0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

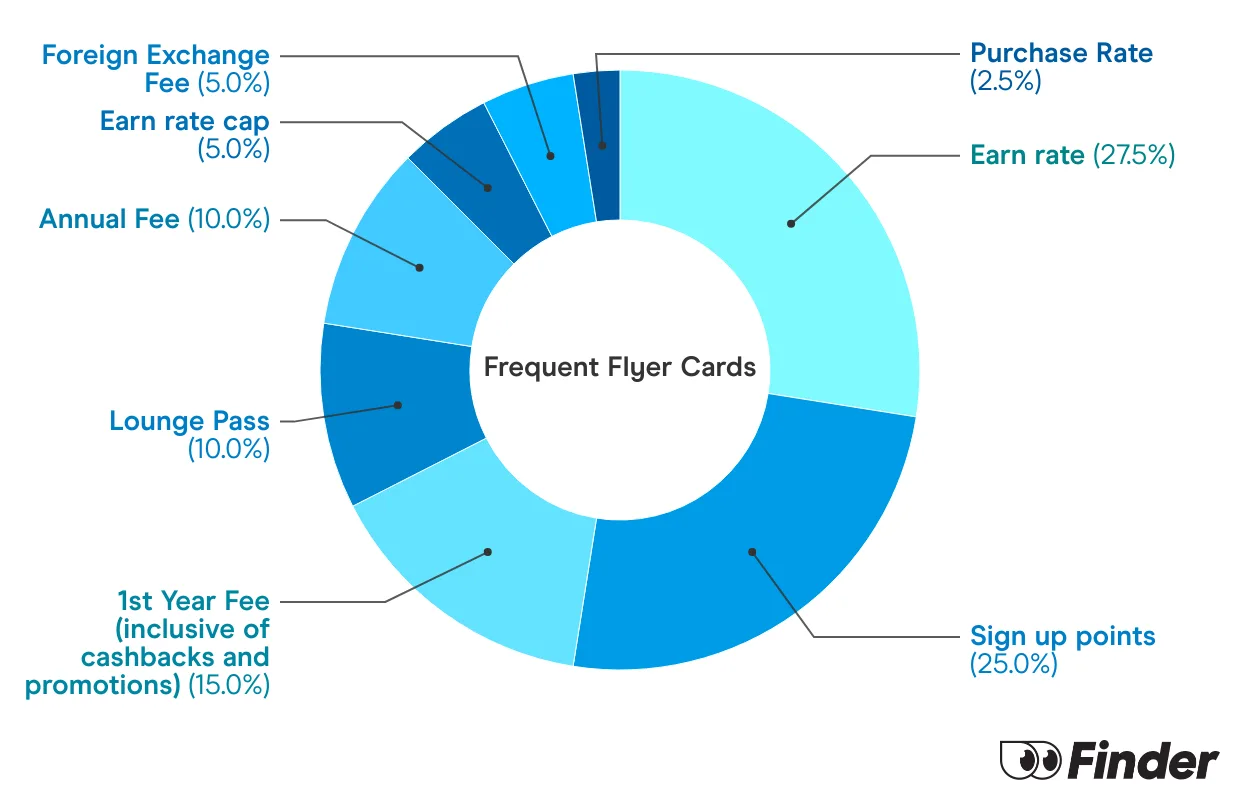

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

What is Complimentary Priority Pass and is there a certain period of time within the year to use the airport lounge visits?

what is the best credit card to get qa club lounge

Hi David,

Thanks for your question.

I’m unable to recommend a specific card for you. However, you can compare a range of cards that offer complimentary Qantas lounge access.

I hope this has helped.

Thanks,

Elizabeth

Hi S.k7,

Thanks for your question.

It depends on which credit card you’re applying for, and what conditions are attached to the offer. For example, with the Westpac Altitude Black, you’ll receive two complimentary lounge visits per year with your Priority Pass Membership.

Unused visits in any year can’t be carried forward to the following year, and they reset every 12 months.

Cheers,

Shirley

Hi,

I have a Qantas Transaction account with Bankwest and they mention 5 points per eligible purchase, but their Bankwest Qantas credit card only earns 0.75 points per eligible purchase… am I missing something? One would expect the credit card to earn more…

Hi FM,

Thanks for your question.

finder.com.au can only provide general advice on a range of products, providers and services. For comments about a specific product, please get in touch with the financial institution.

All the best,

Shirley

Hi

I’m looking for a credit card where I can earn Qff points every time I pay my bills, grocery shopping, rego etc. I will be paying off any balance owing every month before I receive my statement, so I do not incur any interest. I will not make any Cash advance withdrawals and do not mind an annual fee as long as I can benefit from the credit card. Do not want an Amex as I hear that there are surcharges/fees on some purchases. Any suggestions please?

Thank you

Hi Sally,

Thanks for your question.

You can start comparing frequent flyer credit cards that let you earn points by paying your bills. Be mindful that in some cases you don’t earn points by using BPAY to pay your bills, so please read the t&cs before committing to anything.

Cheers,

Shirley

enquiring about the HSBC platinum qantas credit card.

Is the qantas lounge invitations for 2, the full club lounge annual membership.

Hi Graham,

This card has 2 complimentary Qantas Club lounge passes every year

In the fine print, it states that “invitations are valid for Qantas Club and Qantas operated international Business Lounges only. Not valid in International First Class Lounges, Chairman’s Lounge, Qantas Domestic Business, Qantas oneworld® alliance airline, partner airline or associated lounges. Each invitation is valid for a single visit before the date specified on the invitation, when travelling with Qantas or Jetstar. Make an eligible purchase within the first 3 months of receiving your card to receive your two complimentary Qantas Club lounge invitations. Following that, each year, two complimentary Qantas Club lounge invitations will be issued to you within 30 days of the anniversary date of your first spend as long as you are a HSBC Platinum credit card account holder.”

Cheers,

Shirley

Hi there,

I’m a QFF AMEX card holder and I’m planning to get a Visa/Master card (as per not everywhere AMEX is accepted AUS/overseas). My Qs are if I apply to ANZ QFF card and I need to pay my balance the second of week of August can they transfer my balance to ANZ card before that time? and that amount to be paid in August is considered as eligible purchase by ANZ?

Thank you for your reply.

Cheers

Francis

Hi Francis,

Thanks for your question.

Balance transfers to ANZ can take between 3 and 15 business days depending on the institution from which the balance is being transferred.

ANZ also claims that they “will not be liable for any loss or damage whatsoever resulting from a delay in the process of receiving, approving or processing a balance transfer application”.

Balance transfers are not considered as eligible purchases.

Cheers,

Shirley