Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseKey takeaways

- Contents insurance covers only the items inside your home, like your furniture, your TV, appliances and more.

- Contents insurance is ideal for renters, students or property owners who don't need building cover.

- Customising your cover is key to getting the most value out of your policy.

What is contents insurance?

Contents insurance is a type of home insurance that covers the items inside your home, such as your TV, furniture or art, without providing any cover for the actual building.

You can buy contents insurance as a standalone policy or bundle it with building/home insurance.

Usually, contents insurance is highly customisable. You may be able to add cover for items you take outside of the home as well as for high-value items.

What does contents insurance cover?

Most items within your home will be covered by your contents insurance. Although they vary slightly between insurance brands, the following are some common inclusions:

- Carpets and rugs

- Furnishings

- Household electrical appliances

- Above-ground swimming pools

- Wheelchairs and mobility aids

- Tools and gardening equipment

- Paintings and works of art

- Furniture

- Fixtures and fittings

- Blinds and curtains

- Potted plants

- Tools of your trade

Many personal effects are also covered by home insurance, including the following:

- Bicycles

- Binoculars and telescopes

- Clothing and accessories

- Jewellery and medals

- Musical instruments

- Music systems and radios

- Sporting equipment

- Writing instruments

- Baby capsules and prams

- Children's toys

- Cosmetics

- Medical aids

- Cameras, video equipment and accessories

- Glasses, sunglasses and contact

- Watches and clocks

- Non-fabric camping equipment

While contents insurance can cover many things, it’s important to keep an eye on sub-limits. For example, jewellery may be covered but it may have a limit of up to $5,000. This means if your jewellery exceeds this cost, you can’t claim back more than $5,000. That’s worth keeping in mind if you’ve got an expensive ring or watch that you plan to insure.

When am I covered?

Contents insurance kicks in when your belongings are damaged in a specific way. These are called insured events. Take a look at the events below so you know when you'll be covered. Keep in mind, every insurer is different and ‘insured events’ can vary between providers. It’s always best to read your product disclosure statement (PDS) to know exactly what you’re covered for.

| Insured event | Example | Watch out for |

|---|---|---|

| Fire | A bushfire or kitchen fire | ⚠️ Policies might not pay out for damage caused where there was heat but no flame. For example, smoke damage, scorching or melting. |

| Theft and attempted theft | Your home is burgled | ⚠️ Your policy won't pay out if the theft was by someone who entered your home with your permission or if you didn’t make a police report. |

| Storms and rainwater | Surface run-off water enters your home | ⚠️ Unless you have flood cover, you won't be covered for water damage that's due to a body of water breaking its banks. |

| Escape of liquid | A pipe bursts | ⚠️ Contents insurance is unlikely to cover the cost of the item that caused the leak. |

| Lightning | Lightning strikes your home | ⚠️ The damage must be caused by a direct lightning strike or thunderbolt |

| Malicious damage | Someone breaks into your home and vandalises it | ⚠️ Your policy won't pay out if the damage was by someone who entered your home with your permission. |

| Impact | A tree falls on your home or a car loses control and drives into it | ⚠️ You won't be covered if you authorised a tree to be cut down and then it falls on your home. |

| Earthquake or tsunami | A tsunami hits your waterfront home | ⚠️ The tsunami must be caused by an earthquake rather than by "actions of the sea". |

| Breakage of glass, ceramic and sanitary features | A mirror breaks or the glass in a display cabinet breaks | ⚠️ Glass in TVs, tablets and mobile phones are generally not covered. |

| Explosion | Your water boiler explodes, destroying the furniture and belongings in the adjacent room. | ⚠️ Contents insurance is unlikely to cover the cost of the item that exploded. |

| The following insured events are usually optional extras: | ||

| Flood | A nearby river breaks its banks, flooding your home | ⚠️ This is usually an optional extra. You may have to pay more money for this cover. |

| Accidental damage | You spill red wine on the carpet or your dog knocks over your TV. | ⚠️ You won't be covered for general wear and tear, including chips, scratches and dents. |

Who needs contents insurance?

Anyone who keeps expensive or valuable items in their home should consider contents insurance. As contents insurance only covers items within a home, not the building, contents insurance is highly recommended for:

- Renters: Renters are not responsible for protecting the structure of the building they live in. This responsibility is on the landlord or the owner of the building who will most likely have landlord or building insurance.

