0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

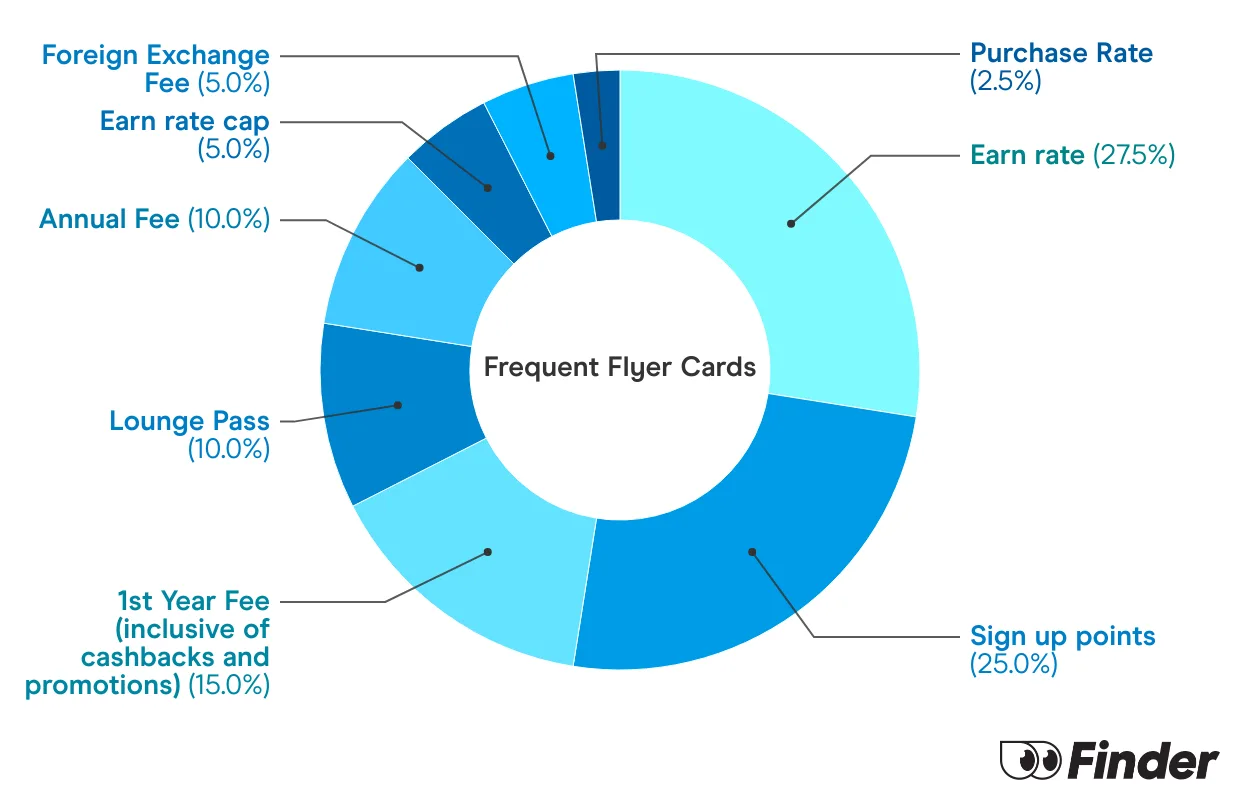

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

Hi i wish to compare credit cards which give me qantas frequent flyer points best per dollar spent , travel insurance as we travel to bali 3 to 4 times a year, lounge access, and annual fee ,

at present we have a platinum commonwealth bank mastercard and american express combined on one account and we pay a discounted annual fee of $295 pa

Hi Kevin,

You are on the right page to compare Qantas Frequent Flyer Credit Card that comes with complimentary travel insurance (international and domestic). The complimentary international travel insurance that comes with the card is automatically activated when you meet the policy eligibility requirements and purchase your return overseas travel ticket on your card. You may also compare credit cards that comes with a complimentary travel insurance. All you need to do is to please click More Info to know more about the specific card.

You can also compare the earning points of each card that is outlined in the table above.

As for the lounge access for credit cards, typically you are only provided two complimentary airport lounge passes per calendar year. Best to check the PDS of the card for more details.

I have a David Jones AMEX and am thinking of applying for the Qantas ultimate AMEX. Will I be eligible for the sign on bonus points? I’m happy to give up my DJ’s card as hardly use it if required to qualify re new card.

Hi Jono,

I’m afraid you would not be eligible for the bonus points. This offer is only available to new card members, as well as bank-issued American Express companion cardholders.

To be seen as a new card member, you must not have held a credit card issued by Amex in the preceding 18 months. The David Jones is issued by Amex, you would not be eligible for the bonus points.

How long does it take to have Frequent Flyer points accredited to your Qantas account? I have had my ANZ FF Black card for nearly six months and haven’t yet seen the points? I met all the criteria but no points yet.

Hi Steve,

Points are awarded for eligible purchases only. Eligible purchases do not include a number of transactions, like cash withdrawals from an ATM, paying some bills and paying credit card and government fees and charges. Refer to the terms and conditions for a full list of transactions that ineligible to earn Qantas Points.

You should be able to receive points every after an eligible purchase. Please contact ANZ directly to check your account

I am the principal card holder of Westpac Altitude Black and Visa Qantas Platinum cards. My wife is a supplementary card holder. Should I pre decease her, will she be able to use the points being held in those accounts?

Hello Ian!

Under Qantas Terms and Conditions Effective February 24, 2017 Section 8. Suspension or Termination of Membership:

8.3 Membership will terminate automatically on the death of a Member. Qantas Points earned but not yet redeemed or transferred prior to the death of the Member will be cancelled. Qantas Loyalty will close the Member’s account on notification of the Member’s death. Qantas Loyalty will not be liable for any loss or damage whatsoever suffered by any person as a result of such cancellation.

I have about 300,000 QFF points accrued. As I am a bit older, unsure if able to travel much, can these points be “refunded” to me?

Hi Ian,

The Qantas points have no monetary value, so they cannot be refunded. If you’re not a frequent traveler, you may still use your points to redeem for a wide variety of items including hotel accommodation, shopping at Qantas store, or paying for health and travel insurance policies underwritten by the QBE Insurance Corporation, etc.