Key takeaways

- You can insure your phone with standalone mobile insurance, contents and portable contents insurance, credit card purchase protection, or a mobile provider plan with insurance.

- Costs depend on the type of insurance you choose and how much cover you want.

- Consider the costs of insurance vs the costs of replacing out of pocket before making a decision.

What is phone insurance?

Phone insurance helps pay for repairs or replacement if your phone is stolen, damaged, or lost. In Australia, there are five main options for phone insurance:

- Contents insurance

- Portable contents Insurance

- Standalone mobile Insurance

- Credit card purchase protection

- Mobile provider cover

Most cover theft and accidental damage, but not all include coverage outside the home. Each option has its pros and cons, so be sure to know the differences to pick the one that suits you best.

Home contents insurance for mobile phones

Home contents insurance for mobile phones

If you have a home contents policy, your phone might already be insured. However, unlike a standalone phone insurance policy, what it covers can be limited, and you won't have cover for it when you use it outside the house.

Because contents policies cover a wide range of items, there are usually per-item limits for devices like phones, which won't always cover the full cost of replacement or repair. You may also have the same excess for claims against your phone as you would with other items, which can get expensive compared to the value of your phone.

What's covered?

- Your phone at home.

- Some types of damage like fire, theft, & flood.

- Accidental damage may need to be added as an extra, increasing your premium.

What's not covered?

- Damage or theft outside the home.

- It may not cover the entire cost of repair or replacement.

- Accidents like dropping your phone or water damage.

Who's it for? This is an easy way to protect your phone, as it's already included in most home and contents policies. But depending on your phone's value, the cost of making a claim might not be worth it. For example, some excesses can be around $500, which could exceed the cost of repairing your phone. Also, the list of claimable events for phone damage is relatively restricted. Unless the damage occurs during a house fire, theft, or flood, you're unlikely to be covered.

If you're looking for cover when you're out and about with your phone, consider a portable contents or a dedicated phone policy.

Portable contents insurance for mobile phones

Portable contents insurance for mobile phones

Adding portable contents cover to your home insurance can protect your phone against loss, theft, or damage when you are away from home. Keep in mind, though, that 'away from home' usually still means within the country. If you're taking your phone overseas, a travel insurance policy will offer better protection.

It's an optional extra on a regular contents insurance policy, so an increased premium and excess fees will usually apply. Some policies have a different excess that applies to extras like portable contents, and others require you to pay the excess listed in your contents policy to use it.

What's covered?

- Your phone at home and out and about.

- Fire, theft, or accidental damage.

- Accidental loss or damage is usually covered as an optional extra.

What's not covered?

- Some insurers don't cover flood damage unless you specify.

- Any items used for business or to make income

Who's it for? If you already have contents insurance, adding portable contents cover is an easy way to protect your phone while you're away from home. However, it's important to check what premium increases and excess applies. A portable contents claim can sometimes cost in the hundreds, which won't always be worth it depending on the value of your phone. Also, some insurers won't cover the damage to your phone if it's as minor as a cracked screen, so it's important to read the fine print on exactly how your phone can be covered.

Standalone mobile phone insurance

Standalone mobile phone insurance

Standalone mobile phone insurance is an affordable way to get dedicated cover for your device. Unfortunately, in our experience, there aren't many options in Australia for standalone insurance. We did find Switched On Insurance, however, which offers two levels of phone insurance for a small monthly subscription fee.

What's covered?

- Standard cover – accidental damage, malicious damage, liquid damage, and cracked screen repairs.

- Premium cover – same as above, plus theft cover and unauthorised use cover.

- Worldwide cover up to a maximum of 60 days per trip.

What's not covered?

- Standard cover – loss, theft.

- Phones financed with remaining debt.

- Wear and tear or neglect.

Who's it for? Standalone phone insurance can be good for those who want coverage for everyday hassles like cracked screens and liquid damage. Because there are typically no contracts and a short cooling off period, it can offer a more flexibility than other types of insurance.

Credit card purchase protection for phones

Credit card purchase protection for phones

Many credit card companies offer purchase protection for phones as a benefit for cardholders. This type of cover is designed to protect your phone against damage, loss, or theft up to a certain time after purchase.