- Those who own an apartment: If you own the apartment you live in, as the physical structure of the building and common areas are typically covered by a strata insurance policy.

- Property owners: Those who own a dwelling will need home and contents insurance to protect their personal belongings and the physical structure of their home.

Sum insured vs total replacement: what’s the difference?

When you begin browsing contents insurance policies, you’ll notice insurers give you the option to have your covered as either sum insured or total replacement.

Under sum insured contents insurance, you will be responsible for setting the amount you want your items to be covered for. Total replacement is where the insurer agrees to cover the full cost of replacing your contents with new items of equivalent quality and standard.

There is no “better” option of the two, so the choice you make will come down to what you’re more comfortable with. It is worth noting that sum insured policies do carry the risk of underinsurance, as items depreciate in value. On the other hand, you may face a higher premium with total replacement, as insurers take on a larger financial risk in this scenario.

How much does contents insurance cost?

We got quotes from 14 different home insurers and found that policies can start from $23 a month.

When you get a quote from an insurer, it will probably vary from these prices because it's entirely based on the value of your stuff. But at least you get an idea, right?

Here's the rest of the research so you can see how different insurers stack up against each other on a monthly and annual basis.

We rounded all the quotes to the nearest dollar. The customer profile had no previous claims and a $500 excess.

Learn more about our methodology

- Quotes were obtained for the same three-bedroom New South Wales home in Baulkham Hills owned by a family of two.

- Homeowning family of two who moved into their property in January 2019.

- Quotes were obtained in February 2026 and were for contents insurance only.

- Three-bedroom, one story freestanding house on flat ground with brick veneer walls, terracotta tiled roof, no verandas and built in 1980.

- Windows secured by deadlocks, with no security devices.

How much contents insurance do I need?

This is entirely dependent on how much stuff you have and how valuable it is. Between different types of furniture, appliances and other sentimental items, no two people have the same set of belongings. To get the most accurate estimate of how much contents insurance you need, we recommend:

- Going from room to room, listing and valuing every time. This helps prevent you from becoming overwhelmed.

- Build a receipt stash wherever you can.

- Use an online contents insurance calculator, like the available via the Insurance Council of Australia.

How can I get the most out of contents insurance?

Contents insurance comes with heaps of cool benefits. Some are included as standard, while others you can pick and choose. Take a look at some examples below.

Portable contents

Sometimes called personal effects, this extra benefit covers the things you take outside of your home. It includes jewellery and bicycles, but not phones or laptops.

Food spoilage

Lots of policies will pay out if an insured event ruins the food in your home. For example, a burst pipe cuts the power and everything in your freezer is ruined.

Motor burnout

This option covers you for loss or damage to electric motors, commonly found in appliances like fridges, freezers or washing machines.

Vet's expenses

Some policies will pay a benefit if your pet suffers an injury as the result of an insured event.

Specified items

Contents insurance sets a limit for the amount you can claim per item. If you have any high-value items, be sure to specify them.

How to save on contents insurance

For the level of protection you get, contents insurance is pretty affordable. But there are still ways to cut the cost of cover and score a serious bargain.

Shop around. It’s our job to compare the differences between policies and their pricing and let me tell you, there’s some pretty insane price differences for almost identical coverage. It’s always worth comparing at least 5 providers to make sure you’re not being ripped off.

Look for discounts. Insurance companies often run deals to attract new customers. You can usually get up to 15% off a new contents policy. Check them out here.

Bundle cover. Some insurance brands will reduce the cost of your premium if you have more than one type of cover. Consider bundling your car insurance to save more cash.

Pay annually. You'll usually get a discount if you pay annually rather than monthly. Some insurers will also give you a discount if you buy online rather than over the phone.

Raise your excess. Choosing a higher excess will reduce the cost of your premium, but make sure the excess is affordable. There's no point pricing yourself out when it comes to claim time.

Don't be shy. Ask the insurer if there's any way you can get a better deal. They might be able to tell you about an offer that's running or give you a price cut.

What isn't covered by contents insurance?

Contents insurance helps in heaps of different situations, but it won't cover everything. Here are some common exclusions to be aware of:

- Actions of the sea, except tsunamis

- Asbestos

- Illegal activity

- Defects and structural faults

- Earth movement

- Wear and tear

- Neglect

- Repossession

- Vermin

Contents insurance for renters

Contents insurance covers most of your belongings kept inside the home. You don't need to insure the building since that's the landlord's responsibility.

