| | | | |

Get 75,000 Bonus Membership Rewards Points when you spend $4,000 on eligible purchases in the first 3 months. New American Express card members only. T&Cs apply.

| | |

| | | | |

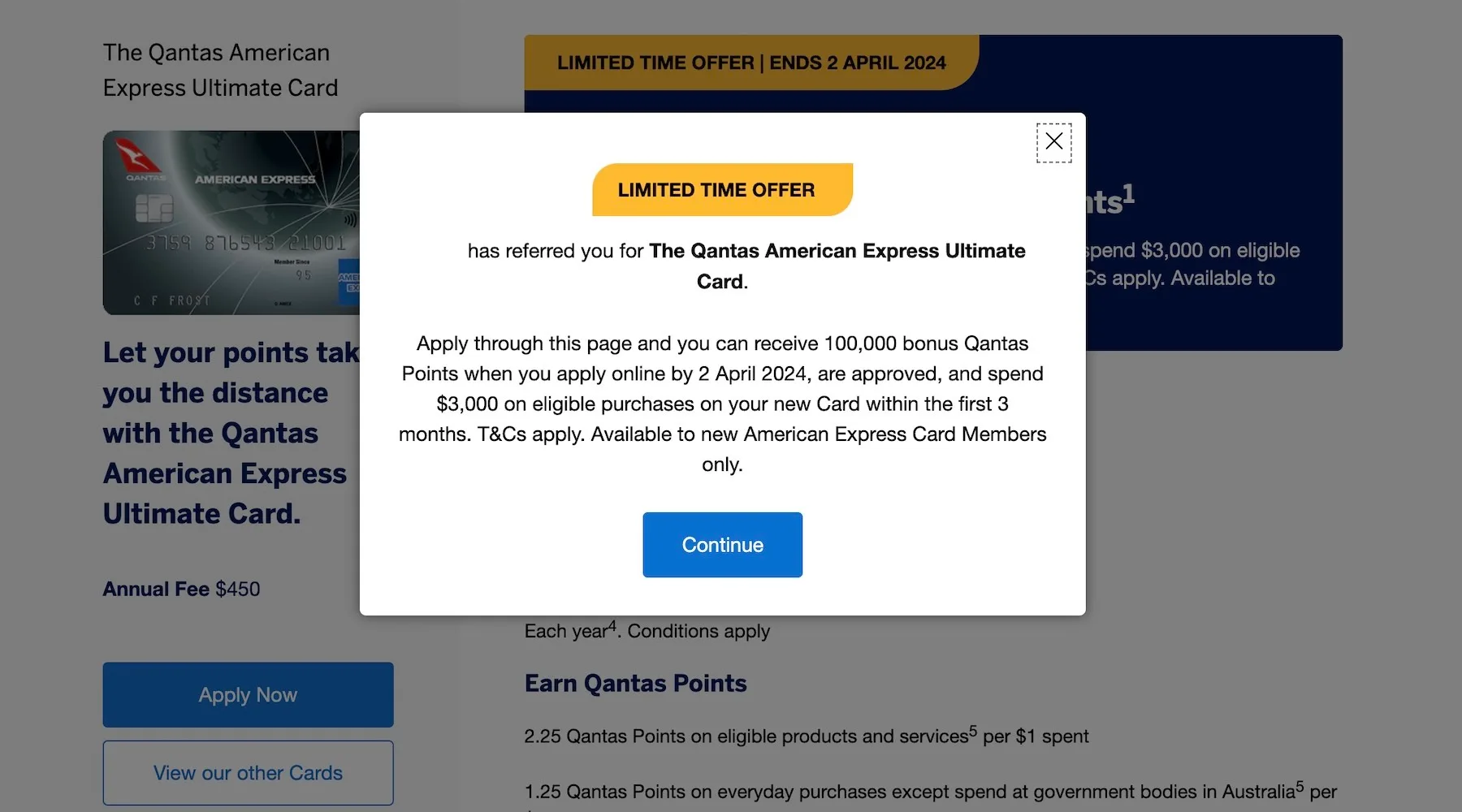

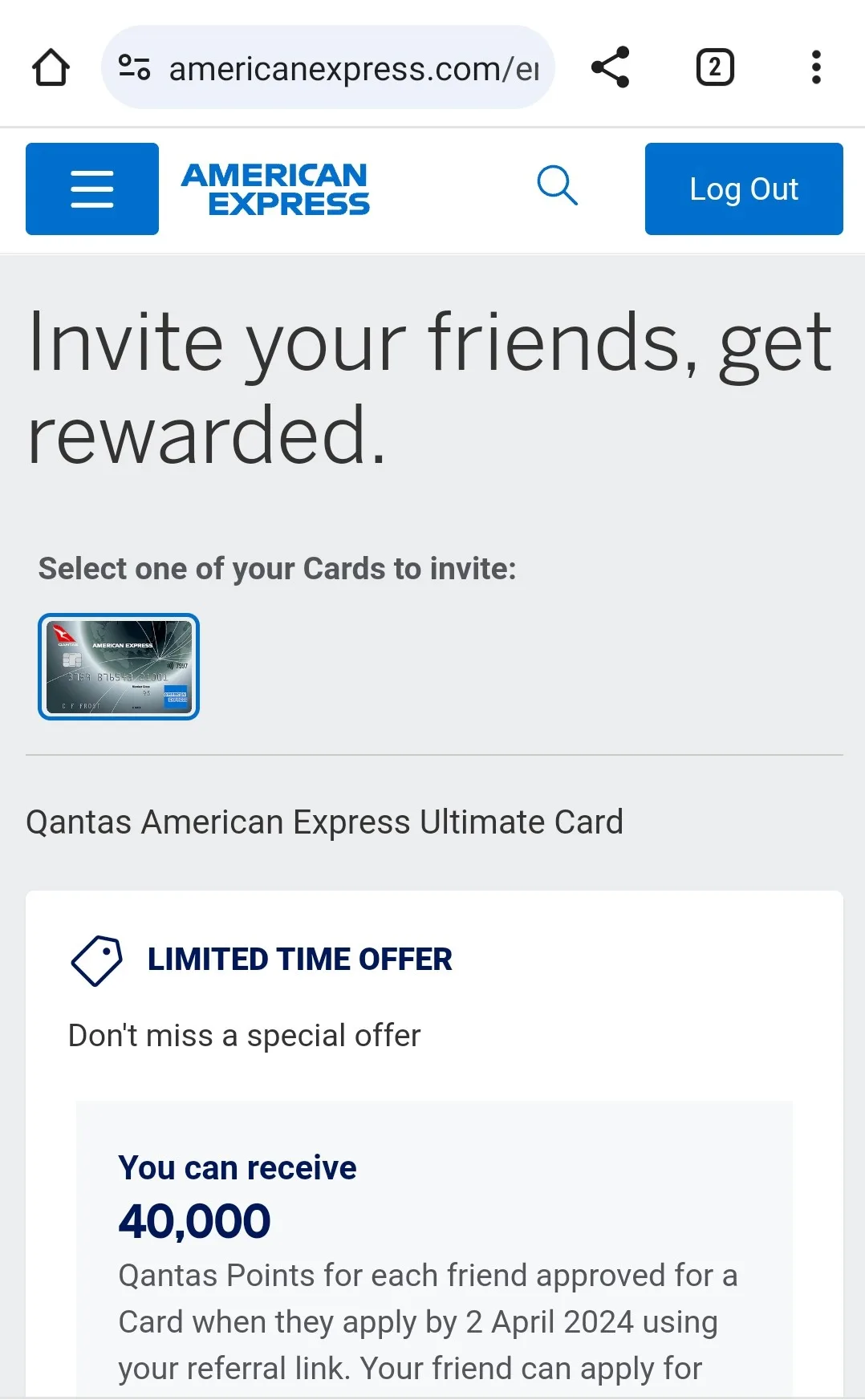

Get up to 100,000 bonus Qantas Points (70,000 points when you spend $5,000 on eligible purchases in the first 3 months and additional 30,000 points when you spend a minimum of $1 within 90 days of paying your second-year annual fee). New American Express card members only. T&Cs apply.

