Key takeaways

- A new for old car insurance policy will replace your new car with another one of the same make and model if it's written off in an accident.

- Eligibility can be strict, and many insurers will only replace your car if it's written off within 2 years of you buying it.

- Insurers may pay you the vehicle's market or agreed value if a new equivalent model is unavailable.

Compare new for old car insurance policies

Compare other products

We currently don't have that product, but here are others to consider:

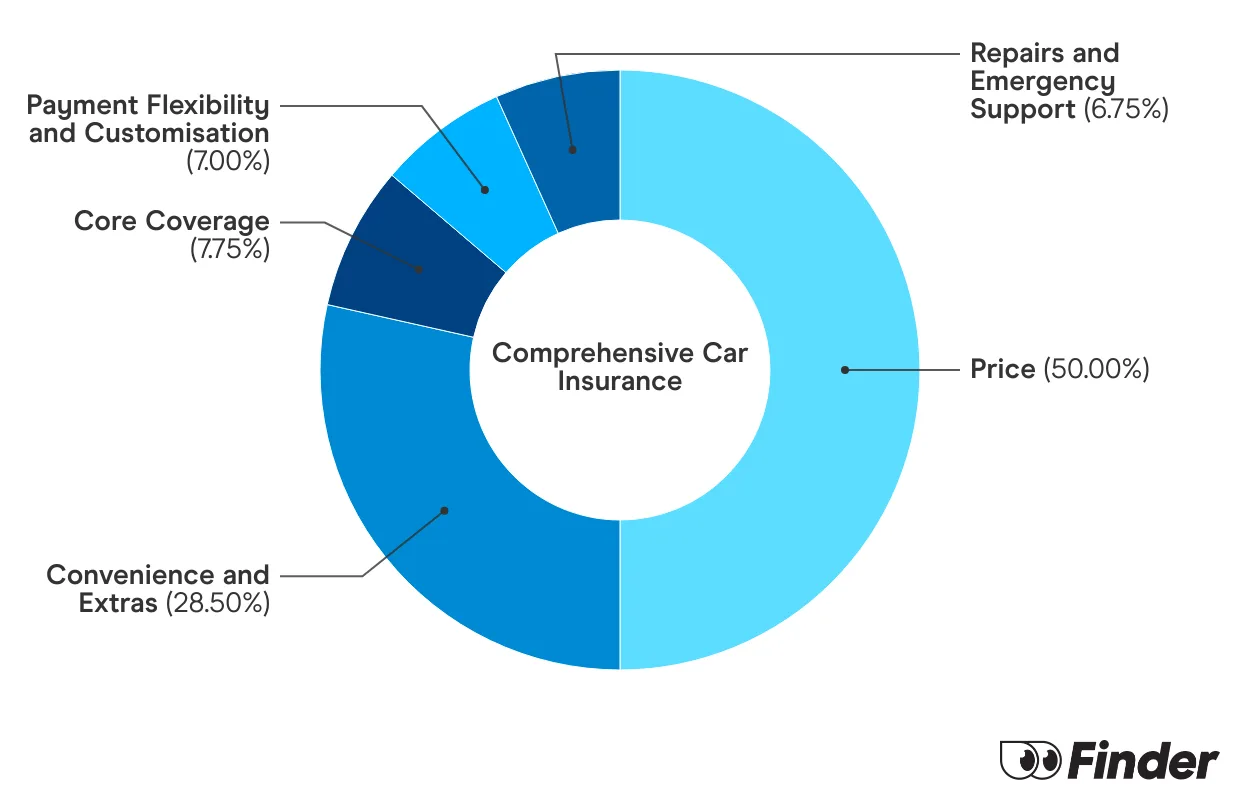

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

How does a new for old car replacement work?

If you've bought a new car and it gets written off in an accident, your insurer will replace it with a new one of the same make and model. This is sometimes known as a 'new car in case of write off' and is a standard inclusion of most comprehensive car insurance policies. This only applies to cars that have been assessed as a total loss after an insured incident, such as a crash, natural disaster, vandalism, or theft.

