0:01

Since my last video where I discussed how I earned 900,000 points with Qantas, I've been busy spending those points. I've been from Sydney to London and back in business with the upgrade paid for points and I have booked flights for myself and my whole family to Japan and back again with points. But despite all that spending, as of today I've actually got more points than before 934,000 points.

0:23

In this video, I'm gonna tell you how I got the upgrades, how I earn those points. I'm also going to discuss some changes coming to the Qantas system which will make it both more difficult and more straightforward to earn points going forward.

0:41 How to get upgrades

The first thing we're gonna talk about is how I managed to get the upgrades between Sydney and London and back in business. Now there's a couple of things that influence the chance of you getting a rewards upgrade when you apply for one with Qantas. And aside from how sold out the flight is and how many spare seats there are, the biggest contributing factor is your status with Qantas - Gold, Silver, etcetera

1:02

Now I'm currently Platinum with Qantas, which makes me the second highest priority aside from Platinum One for getting a rewards upgrades on the flight. Now I don't normally fly enough with work or in my personal life to achieve platinum level status. The way I managed to do it was by having a child. Now I know this isn't something that everybody can do but if you have had a kid recently or you have one on the way and you're going on parental leave from work then you can use that as a reason to lock your status with Qantas.

1:29

If you're going for leave above a certain period of time, you get a letter from your company, you send it in to Qantas, they lock your status. The benefit of locking your status is that while it's locked for that two year period you continue to earn status credits and they don't expire. So a few trips home to Ireland and back in the first couple of years of my kid's life managed to get me platinum status which made me high priority for the upgrade. That's something worth looking at.

1:50

Aside from that, travelling in smaller parties, travelling on your own makes an upgrade more likely and in this case, I booked premium economy and upgraded to business. So that gives you a better chance than if you just book economy.

2:05 How to earn more points

Those two business upgrades cost me about 70,000 points each way gone from my account. How do you replace the points when you're using the points? Well the main way I did it over this last three months was with shopping and with purchasing wine firstly with Qantas Wine. Look for cases on Qantas Wine's website that come with bonus points particularly around sale periods or stock clearance periods. You can get up to 25,000 bonus points per case.

2:29 What you want to make sure is you're not paying above odds for those points. So you want to check the prices of all the wines in the case versus availability elsewhere. That can be pretty time consuming. But recently I found that ChatGPT does a pretty good job of doing the price checks for me.

2:44

So that's one way to earn points that covered one of the upgrades for me over the last 3 months and the second way is via shopping, by converting my Woolworths points to Qantas Points. For more details on that, you can check my previous video. But also by shopping and spending via my American Express Ultimate card which costs $450 a year in an annual fee.

3:05

But you get all of that back in Qantas travel credit. It earns 1.25 points per dollar which is one of the best earn rates on the market and that's been the main way I've been earning points.

3:13

for the last few years now, it's worth noting Qantas program changes. There are some changes coming to the Qantas rewards program. Some good, some bad. Basically, it breaks down into four different changes. First of all, Qantas are adding more reward seats on partner airlines like KLM Hawaiian Airlines and Air France which is good because it means you can use your points to book business or economy seats on other airlines, which might have better availability than Qantas.

3:38

The second change is Qantas is now going to be offering more points earned on domestic flights. They say about 25% more, though I gotta be said, it's gotta be said flying doesn't generally earn you that many points anyway. A fraction of the points I earn actually from flying. But if you're flying domestically regularly that could be a good way to earn extra points.

3:56

Third change is that they are going to make it cheaper to book rewards seats with Jetstar. So that's a positive. But the drawback, the fourth point here is from August, Qantas are going to make it more expensive to book Classic Reward seats. So you have to spend a higher percentage of points to get those seats.

4:13 Virgin status match vs Qantas

Overall, it's a bit of a mixed bag. You can check out an article from Angus Kidman on Finder which I'll link in the description below. For more information on these changes, finally, it's worth noting that there is another major airline in Australia. I know we really should have more than two, but Virgin Australia is also available and the benefit of being high status with one airline is you can often use that to match your status with the other

4:37

so I managed to get Virgin to match my status with Qantas. Not quite match. I got gold with Virgin and I'm platinum with Qantas but getting gold with Virgin allowed me to fly on Virgin with status and use their lounges. I've done a domestic flight and I've got a international flight coming up.

4:54

So in future, we will do a video looking at the difference between the flying and club experience between Qantas and Virgin and answer the question "Which is better?". Which is worth spending your time investing in?

5:06

Thank you for your time watching this video you can find more frequent flyer news on finder.com.au.

Hi, I note the current offer for Citi Premier Qantas Card states “for new customers only”. Is that to say even if I have previously held one of these cards but closed it approx 3 years ago, I do not qualify for this current offer? Most other Qantas cards seem to have an 18/24 month waiting period before being eligible again.

Thanks

Hi Todd,

Yes that’s right. Citi doesn’t specify a length of time if you’ve previously held a card. I suggest contacting Citi directly and seeing if they can give you more details.

