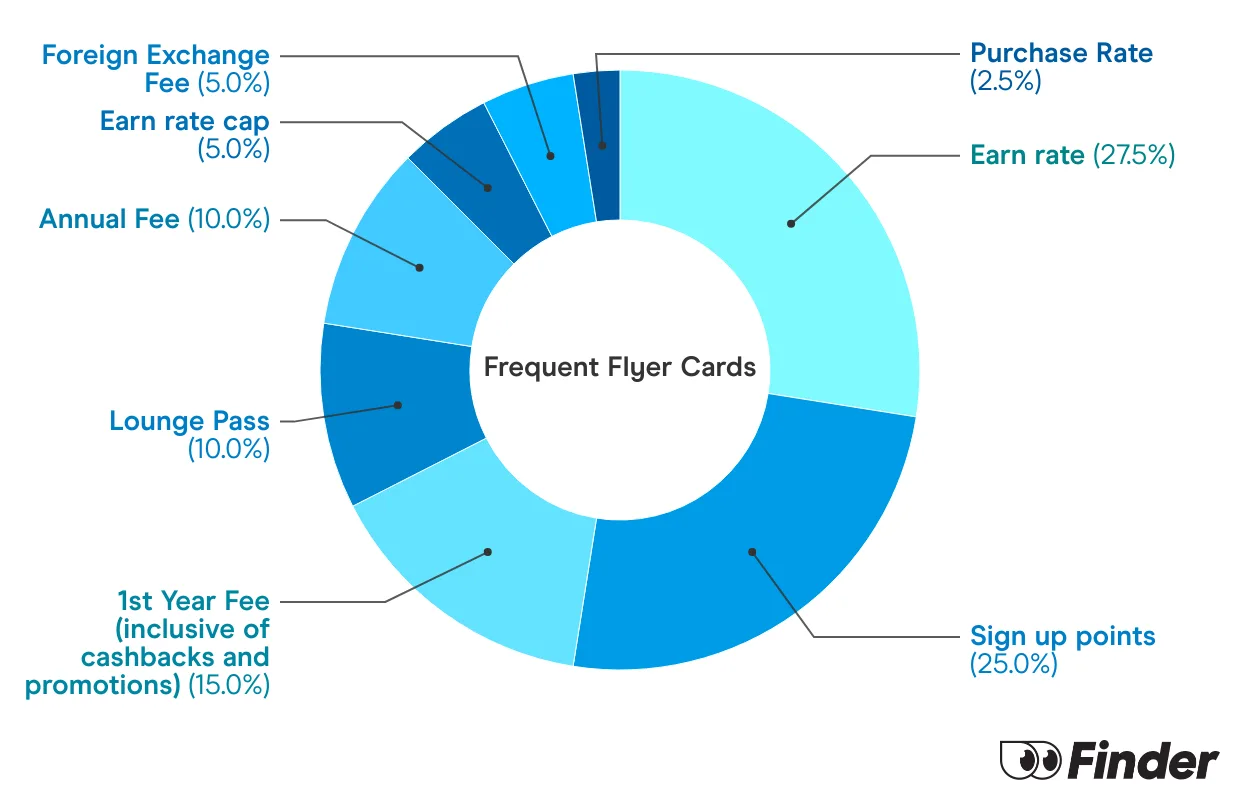

How does the Finder Frequent Flyer Score work?

The Finder Score is an easy way you can figure out which frequent flyer credit cards are worth the trip, and which ones aren't worth getting out of bed for.

Here's how the score works:

- We analyse over 250 credit cards and assess 8 features, giving a score for each one.

- Then we combine these scores using a weighted methodology (because some features are more important than others).

- This gives us a final score out of 10: the Finder Score.

Sources

More guides on Finder

-

Best international credit cards

Find credit cards that make international spending cheaper with 0% international transaction fees.

-

American Express statistics

Insights and analysis on American Express credit cards, costs, acceptance and more.

-

Instant approval credit cards

Compare credit cards that give you an outcome within 60 seconds of when you submit your application online and find out how to increase your chances of getting this type of "instant" credit card approval.

-

Cashback credit cards — up to $500 back

Get a percentage of your spend back, gift cards or vouchers with a cashback credit card. Find out more and compare current offers in our guide.

-

Best Credit Cards in Australia right now

You deserve the best credit card. Let us help you find it.

-

Best Qantas credit cards

Compare the best Qantas frequent flyer credit cards based on bonus point offers, points per $1 spent, rates, fees and other features so you can find a card that works for you.

-

Easy credit cards to get approval for in Australia

When you apply for a credit card online, you could receive a response within 60 seconds. Find out how you to find a card that you're eligible for and increase your chances of approval.

-

Credit cards for people on Centrelink benefits

Find out what your credit card options are, whether you're employed casually or get Centrelink payments as your main source of income.

-

No international transaction fee credit cards

Find out how you can keep your overseas spending costs down by comparing credit cards with no foreign transaction fees and no currency conversion fees.