Most policies will only cover a replacement if the car is within 2 years of being purchased. However,

some insurers even offer new-for-old replacement for the life of your car under some circumstances. This is normally sold as an extra or as part of a top-end comprehensive policy and is subject to additional criteria.

On paper, it's a fantastic deal. But insurers don't necessarily make it easy. Depending on your insurer, you may have to meet the following criteria to qualify:

- You must be the first registered owner of the car.

- Your car must be less than 2 years old from new.

- You are often eligible for new car replacement even if the vehicle was pre-registered as a demo model by the dealer, but this is not the case with all insurers.

- If your vehicle was purchased with the aid of a car loan, your credit provider must give permission for the original vehicle to be replaced with a new one.

In what situation would I receive a replacement vehicle?

Most insurers will offer a new car replacement if your vehicle is a total loss, usually defined by three criteria.

- Your vehicle was stolen and could not be recovered for a specified period of time, for example, 14 days.

- The cost of repairing your vehicle exceeds the sum insured.

- Your car cannot be repaired well enough to ensure that it will be safe to drive.

What kind of car will I receive?

- Same make, model and series. The replacement car will basically be the current version of the car that was insured.

- Accessories and modifications included. If you loaded your new car with expensive optional extras, most insurers agree to provide you with a replacement vehicle kitted out in the same way.

- On-road costs are covered. Most insurers will cover compulsory third party (CTP) insurance and throw in stamp duty plus 12 months' registration.

What kind of car will I receive?

- Same make, model and series. The replacement car will basically be the current version of the car that was insured.

- Accessories and modifications included. If you loaded your new car with expensive optional extras, most insurers agree to provide you with a replacement vehicle kitted out in the same way.

- On-road costs are covered. Most insurers will cover compulsory third party (CTP) insurance and throw in stamp duty plus 12 months' registration.

What happens after my car is replaced?

This varies from insurer to insurer. In some cases, the insurer will transfer your policy to the new vehicle. In others, your cover ends, and you must obtain a new policy for your replacement car. Read the product disclosure statement (PDS) carefully to know exactly what rules apply

Is new car replacement worth it?

Most comprehensive policies, with a few exceptions, will automatically include new for old replacement cover. However, if you're wondering whether it's worth it, consider the following:

- Do you have a new car? First and foremost, it's only worth it if you are eligible. In most cases, your car needs to be less than 2 years old for you to be covered. There is also sometimes a 40,000km odometer limit.

- Do you live in an area prone to floods, storms or natural disasters? As Australia's climate crisis intensifies, the chances of extreme weather where you live increases. If your new car was written off due to an act of nature, a new car replacement benefit would ensure you got either one of the same model or of the same market value.

- Could you afford to replace your new car? New cars are expensive. Most of us couldn't afford to just go out and buy a new one if ours was written off. New for old replacement ensures you don't have to worry about that.

- What about if you're in a crash? New car replacement is designed to help you financially in case your car is written off. In most cases, this is because of a collision. If you're willing to take the risk with such a big investment, then new car insurance probably isn't worth it for you. Otherwise, it's a really helpful benefit you'll be thankful you got if something goes wrong.

Does it cost extra to get new for old car insurance cover?

Not really. Basically, if car insurers didn't offer it, it probably would result in very slightly cheaper premiums. However, most automatically include it in their comprehensive car insurance policies. Budget Direct, Youi, Coles, Virgin, Qantas and Real all cover new car replacements. If you want to go with a major provider, it's probably not going to cost you any more money.

One of the few car insurers to offer it as an optional extra is Bingle. However, if you wanted to add a new car replacement to a Bingle comprehensive policy, it'll only cost you around $2* more a month.

*$62.21 without new for old and $64.45 with new for old, based on a 30 year old male driving a 2019 Toyota Corolla (automatic).

What type of exclusions are there?