The details of the cover vary between brands, including eligibility, timeframes, cover limits, and whether you have to pay a fee to make a claim. For example, NAB offers 90 days of coverage after purchase, while Westpac provides four months. Cover limits can also vary quite a bit. We found that Citibank won't pay more than $1,650 over 12 months, whereas Bendigo Bank has a $25,000 limit.

What's covered?

- Theft or damage within your cover period

- There are cover limits, usually up to a full $10,000 per item. But this varies.

- Not all credit cards are eligible

What's not covered?

- Theft or damage that happens outside of your cover period.

- If you lose your phone or don't take reasonable precautions to keep it safe.

- Weather events aren't usually covered.

Who's it for? Depending on the credit card provider, purchase protection can cover your phone without you having to pay a cent. However, if you want extended protection, this might not be the option for you as cover periods can be as short as 3-4 months.

It's important to note credit card purchase protection is not the same as standalone phone insurance and there may be more restrictions that apply.

Mobile provider cover

Mobile provider cover

Many phone providers offer a level of cover with "Swap, Replace, or Repair" or "Upgrade and Protect" programs when you purchase a phone with them on a plan. You pay a monthly subscription fee which lets you upgrade your phone or replace your screen for a heavily discounted fee. Some providers offer free upgrades if your phone is in working order after a certain period in your contract.

For example, Telstra Upgrade & Protect offers a $0 upgrade if your phone is in good working order within the final 6 months of a 12-month contract or in the final 12 months of another contract. With Optus Upgrade & Protect, upgrading your device is free if you have less than a year of repayments on a phone you purchased with them.

What's covered?

- Phones that are bought on a payment plan or contract with a provider.

- Free upgrades for phones in working order after a certain period in your contract.

- A discounted fee to upgrade your phone.

- Limited free screen replacements per year for a fee.

- Limited damaged device upgrades per year for a fee.

What's not covered?

- Replacements if your device is lost or stolen.

- You can only claim a certain number of replacements and repairs per year.

- Phones that have been bought outright.

Who's it for? If you're on a budget and want basic, hassle-free phone protection, this is a good option. However, if you're looking to insure your phone against theft or loss, this type of cover may not be enough.

It's important to understand that depending on your needs, mobile provider cover can get expensive. While the initial cost is usually only $10-20 per month, depending on how many claims you make and how long you keep the service, the regular payments and fees can add up over time.

Compare contents insurance that can include phone cover

Compare other products

We currently don't have that product, but here are others to consider:

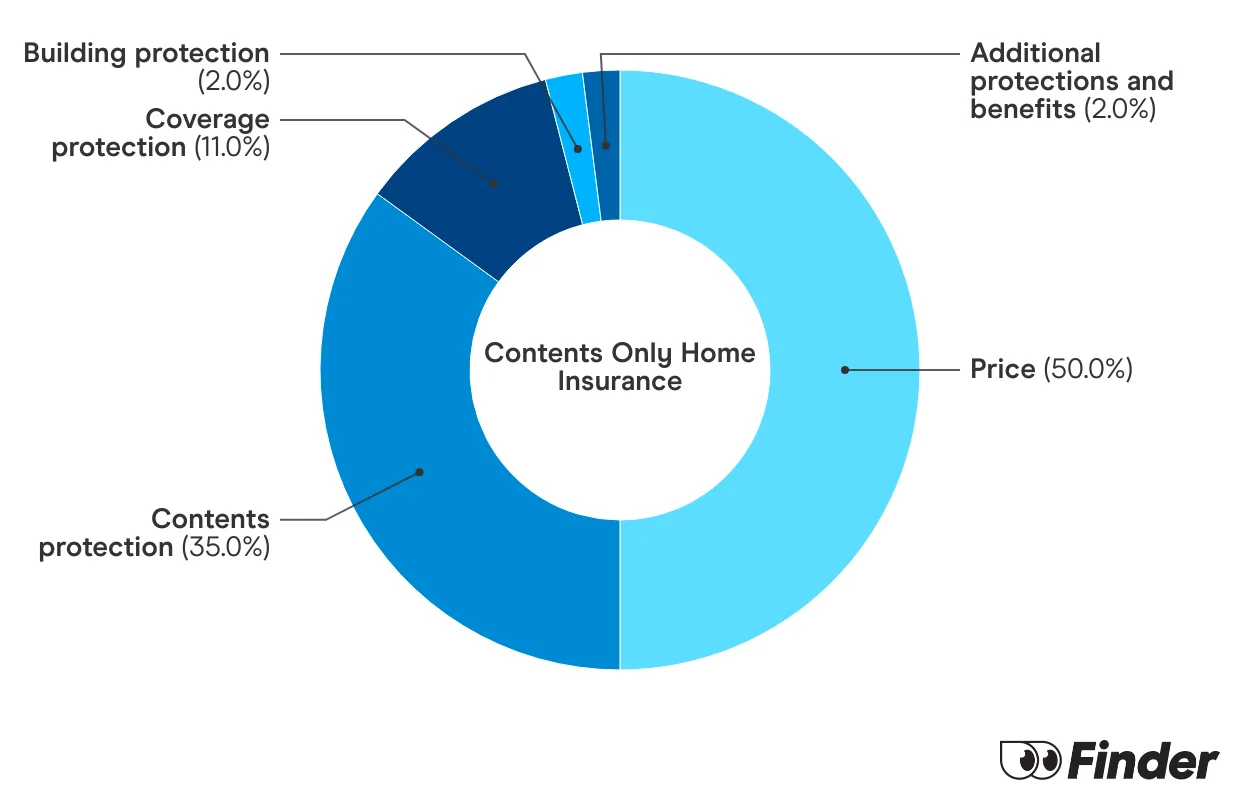

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How much does it cost to insure a phone?

It all depends on the type of phone insurance you choose and whether you've got home and contents insurance. Each type has its own pay model, which changes how much you end up paying to get cover and to use it.

Even if the initial cost seems cheap, premiums and additional fees can really add up if you're not careful, so it's always a good idea to compare policies. Let's take a look at the average price of a few different brands and phone insurance types.

At the higher end, NRMA ($124.44) will charge you over $120 extra to include a phone in your contents insurance policy. While it was less than $60 extra to insure your phone with QBE ($58.26) as the cheapest option.

| Provider | Premium cost without phone | Premium cost with phone |

|---|---|---|

| $581.61 | $706.05 |

| $502.25 | $591.36 | |

| $702.23 | $760.49 |

| $597.79 | $694.94 |

This information is accurate as of February 2026.

"Phone insurance can be extremely handy! I've had to replace any number of handsets or get them repaired over the years thanks to dropping them on bushwalks, dropping them on cement, and on one unfortunate occasion dropping it in the bathroom. With the right policy, you can save quite a bit on repairs -- just make sure you do some comparisons before you buy. "

What to consider before buying phone insurance

Replacing your phone can be expensive, but the options to insure a phone aren't necessarily cheap either. It's important to consider if phone insurance is worth the purchase. Ask yourself:

- Could you afford to replace your phone if it was stolen or damaged beyond repair? If the answer is no, a form of portable contents insurance or general phone insurance could be a good option.

- Do you rely on your phone for work? If yes and you wouldn't have the funds to replace it out of pocket, insurance could be worth considering.

- Does the insurance policy you're looking at cover the damage you expect to incur? For example, if you're looking into phone insurance because you're a chronic screen cracker, be sure that this is actually covered. In a few of the contents policies we looked at, cracked phone screens didn't make the cut for inclusions.

It's always a good idea to weigh the costs of each policy type to see if it's worth it compared to fixing or replacing your phone on your own.

Think about how important your phone is to you and the chances of it getting damaged or lost. If you tend to go through phones quickly or if it's vital for work and you travel a lot, it might be worth considering a form of phone insurance.

Find and compare portable contents insurance with Finder.

FAQs

Sources

Ask a question

4 Responses

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.

iphone 13 pro insurance?

Hi John,

If you’re looking for phone insurance, you can refer to the comparison table above to compare and choose an insurance provider. Use the ‘Get a Quote’ to get a quote within minutes directly from the provider.

As a reminder, always read a policy’s Product Disclosure Statement (PDS) so that you’re aware of what you’re covered for, along with any exclusions or restrictions.

I hope this helps!

Regards,

James

Hi, I’ve noticed this article https://www.finder.com.au/home-insurance/phone-insurance

does not include specialised Gadget Insurance companies such as Big Giraffe gadget cover, Covertec and Brightside Cover?

Is this an oversite? Hoping you might be interested in cover the full market rather than just a small select few?

Thanks

David

Hi David, thanks for your inquiry!

We’d like to thank you for your suggestions. This has been forwarded to our publishing team for approval.

Best regards,

Jonathan