0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

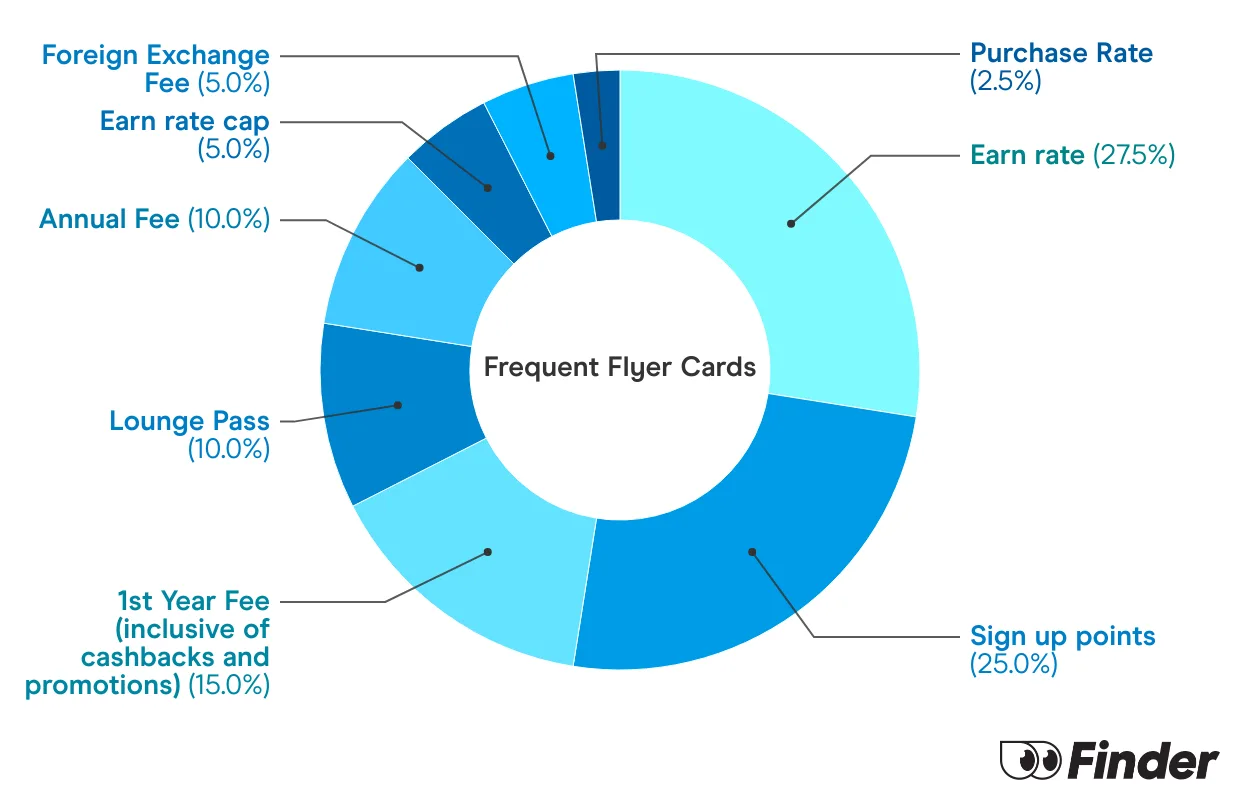

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

Hi

If I use my Frequent Flyer Credit card with Qantas global partners, can I, in effect, earn points twice – once on my card and once with the partner?

Thanks

Janelle

Hi Janelle,

This may depend on the card you’re using, but generally, you can only transfer the points to one of the programs rather than earning points twice.

Cheers,

Sally

Do you know if it easy once you reach bonus FF points with a Credit Card to cancel & then go on to another bank & join up another one to get more bonuses?

Obviously would only do it on $0 join up fee, do you know if this can be done as it seems like a good way to rack up the points?

Hi Craig,

Thanks for your inquiry!

Jumping from one frequent flyer credit card to another to accumulate the bonus points can be a quick way to get to your next holiday destination/ rewards. However, we are unable to provide a guaranteed response as the credit requirements and bank lending criteria are disclosed to the public. Generally we do not recommend any credit applications at least 3-4 months apart. Your credit score and history will also affect how often you can apply. Taking these factors into account, a good strategy can be to apply for a card that maximises your bonus points earnings.

You can compare frequent flyer cards and their bonus points offers, flights, upgrades and lounge access.

Please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan

how do I claim the points from my old woolies reward card

Hi Lorraine,

Thanks for your inquiry!

Qantas Points earnings have been postponed until June-July 2016 due to the new Woolworths Rewards update. For more information on the change please see our full guide on Woolworths Rewards.

Please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered on your transactions.

Cheers,

Jonathan

Is there a Credit Card available which provides Qantas Frequent Flyer points for Australian Taxation Office payments ? If so, which ones and are the points capped to a dollar amount ?

Hi Peter,

Thanks for your inquiry!

Yes, you can compare credit cards that earn points for ATO payments and know the points per $1 spend for government charges.

You can select the “Go to site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific questions. A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan

Hi

I’m interested in getting a credit card for 12 months but no longer…are there any penalties re point allocation i.e. 20000 points and 12 months no membership fees

Hi Jeaine, thanks for your inquiry!

Bonus point offers can require certain terms and conditions to be met, such as a spend requirement and holding the card for at least 3 months. Was there a specific Qantas Frequent Flyer credit card you were inquiring about today?

Cheers,

Jonathan