| | |

| | | | |

Earn 200,000 Bonus Membership Rewards Points when you spend $5,000 on eligible purchases in the first 3 months. New American Express card members only. T&Cs apply.

| | |

| | | | |

Offers up to 100,000 bonus Velocity Points (70,000 points when you spend $5,000 on eligible purchases in the first 3 months and additional 30,000 points when you spend a minimum of $1 within 90 days of paying your second-year annual fee). New American Express card members only. T&Cs apply.

| | |

| | | | |

Get 30,000 bonus Velocity Points when you spend $3,000 on eligible purchases in the first 3 months, plus a $50 Virgin Australia Statement Credit. New American Express card members only. T&Cs apply.

| | |

| | | | |

Earn 30,000 Bonus Membership Rewards Points when you spend at least $3,000 on eligible purchases within the first 3 months. New American Express card members only. T&Cs apply.

| | |

| | | | |

Receive 200,000 bonus Velocity Points when you spend $6,000 on eligible purchases in the first 3 months. New American Express card members only. T&Cs apply. ABN holders w/ $75,000 revenue. | | |

| | | | | Limited-time offer: Get 350,000 Bonus Membership Rewards Points when you spend $12,000 on eligible purchases in the first 3 months. New American Express card members only. T&Cs apply. ABN holders w/ $75,000 revenue. | | |

| | | | |

Earn 170,000 bonus Qantas Points when you spend $6,000 on eligible purchases in the first 3 months. New American Express card members only. T&Cs apply. ABN holders w/ $75k revenue. | | |

| | | | |

Get 100,000 Bonus Membership Rewards Points when you spend $5,000 in the first 3 months. Plus, earn up to 3 points per $1 spent at Xero, Google Ads, Meta, Amazon Web Services and Dell. New Amex card members only. T&Cs apply. ABN holders w/ $75,000 revenue. | | |

| | | | |

Earn up to 1.75 Qantas Points per $1 spent, with no ongoing annual fee.

| | |

| | | | |

Offers a low ongoing interest rate of 10.99% p.a. and a $0 annual fee. Plus, complimentary purchase cover.

| | |

| | | | |

Get 20,000 bonus Qantas Points, 2 complimentary Qantas Club lounge passes per year and complimentary travel insurance. New American Express card members only. T&Cs apply.

| | |

| | | | Annual fee $0 first year ($195 after) |

Save with a $0 annual fee in the first year. Plus, $200 Travel Credit every year. New American Express card members only. T&Cs apply.

| | |

| | | | |

Earn 50,000 Membership Rewards Bonus Points when you spend $10,000 on eligible purchases in the first 2 months. For new corporate card programs only. T&Cs apply.

| | |

| | | | |

Earn 75,000 Membership Rewards Bonus Points when you spend $10,000 on eligible purchases in the first 2 months and uncapped points potential. For new corporate card programs only. T&Cs apply.

| | |

| | | | |

Get 75,000 Membership Rewards Bonus Points when you spend $10,000 on eligible purchases in the first 2 months. For new corporate card programs only. T&Cs apply.

| | |

| | | | |

Offers 50,000 Bonus Membership Rewards Points when you spend $3,000 on eligible purchases in the first 3 months, complimentary travel insurance and 2 airport lounge passes. New American Express card members only. T&Cs apply. ABN holders w/ $75,000 revenue. | | |

| | | | |

Earn 50,000 Membership Rewards Bonus Points when you spend $10,000 on eligible purchases in the first 2 months. For new corporate card programs only. T&Cs apply.

| | |

| | | | |

Receive 350,000 Bonus Membership Rewards Points when you spend $25,000 on eligible purchases in the first 2 months. Plus, complimentary travel insurance. For new corporate card programs only. T&Cs apply.

| | |

| | | | |

Enjoy 350,000 Membership Rewards Bonus Points when you spend $25,000 on eligible purchases in the first 2 months. For new corporate card programs only. T&Cs apply.