- You will usually not be covered for any extended warranty you purchased for the original vehicle.

- A basic excess often applies, but some insurers will waive this if your car is written off in an accident where you were not at fault.

- Some insurers stipulate a maximum tare weight limit for the vehicle to be eligible for new car replacement.

What are the limitations of new car replacement plans?

The main pitfall with new car replacement insurance is its limited validity period. With most policies, as a soon as your car is more than two years old, or once you've crossed the 40,000km limit (depending on your policy, your sum insured will plummet if you've chosen market value rather than agreed value.

Another issue is the availability of a similar replacement car. Some insurers might not provide a car if they can't find a match, preferring to offer the market value as a cash reimbursement instead. This is particular relevant if your policy has a lifetime new for old replacement option.

If this happens, try finding a replacement yourself within your policy's time limit. Your insurer will be obligated to deliver it as your replacement.

What are the alternatives to new car replacement?

- Agreed value car insurance. Even if your car is less than two years old, you will usually not be eligible for a new car replacement if you are not the first registered owner. However, you can estimate how much a new replacement vehicle would cost and negotiate an agreed value to cover this with your insurer.

- New-for-old lifetime insurance. Some insurers will replace your car with a new one even after its second birthday if your vehicle has been continuously insured under a top-end comprehensive policy within 13 months of purchase. In this case, the insurer has the right to decide on a suitably similar new car, considering parameters such as engine size, type of finish, optional extras and so on.

Comprehensive car insurance policies that offer New Car Replacement

| Brand | Conditions |

|---|---|

| 1300 | If your car is written off in the first 2 years |

| AAMI | If your car is written off in the first 2 years |

| Allianz | If your car is written off in the first 2 years |

| ANZ | If your car is written off in the first 2 years or is under 30,000 km |

| Australian Seniors | If your car is written off in the first 2 years |

| Australian Unity | If your car is written off in the first 2 years |

| Bank of Queensland | If your car is written off in the first 2 years |

| Bendigo Bank | If your car is written off in the first 3 years or is under 50,000 km |

| Beyond Bank | If your car is written off in the first 2 years |

| Bingle | If your car is written off in the first 3 years |

| BMW | If your car is written off in the first 3 years |

| Bupa | If your car is written off in the first 2 years |

| CGU | If your car is written off in the first 3 years or is under 50,000 km |

| Coles | If your car is written off in the first 2 years or is under 40,000 km |

| Commonwealth Bank | If your car is written off in the first 2 years |

| Everday | If your car is written off in the first 2 years |

| GIO | If your car is written off in the first 2 years |

| HSBC | If your car is written off in the first 2 years |

| Huddle | If your car is written off in the first 2 years |

| Hume | If your car is written off in the first 2 years |

| Kogan | If your car is written off in the first 3 years or is under 60,000 km |

| MB | If your car is written off in the first 4 years |

| Mortgage Choice | If your car is written off in the first 2 years |

| NAB | If your car is written off in the first 2 years |

| National Seniors | If your car is written off in the first 2 years |

| NRMA | If your car is written off in the first 2 years |

| RAC | If your car is written off in the first 2 years |

| RACQ | If your car is written off in the first 2 years |

| RACT | If your car is written off in the first 2 years |

| RACV | If your car is written off in the first 3 years |

| Real | If your car is written off in the first 2 years |

| Shannons | If your car is written off in the first 2 years |

| St. George | If your car is written off in the first 2 years |

| Suncorp | If your car is written off in the first 2 years |

| Youi | If your car is written off or stolen in the first 2 years |

Table last updated January 2025

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

Hi Cameron

Excellent compilation. Thank you very much for this. What does MB stand for – which organisation is that which offers 4 years new car replacement insurance?

Thanks,

Joy

Hi Joy,

MB offers car insurance for prestige cars. You can view their website here: https://www.mbinsurance.com.au/

They’re the ones who offer 4 years new car replacement insurance.

Hope this helps!