0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

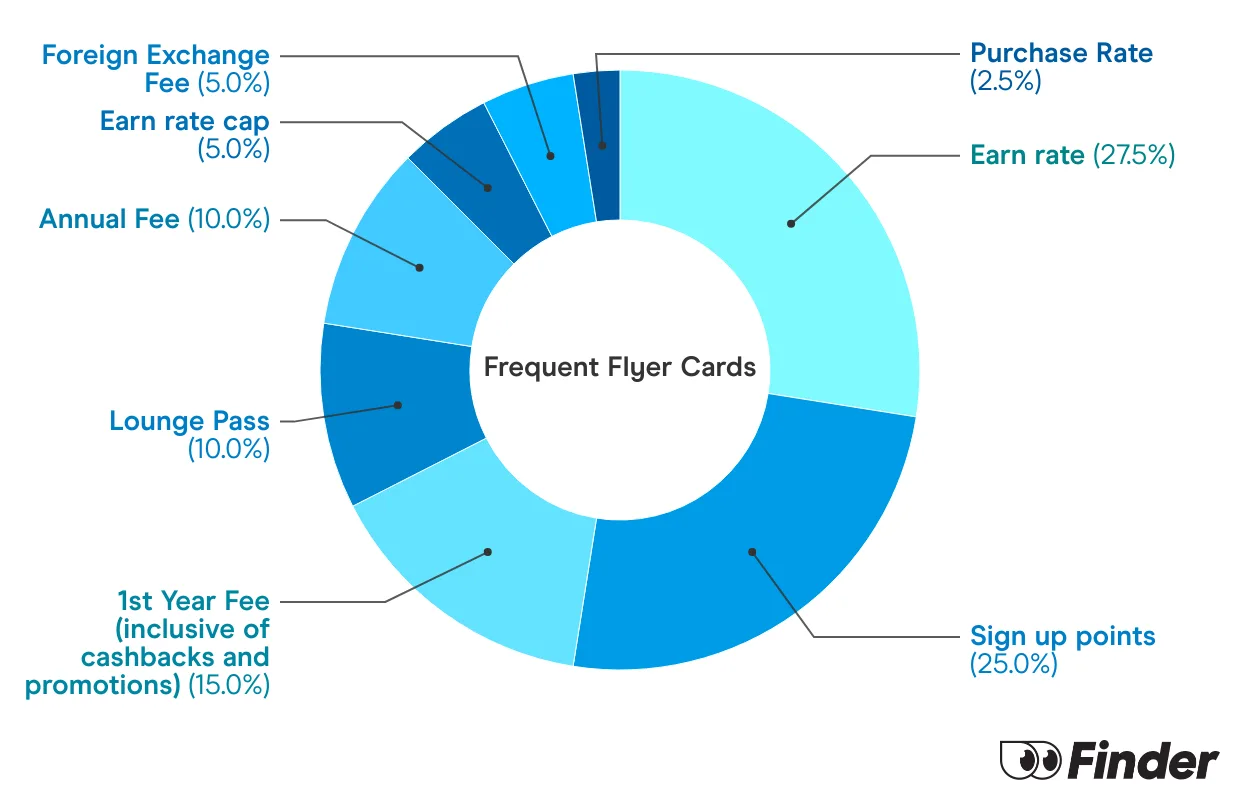

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

How long do my points last. Do I have to use them in specific time frame?

Hi Debra, thanks for your inquiry,

There is no points expiry as long as your Qantas Frequent Flyer account remains current and in good standing and is not overdue.

Cheers,

Jonathan

Can Westpac Altitude Black Mastercard and American Express cards be linked to Qantas Frequent Flyer points?

Hi Jenny,

Thanks for your inquiry.

Yes, the Westpac Altitude Black offers two reward programs that you can choose from – the Westpac Altitude or the Qantas Rewards. With Qantas Rewards, you can earn and use your Frequent Flyer points to redeem goods and services such as devices, flights, hotels, etc.

American Express, on the other hand, offers a few cards that can also be linked to a Qantas rewards program. For a list of these AMEX cards, kindly refer to our guide on Qantas frequent flyer credit cards.

I hope this has helped.

Cheers,

Jonathan

I need a simple no Annual Fee Credit Card.

Hi Thomas,

Thanks for your inquiry.

Please refer to the following link for a list of no annual fee credit cards and compare features, benefits and costs that would be suitable for you. You can press the “Go to Site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific questions. A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan

What are some eligible purchases? and do they differ from according to providers?

Thank you.

Hi Alvaro,

Thank you for your question.

Eligible purchases mean any retail purchase which is made by the use of a card. Exclusions include cash advance transactions, balance transfers, special promotions, fees, government charges and payments to the Australian Taxation Office. Eligible purchases may be different from one issuer to another but usually exclude the same things.

I hope this has helped.

Thanks,

Sally

I plan to sign up with the ANZ Frequent Flyer credit card. What is the reward rate on the second card?

Hi Mithcell, thanks for your inquiry!

Reward Points do not accrue to additional cardholders and all Reward Points earned as a result of spend by an additional cardholder will accrue to the account holder’s points record. The earnings rates of the credit card apply to both the primary and additional cardholder/’s.

Cheers,

Jonathan