| | |

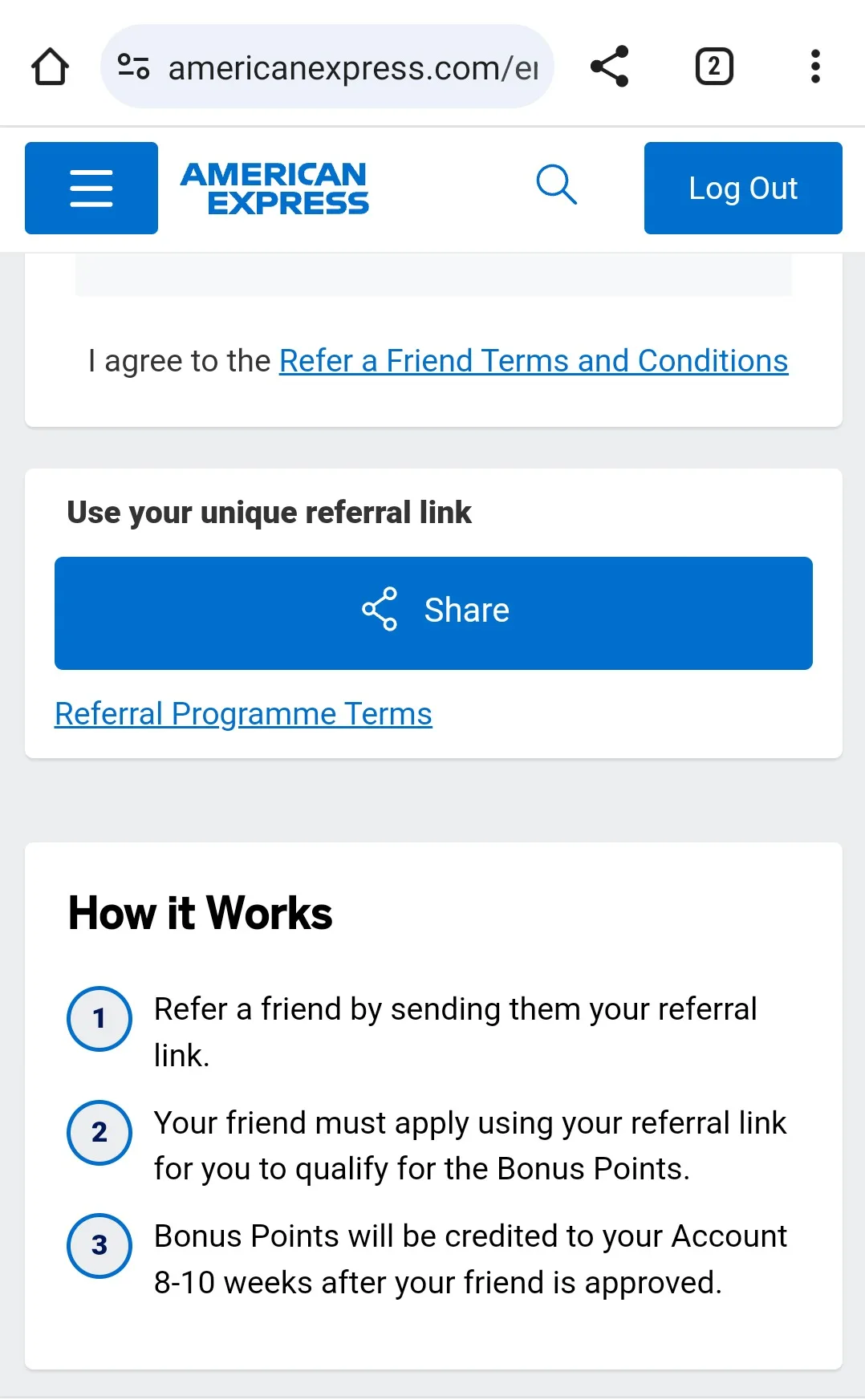

If my friend has an American Express Business Platinum Card and refers me, and I then get approved for the Personal Amex Platinum card, how many additional bonus points do I get on top of the 200,000 bonus points first time offer?

Hi Gino, This will depend on the specific referral offer your friend is using. Our guide to Amex referral bonuses has more on how the process works.