It'll also cover some semi-permanent features – like air-con units, ovens and carpets – as long as you paid for them.

Check out our guide to renter's insurance for more information.

Contents insurance for landlords

Landlord insurance covers both the fixtures and fittings inside your property, including built-in wardrobes, shelving units, ceiling fans and kitchen countertops.

You can also add cover for malicious damage and tenant default.

Check out our guide to landlord's insurance for more information.

Contents insurance deals - February 2026

Compare other products

We currently don't have that product, but here are others to consider:

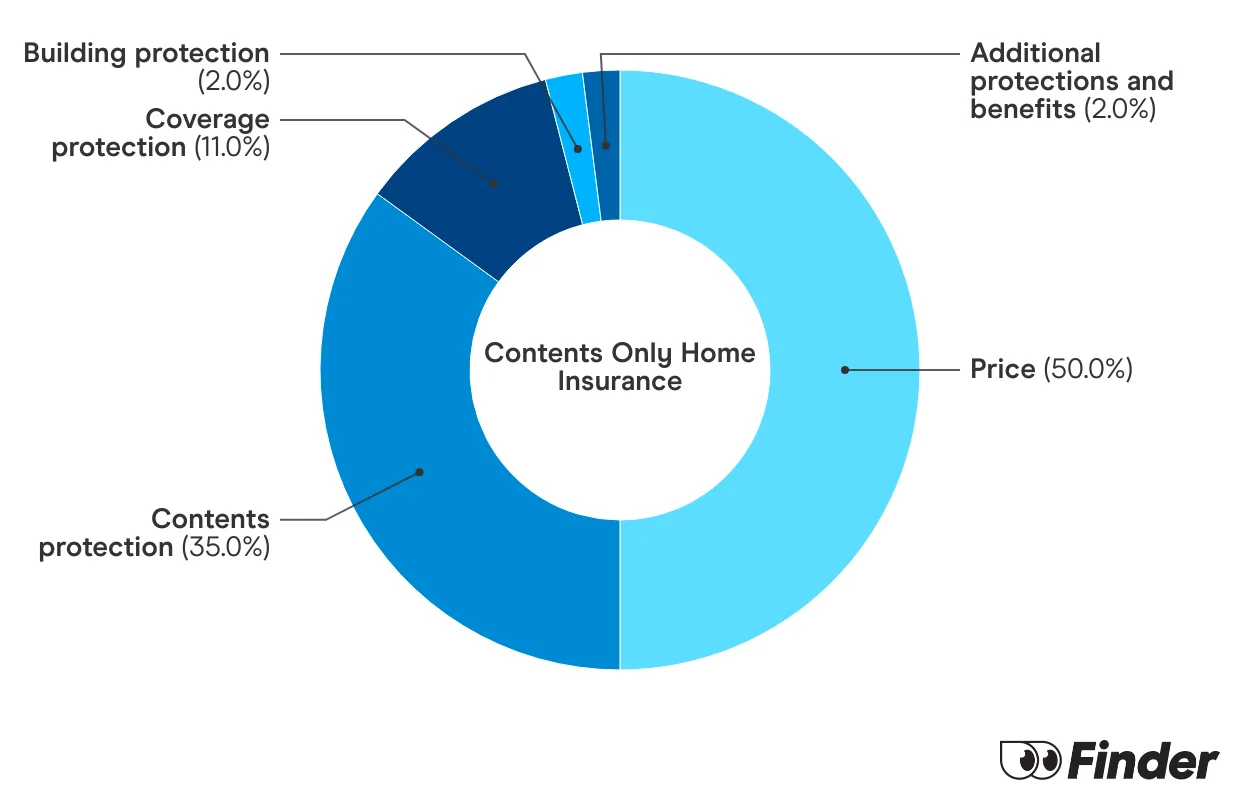

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

FAQs

Sources

Read more on Home Insurance

-

Handbag insurance

Love your handbag? Handbag insurance is a good way to show it.

-

Are kitchen appliances covered by contents insurance?

Get protection for your high-value electronics and whitegoods with home and kitchen appliance insurance.

-

Art insurance

Find out the ins and outs of art insurance and what type of cover is right for you.

-

Watch insurance

Find out more about watch insurance and how to get cover.