0:01

If you're serious about earning Qantas Points, then you need the right credit card. And every month of Finder, we examine every card on the market to find

you the best Qantas points cards.

0:10

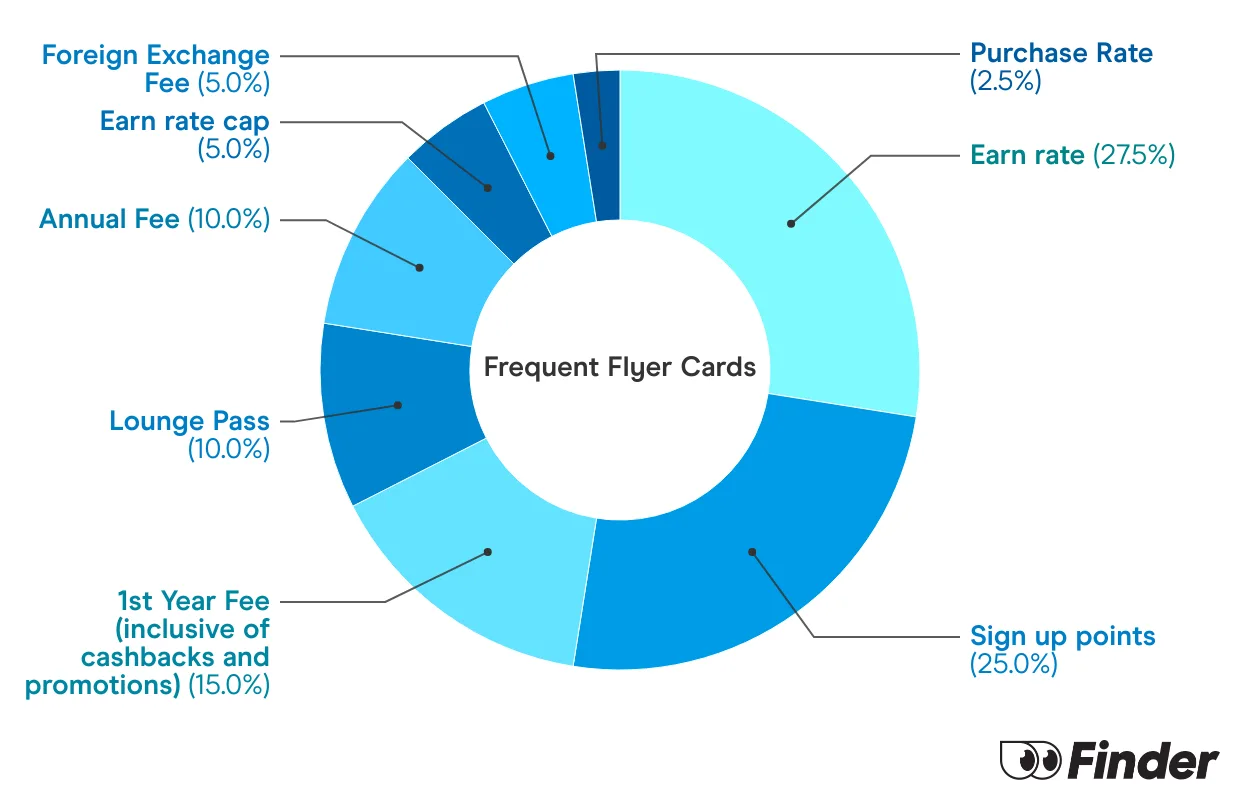

We look at annual fees, we look at earn rates, we look at bonus points offers, we look at card perks, we look at everything. So, here they are, the three best Qantas points cards on the market right now.

0:23

At number one, we've got the Qantas American Express Ultimate Card. This is an Amex card and it gives you 90,000 bonus points. But to get those points, you'll need to be a new Amex customer and you'll have to spend $3,000 in the first 3 months.

0:37

This card has a pretty high annual fee over $400. But it also comes with a yearly Qantas travel credit of the same amount. So, if you use that travel credit each year, you're effectively making the card pay for itself, which makes it a really attractive offer.

0:52

Number two, we've got the Qantas Money Titanium. Now, this card is a points earning beast. It gives you 150,000 bonus Qantas points. It's one of the market's biggest offers, and you can earn over two points for every dollar you spend. It's a really lucrative card.

1:10

It also has flight discounts, bonus status credits, lounge passes. It's a really feature rich card, but there is one big downside. The annual fee is $1,200. This is a points earning card for high rollers and serious earners. If you can afford this card, you probably don't need any financial information from me.

1:31

And last, we have the A&Z Frequent Flyer Black. This card is a popular card. It's an award winner at Finder. It regularly is in our top scoring cards. Right now it gives you a 130,000 bonus Qantas points, which is one of the top offers in the market right now.

1:46

There's only one sort of downside, which is you have to hold the card for over 12 months to get those full amount of bonus points, and that means paying the annual fee twice. The annual fee is quite high. It's above $400, but the card does have a $200 cash back offer as part of the bonus offer. So, that offsets that slightly, which makes it a pretty affordable deal with a really high number of Qantas points.

2:06

And there you have it, our top three Qantas points cards on the market right now. You can compare all these cards and more great Qantas offers right here at Finder.

I have not been able to login on my account therefore cannot use my account card. Could you tell me why I cannot login or able to put money to use. Got it to save points for a trip when we’ll enough but just doesn’t work.

Thank you

Hi Julie,

Thanks for your question.

You’ll need to get in contact with the card issuer in order to find out what the problem is with your account. As a comparison site we have no direct access to your account so unfortunately won’t be able to tell you what the problem is.

Thanks,

Elizabeth

Which card offers the best frequent flyer rate for every $ spent plus travel insurance and bonus points on application NOT AMEX. Interest rate is not an issue because I pay outright on time

Hi Graham,

Thanks for your question.

You have options to compare frequent flyer cards where you can see the earn rate and bonus points available. The individual reviews (that you can access by clicking on the name of the card) will list whether complimentary insurance is available.

I hope this has helped.

Thanks,

Elizabeth

In regards to getting five qantas points per eligible purchase, it this 5 qantas points per 1 dollar spent or per eligible transaction regardless of the dollar value?

Also, can this account be used like a credit card ie if I have no money in it can I set up a limit on it like a traditional credit card?

Thanks

Hi Marie,

Thanks for your questions.

Are your referring to the Bankwest Qantas Transaction Account? If so, the five Qantas Points are earned per eligible transaction regardless of the dollar value. As this is a transaction account, the card attached is a debit card and so you only have access to your own money.

Hope this has helped.

Thanks,

Elizabeth

Karen

You could look at Suncorp’s ClearOptions visa card. It has good FF rewards up to an annual of 120,000 which CitiCorp has also got a very good FF deal with no annual limit. Both tend to allow up to $30,000 credit limit.

I have ANZ visa platinum card and just received letter stating from Oct 24 “eligible purchases” made using the card of up to $6000 per statement! This is not good enough for me as I can spend up to $12000. They suggested American Express but a lot of places do not take this card or there is a fee. What can you suggest please for another card. (I will keep the card).

Hi Karen,

Thanks for your question.

Please see a comparison of credit cards that have uncapped rewards points earning. While most of them are Amex, there are a few that come linked with a Visa as well.

Cheers,

Shirley