Hello There

I have question about frequent flyer credits cards. I would like to find out how much I would per month and as I am beginner, which one would suit me the best? I am also plainning holiday for 3 people this year and I would like to use the card for travel

Hi Amy,

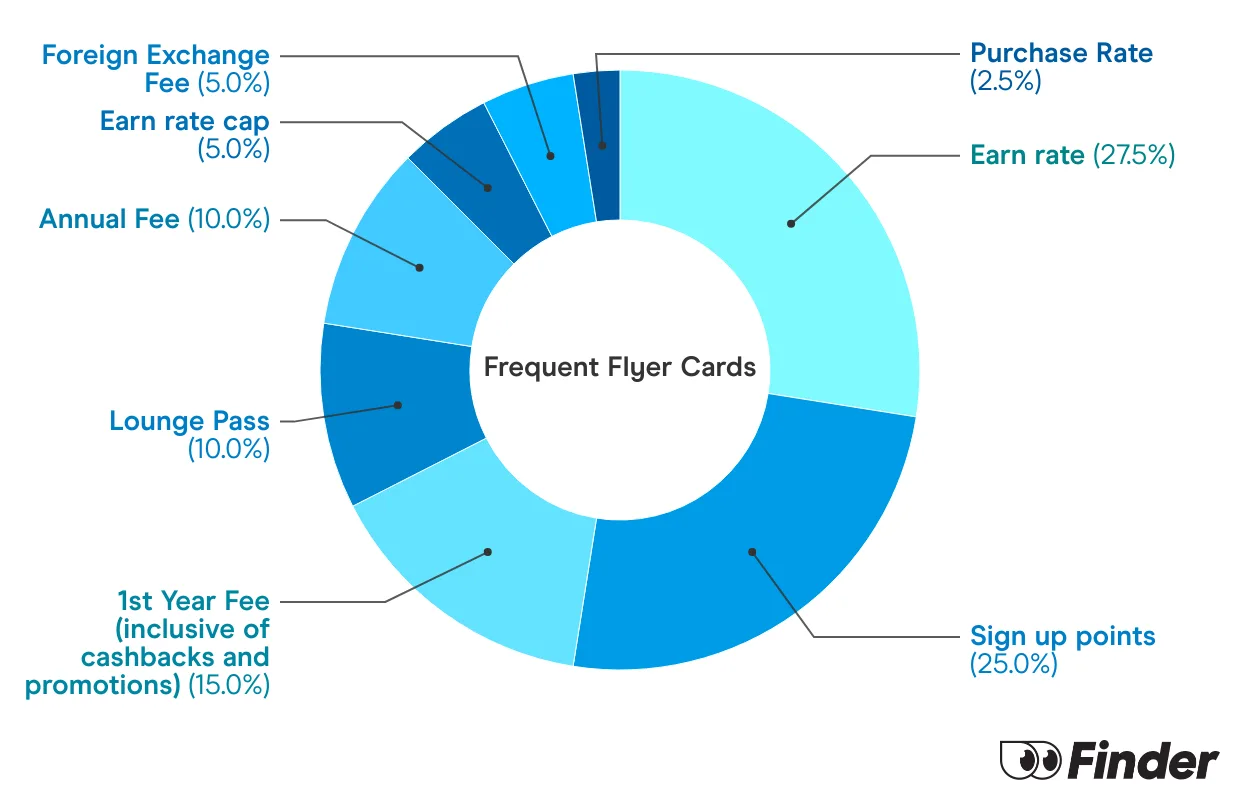

Finder provides factual information and general advice, so it’s important you consider your own circumstances when comparing and choosing a credit card. In terms of earning points, you can get an estimate of the number of points you’ll earn each month by multiplying the card’s points per $1 spent rate by your average monthly credit card spending. For example, if a card earned 0.5 points per $1 and someone spent $1,000 on a credit card each month, that would equal 500 points per month (0.5*1000 = 500). When using a credit card for travel, keep in mind that most frequent flyer credit cards charge a foreign transaction fee, which typically adds 2-4% to each transaction you make overseas (or online with businesses based overseas). Make sure to also check the annual fee, interest rate details and other features that you’re interested in. You can use the comparison table, as well as individual card review pages to find out more about different options currently available. I hope this helps.

hi,

I am looking at getting my card that allows me to earn qantas points, I would prefer to stay with a debit card, however i cannot earn points on my debit card. What would be the best card to start earning points.

Thanks

Hi Cooper,

Please keep in mind that Finder only provides general advice and factual information. But you can compare Qantas Frequent Flyer Credit Cards on Finder’s comparison page. You could also consider the Qantas Travel Money Card as a prepaid debit card option, or the Bankwest Qantas Transaction Account. I hope this helps.

Thanks for your reply. What is your general advice/review on CBA ultimate awards?

Hi Ilan,

We’ve laid out all details on our review page which you might find helpful reading in regards to seeing if it will work for your own personal situation. On the page you can find a general “verdict” which lays out a balanced view of the card, some pros and cons, and of course the details in regards to costs and features.

Hope this helps,

Elizabeth

Hello, my wife and I have the ANZ Qantas Black card. We got this card initially as part of their Breakfree package when we got our home loan. We make sure to use the card for most household expenses. We have since refinanced our mortgage to another bank and hence don’t get the card for free anymore. We are also looking at purchasing another property so want a card with a lower minimum credit limit. We do not need 15k. What card would you recommend for say a 10k limit with similar benefits (insurances, lounge access and not a crazy fee)? The CBA Ultimate Awards looks tempting. Thanks in advance!

Hi Ilan,

Please be aware Finder can only give general information not personal advice. In regards to minimum credit limits, there are plenty of frequent flyer credit cards that offer minimum limits of $3,000 to $10,000, including the Qantas Premier Platinum and Qantas American Express Ultimate, which were highly commended in the Best Frequent Flyer Credit Card – Qantas category of the 2023 Finder Credit Card Awards. You can view details of the minimum limits and extras such as lounge access or insurance on Finder’s review pages or the bank websites. Finder’s mortgage calculator also factors in credit limits and may help when considering your options. I hope this helps.