Key takeaways

- You can get laptop insurance as part of contents insurance which covers all belongings kept at your home – this is often a better value-for-money option.

- You can insure your laptop with single item insurance – this is usually a cheaper option.

- If you want protection outside the home, you can add on portable cover to contents or single item insurance policies.

What is laptop insurance?

Laptop insurance can protect your laptop from theft or accidental damage. Depending on your policy chosen, you can be covered for inside the home and while you're out and about (if you add portable contents cover).

What are my laptop insurance options?

Contents insurance

Contents insurance is designed to cover all the belongings inside your home, including your laptop. If you want to protect specific items you frequently take outside, like your laptop, you can add on portable contents insurance to your policy.

Single item insurance

This is a cost-effective way to insure the items you value most, like your phone or laptop. It's a good option if you only want cover for specific items and you can pay extra to protect your laptop outside your home.

Compare contents insurance policies for your laptop

Compare other products

We currently don't have that product, but here are others to consider:

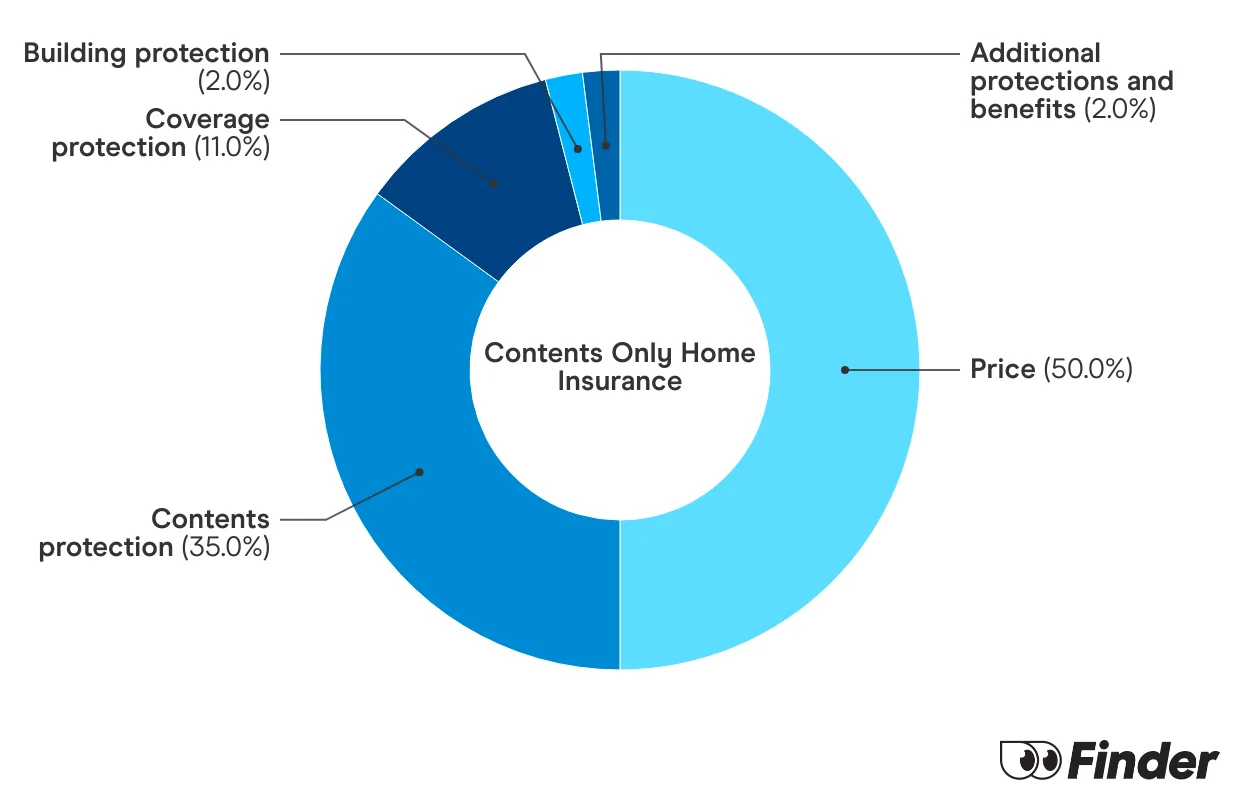

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How much does it cost to insure a laptop?

This depends on how you choose to insure it and how much it's worth. To give you an idea of what costs could look like, we got quotes for a contents policy worth $80,000 and added portable contents insurance for a $3,000 laptop.

How much does Laptop insurance cost?

| Provider | Premium cost without laptop | Premium cost with laptop |

|---|---|---|

| $516.20 | $771.53 |

| $533.83 | $681.83 | |

| $394.22 | $519.21 | |

| $1,039.87 | $1,264.09 | |

| $400.89 | $673.87 |

This information is accurate as of September 2024.

FAQs

Sources

Ask a question

More guides on Finder

-

National Seniors home insurance review

If you're over the age of 50 and are looking for the right home insurance policy, National Seniors could be one to consider.

-

Home Insurance Victoria

Be ware of the unique risks faced by Victorian homeowners. Discover how to find a home insurance policy that gives you the cover you really need with this handy guide.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

NAB home insurance review

A review of NAB's home and contents insurance policies. Find out how NAB can cover your house and possessions, giving you peace of mind and protection against the worst.

-

St.George Home Insurance review

Compare 3 home and contents insurance policies with St.George. Get a 10% discount for the first year if buying online.

-

Bendigo Bank home insurance review

Here's a detailed review of Bendigo Bank home insurance with information on 3 cover options.

-

Bupa home insurance review

Bupa Health Members may want to consider taking out a Bupa Home Insurance policy – you can get up to 15% off.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.