0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

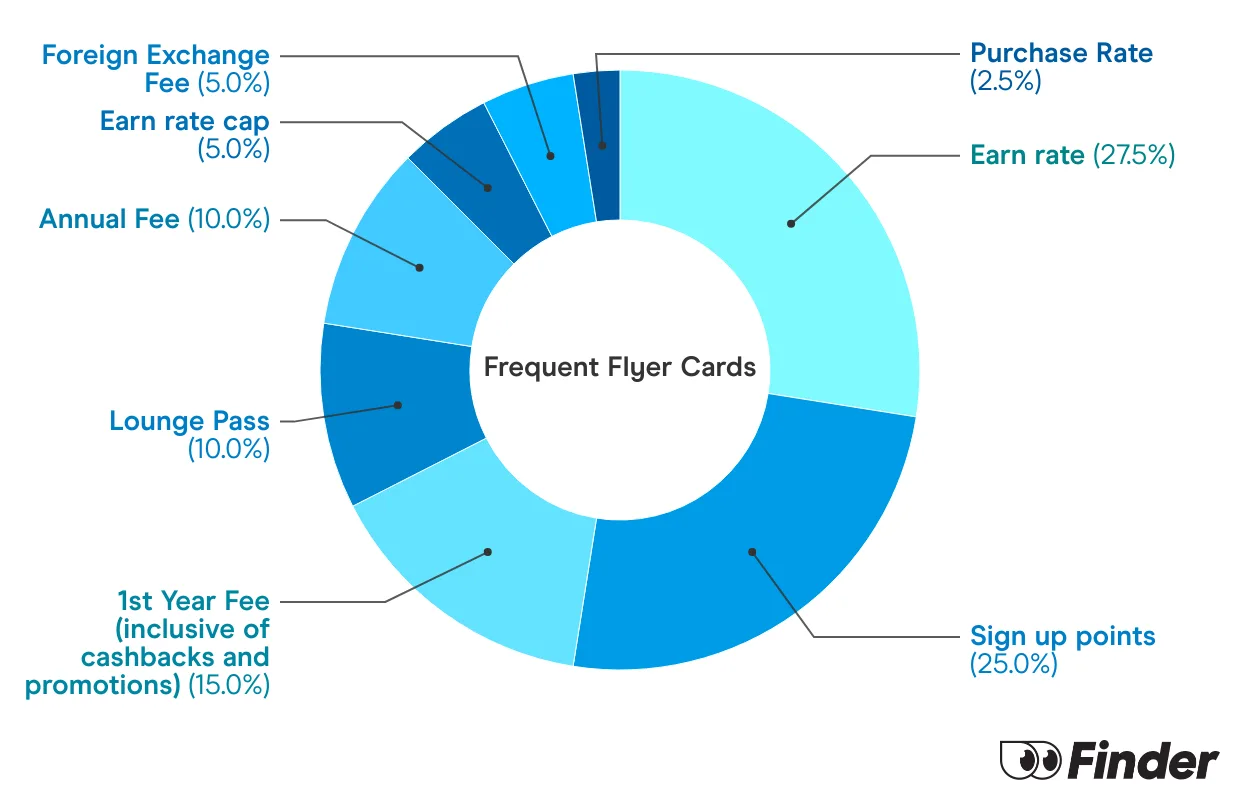

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

Hi, Thanks for your reply. I will indeed go check my credit rating, as I think it is A1, but maybe others do not agree. I did provide HSBC with my SMSF statement showing almost 2 million is assets with no liabilities other than day to day.

So, maybe I have no choice and I am stuck with the Citi credit card.

Citibank advise that BPAY, or Direct Debit payments each month do not attract FF points. I am a bit perplexed as to how you now earn FF points when using a credit card…They keep saying “eligible payments”, without explaining what an eligible payment method is in real English other than their legal terms and conditions.

Are eligible payments those made through the credit card to certain vendors only? Do I have to link the card to these vendors?

Hi Geoff, thanks for your inquiry!

Eligible purchases/ payments typically require a good/ service to be exchanged. You can earn FF points by using your credit card at the point of sale. Since direct debit payments are usually associated with paying bills and charges these transactions do not qualify for earning FF points.

Cheers,

Jonathan

I made an application to HSBC for a Platinum Qantas Credit Card, but they declined me.

They advise there is no, “one” reason for their decision, but i am sure they must there must be a reason. Can I make them tell me the reason(s) for declining me?

I have had a credit card all my life, never been in default, or late payment, and my credit history should be perfect, as never any issues. My present credit card has a limit of $25,000, and they keep offering me more….The new card would have provided greater points earning ability.

The only issue maybe, is that I retired a few years ago. However, my income from my super and private investments gives me an annual income of $60,000+, and despite a few world trips each year over the last three years with Qantas in First and Business, my super balance is still going up, proving we can live within the income range.

