0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

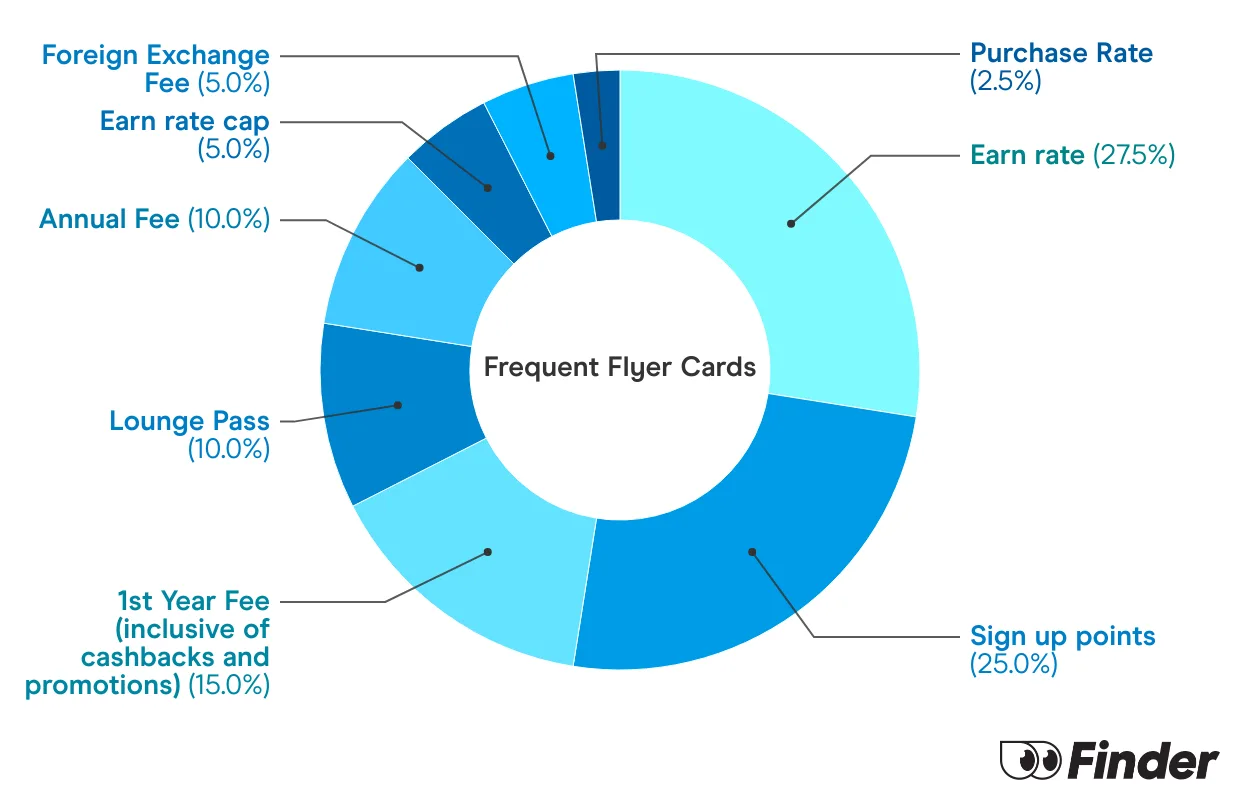

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

Do Jetstar flights earn QFF points?.If so , how many Qff points does a Jetstar flight generate ?

Hi Mary,

Thanks for your question.

I’ve emailed you a page with more information about this.

Cheers,

Shirley

Do the two NAB Qantas Premium Rewards cards (Visa and Amex)offer points for payment of utilities bills and car registration?

Hi Sherlock,

Thanks for your question.

NAB credit cards generally do earn points by paying bills, but you will need to pay the bills directly, rather than using Bpay. You may find our guide useful in earning frequent flyers and rewards by paying bills.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions before making a decision on whether it is right for you.

Cheers,

Shirley

My wife and I have approx 120,000 FF points and are travelling overseas. Can we use these points for entry to the Qantas lounge in Brisbane and Dubai.

Hi Errol,

Thanks for your question.

According to the Qantas website, “lounge access eligibility is based on the class of travel, Qantas club membership or the Frequent Flyer Membership tier for your next onward flight.”

Unfortunately you can’t redeem your points for lounge access, but you can use them upgrade your flight to gain access to these lounges.

Cheers,

Shirley

I’m looking for a platinum credit card linked to Virgin’s Velocity frequent flyer scheme and including travel insurance. Have you surveyed all cards linked to Velocity?

Hi Russell,

Thanks for your question.

You may want to compare a range of Velocity Frequent Flyer credit cards and check out direct earn credit cards linked to the Velocity Program.

You can click the table headings to arrange the cards by things like their rates of interest and annual fees. If you would like a side-by-side comparison of multiple cards, you can select the boxes to the left of the card name (and then click compare).

You can find out whether a card offers complimentary international travel insurance by reading a review of the credit card. Please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you.

I hope this helps.

Cheers,

Jacob

I am looking for a frequent flyer credit card. I have been offered one by Commonwealth Bank but it has a 250,000 points converted to 100,000 frequent flyer points. What if my flight needs 150,000 points? Can points be accumulated ? Is there an expiry?

Hi, Carmen.

Thanks for your question.

Commonwealth Bank points do not expire as long as you remain a cardholder. Qantas Points expire after 18 months of inactivity on your account. Your points will accumulate when you make a purchase on your card. You can have a look at our guide on transferring frequent flyer points for more details.

I hope this helps.

Jacob