0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

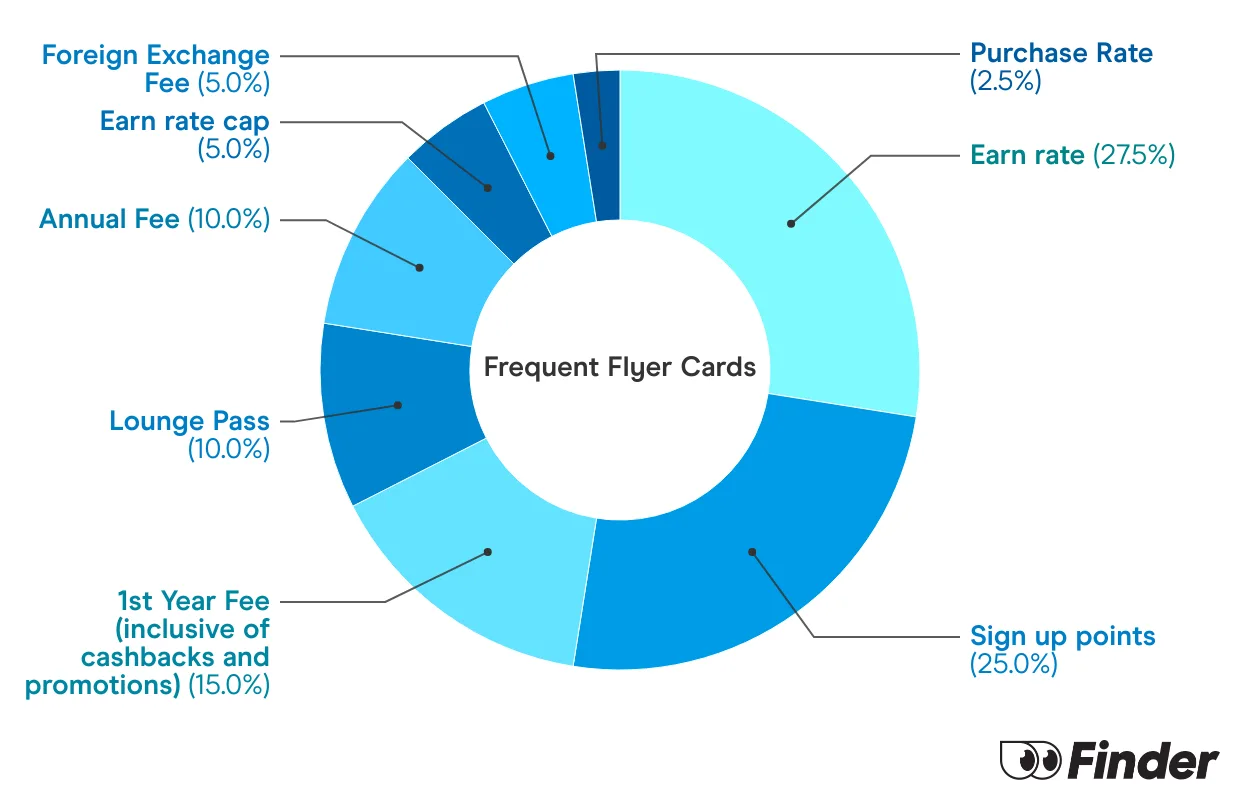

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

Can we convert Qantas Frequent Flyer points for US Dollars as a Platinum frequent flyer?

Hi Derek.

Thank you for your inquiry.

Qantas Frequent Flyer points are not convertible to US Dollars but you can use them to redeem flights, hotel packages, gift cards and products.

Cheers,

Jason

Forgot Pin No. Please advise

Hi P L Lee,

Thanks for your comment. Please note that you’ve come through to finder.com.au we are an Australian financial comparison website and general information service.

To be able to assist you further, may I ask which credit card you are referring to? It’s also best to get in touch with your bank directly if you need assistance in retrieving your PIN.

Cheers,

May

Hi I currently hold an Amex Platinum (business) card. What I like about is the reward points that can use for both qantas and non qantas. However $1500 annual fee plus vendors charging me 4% transaction fees makes me want to switch to a Visa or MC.

Is there a card Visa or MC with similar reward scheme ?

Thanks

Hi Ahmed,

Thank you for your inquiry.

Sorry for the delayed reply. On our page about frequent flyer credit cards, you may compare your frequent flyer card options with the Visa logo. Please note that these are personal credit cards that can be linked to your frequent flyer account like Qantas.

Hope this helps.

Cheers,

May

I have lost my card, how do I apply for a new one

Hi Doris,

Thanks for your question.

If you can tell me what credit card you are referring to, I will be able to assist you.

Alternatively, you can directly call your bank’s customer support to request a replacement card.

Cheers,

Anndy

What CC would you suggest for employee business expenses – i.e. to keep expenses incurred from work seperate so they can be claimed and reimbursed later (for me this includes mainly local and international work travel and expenses).

In this situation balance transfers, insurance, and interest rates are largely irrelevant, whilst I am interested in a low annual fee, Rewards points (either Qantas or CC), and world wide acceptance (so only AMEX if it has dual functionality).

Hi Stephen,

Thanks for your inquiry.

Please feel free to check these business cards and find information and a guide on how to select a business credit card that matches your everyday business spending while helping you manage your expenses with convenience.

In the meantime, most business credit cards’ annual fees are in more than a hundred to $1,500 in range. Annual fees for business cards are somewhat high especially if rewards systems or frequent flyer points are attached to the card.

As for the worldwide acceptance of the card – credit cards with Mastercard, Visa or AMEX logo are generally globally accepted.

I hope this is helpful.

Cheers,

May