I would have thought, some one like me with a million plus in super, with no mortgages etc is a far better risk than some person an a salary paying a mortgage and other commitments, with their job always in question…..

Hi Geoff,

Thanks for your question and we’re sorry to hear about your declined credit card application. If your credit history is in good standing and you meet the eligibility requirements, perhaps you didn’t include all of the necessary information (such as superannuation statements and assets) to prove your income.

Declined credit card applications can have a negative impact on your credit score, so you might want to take some time comparing your options before applying for another one. In the mean time, you might like to read over the product disclosure statement to confirm which documents you need to provide to increase your chances of approval.

I hope this has helped and we’re sorry we can’t provide you with more specific information.

Cheers,

Sally

Is direct debit payment considered to be an eligible purchase with BankWest Qantas transaction account? Thanks

Hi Thoi, thanks for your inquiry!

Direct debit payments can qualify as eligible purchases providing a good/ service is being exchanged for funds. Transactions that do not qualify as eligible purchases include cheques, any transaction which incorporates a cash-out transaction at any merchant, BPAY payments, interest charges, government charges and business related expenses. Please refer to page 3 clause 5 of the PDF I have sent to your email for the full list of ineligible transactions.

Cheers,

Jonathan

My present credit card provider has advised me from May they will no longer accept payments via BPay as eligible payments to earn Qantas FF points. Is the BPay payment a common restriction?

I am thinking of using the Bank@Post as an alternative

Hi Geoff,

Thanks for your inquiry!

A number of banks/ issuer allow bill payments to earn Qantas FF points. So we can inform other users to this update could you please let us know who your credit card issuer is?

Thanks,

Jonathan

Hi, I was looking at the HSBC card which allows bill payments to be claimed as flyer points…I am in the process of an application…But, when I look at their site, it seems to be saying they do not allow BPAY ??

“Ineligible transactions for earning points includes balance transfers, cash advances, interest free transactions and HSBC’s special promotions, business expenses, fees or charges (including government), any value charged to your card in association with a points plus pay redemption, any expenditure incurred as part of a ‘points plus pay’ transaction, a transaction which HSBC decides is fraudulent or involves the abuse of a card, a disputed debit transaction and finally BPAY transactions.”

Hi Geoff, thanks for your response.

That is correct, unfortunately HSBC does not allow earning points with BPAY transactions. Since earning points with BPAY payments is less common transaction the best way to approach this would be to narrow down your list of credit card options and determine whether each bank accepts BPAY payments or not. Were there any other credit cards you were considering to apply for?

Cheers,

Jonathan

Hi, Any card will do that I can use my monthly payment to attract points.

My present card will have annual fees of $160. Unless I can earn sufficient points, maybe the award card is not worth it?

Maybe I go back to the old way of paying the card – A bank transfer! I do not see any reference to this as being not an eligible payment.

Hi Geoff,

Thanks for your inquiry!

That is correct. It is beneficial to take your annual fee into account and assess whether you earn sufficient points to justify the value of having a particular rewards card. You can compare a range of Qantas credit cards and check your options. You can compare these cards based on annual fees, interest rates, and rewards points earned per $1 spent.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you.

I hope this helps.

Cheers,

Jonathan

Hi Jonathon,

My current provider is Cardservices – Mycard (part of the citigroup)

They have advised me about a few changes:

BPAY transaction no longer able to earn reward points.

The international transaction fee will be 3.4% of the AUD dollar conversion of any transaction made in a foreign currency.

Any transaction made with an overseas merchant in Australian Dollars, of which a 1% service and assessment fee is payable by Mycard to MasterCard

A $49.00 annual fee for the rewards program(used to be free)

Change from 1 point for each Australian Dollar to 1 point for each Australian Dollar for the first $1500 spent each statement period and 0.5 Points thereafter.

Platinum reward points earn rate reduced from 1.25 to 1 point

So, in my case, I pay my card each month via BPAY, which I have done for many years). If I can no longer earn points this way, I need to find another way of making payment(I have asked them this and they are considering my request)

OR look for a new card provider. But, now retired, obtaining a new card may not be as easy when working.

Hi Geoff,

Thanks for your reply!

We can confirm that Citi has cancelled the feature of earning Qantas Points with BPAY payments. Since this feature varies between banks please refer to the section ‘Which credit card issuers let you earn Qantas Points paying bills’ for an evaluation of which banks still allow this points transaction.

Please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you.

Cheers,

Jonathan

What are the affiliated shops were you earn double points

Hi Ash,

Thank you for your inquiry.

We can’t provide a full list of the shops where you can earn double points. These offers may also vary on the credit cards or issuers that lets you earn Qantas Points. You may want to go directly to Qantas Store website or contact a customer service representative directly, they may able to assist you further with your concern.

Kindly visit our guide to Qantas Frequent Flyer program partners.

I suggest that you revisit the relevant product disclosure statement and terms and conditions to ensure that you got everything covered on your transactions.

I hope this helps.

Cheers,

Debbie