Key takeaways

- Content insurance can cover that massive rock on your finger. I mean your engagement ring.

- You can also be covered for when you take the ring outside.

- You got options. You can list your ring on your contents cover, or you can get jewellery cover.

What is engagement ring insurance?

Engagement ring insurance covers the cost of repair or replacement if your ring is lost, damaged or stolen. You can be covered both inside the home and when you’re out and about.

With engagement ring insurance, you can be covered for:

- Theft of your ring

- Accidental loss of your ring

- Accidental damage to your ring

- The repair and replacement of your ring

It’s important to note, you will not be covered for the following:

- General wear and tear

- Deliberate acts by you, your spouse or family members

- Loss or damage while overseas

- Lawful seizure or confiscation

- Damage caused during cleaning or alterations

How can I get engagement ring insurance in Australia?

There are three main options for engagement ring insurance in Australia. You can add cover to your home contents insurance, buy specialised engagement ring insurance or take out single-item insurance. Each option has its own pros and cons.

Contents insurance

If you have contents insurance for your home, you can add cover for an engagement ring to your policy. This option is usually the cheapest, but it's only economical if you already have contents insurance, or are looking to buy a policy anyway.

If you do decide to add cover for an engagement ring to your policy, make sure you're also covered for loss outside of the home. You may have to include portable contents insurance, sometimes known as personal effects cover.

Specialised engagement ring insurance

Some insurance companies specialise in jewellery, including engagement rings. This option is great for people who don't have contents insurance or have higher-value items that wouldn't be covered by their home insurance policy.

If you're unsure about the value of your jewellery, some brands will even offer valuations as part of the service, including Jewelsure and QReport.

Single item insurance

Single item insurance is designed for people who want to insure certain items in their home, rather than the entire contents. It's great if you only have a few valuable pieces that you'd like to protect, and is pretty low-cost too.

If you opt for single item insurance, you may have to upgrade the policy so that your item is covered outside of the home.

Compare specialised jewellery insurance options

Compare contents insurance policies

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score - Home Insurance

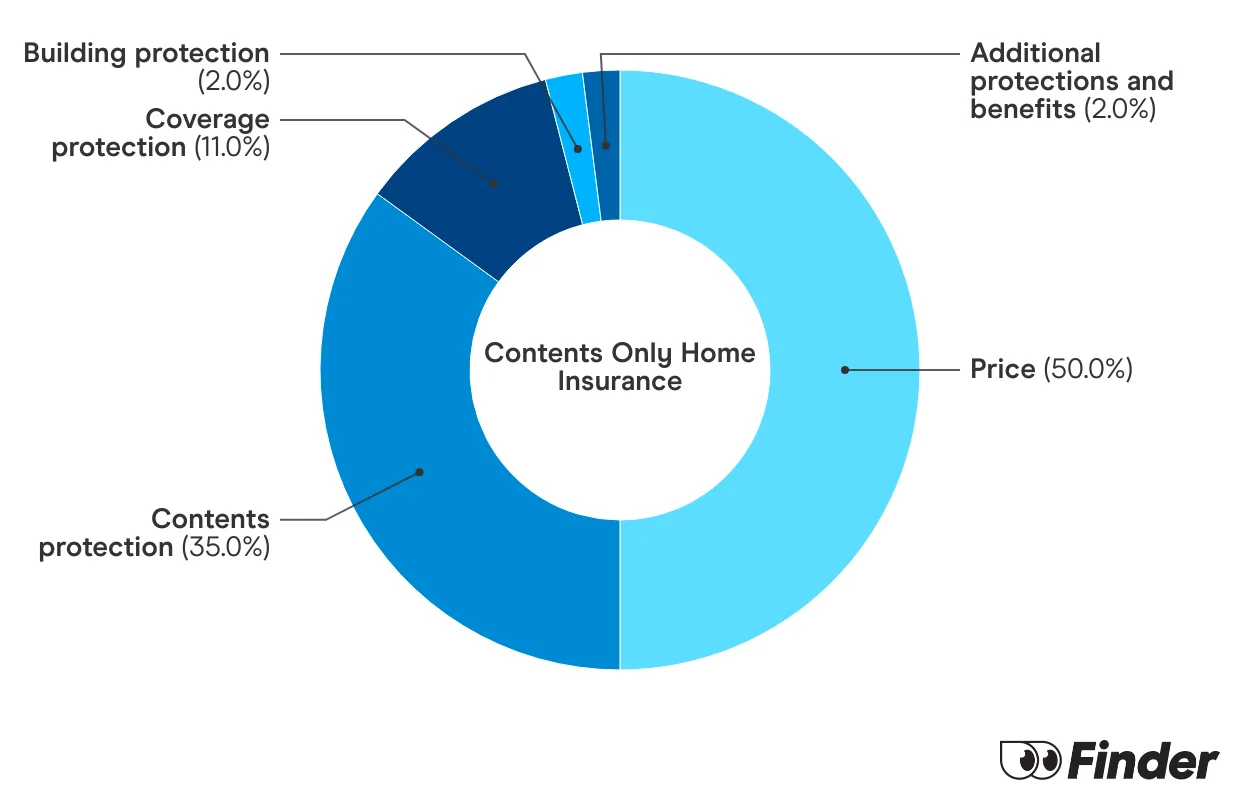

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How much does engagement ring insurance cost?

| Provider | Premium cost without engagement ring | Premium cost with engagement ring |

|---|---|---|

| $548.93 | $740.44 |

| $560.98 | $573.65 | |

| $446.46 | $446.46 | |

| $1,154.15 | $1,203.60 | |

| $534.07 | $930.02 |

This information is accurate as of September 2024.

"When purchasing insurance for your engagement ring, it’s important to consider the following:

- The value of your ring. Knowing its value so you can purchase an adequate amount of cover.

- The type of cover needed. Knowing the value will also help you understand what type of policy is right for you; a general contents policy with portable items cover or a specialised policy.

- Applicable excess. I recently bought insurance for my own ring as part of my home and contents policy. I split the excesses so I’d have to pay less in the event I needed to claim on my ring and kept a higher excess for the rest of my policy."

FAQs

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.