0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

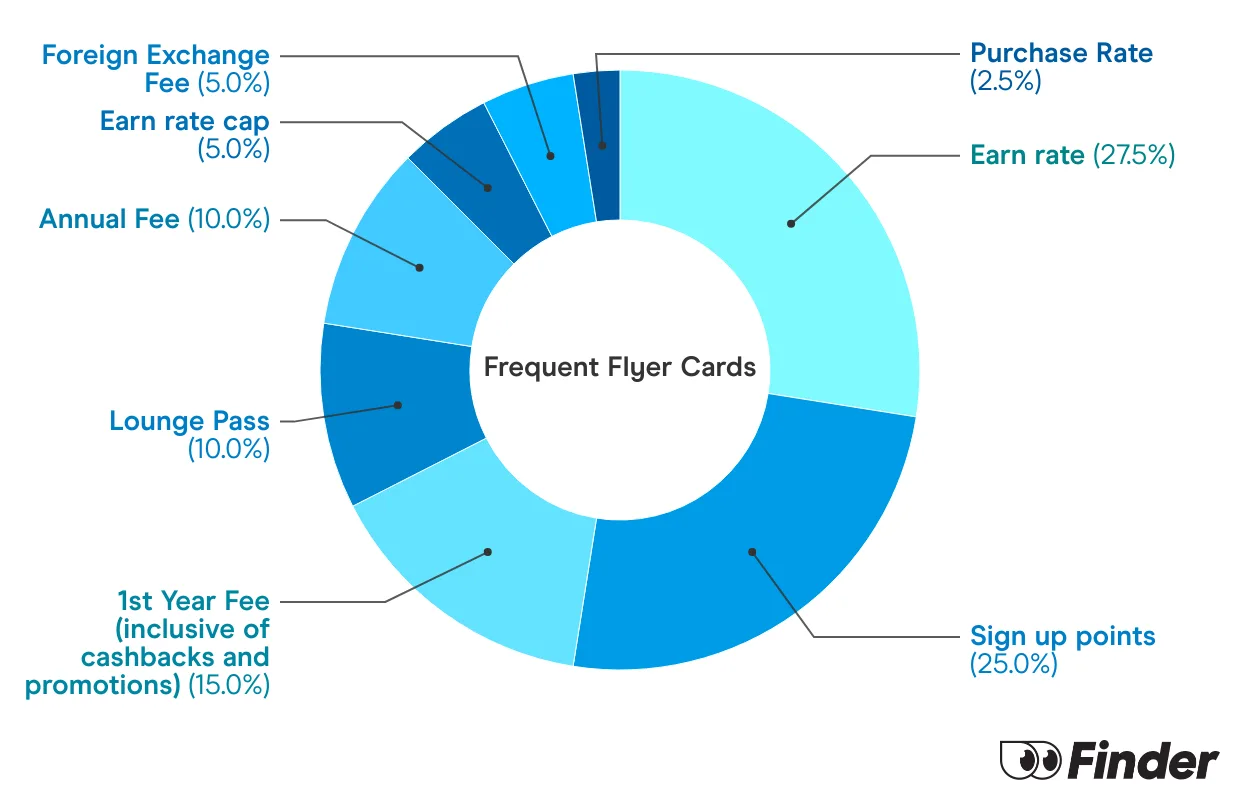

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

Can you use one credit card for the offer and then use another type of card for the similar kind of offer?

For example: If I use the ANZ offer and then use the HSBC offer for the points from that as well?

Hi Anthony,

Yes, you can so long that when you apply for those cards, you meet the all the requirements and eligibility criteria. You may contact the bank directly if you wish to discuss your chances of approval.

how do I find out how many points I have?

Hi Kerry,

There are several ways to check your Qantas points and one way is through your monthly card statement. You can also check by logging into your Qantas Frequent Flyer account online.

Can you cancel you CC once you have earned the “initial points” and reapply for the same promotion of that credit card in the future?

Separate question. Can a husband and wife independently apply for the same promotion if they live in the same household and be eligible?

Hi Brad,

This ultimately depends on the credit card. For instance, if it’s an ANZ credit card, generally their bonus offer applies only once per customer. You are also unable to receive the bonus offer if you currently hold or have closed certain ANZ credit cards within the previous 12 months. HSBC is even stricter because you won’t be eligible to receive their bonus offer if you have held certain HSBC cards for the last 18 months.

For your second question, yes, both husband and wife can apply for the same credit card offer, so long that they are able to meet the eligibility criteria.

I have a CBA bank issued American Express Card at present. Does this mean that I am not a “new” Amex customer, as required to take advantage of their 100,000 frequent flyer points offer.

Hi Tonie,

Since your current AMEX card was issued by CBA, you will be considered as a new customer of AMEX if you will apply for the American Express Qantas Ultimate Card. So long you are approved and have met the spending criteria of $1,500 on eligible purchases on your card within the first three months of card membership, you will be able to receive the 100,000 bonus Qantas Points.

How many Qantas points do I need to hire a small automatic car for 4 days?(Pick up 12.00 on day 1, return 15.30 on day 4)

Hi Sue,

Depending on what type of vehicle. It would be best to visit the Qantas website for earning and using points for fuels and cars to check how many points you should use.