Compare other products

We currently don't have that product, but here are others to consider:

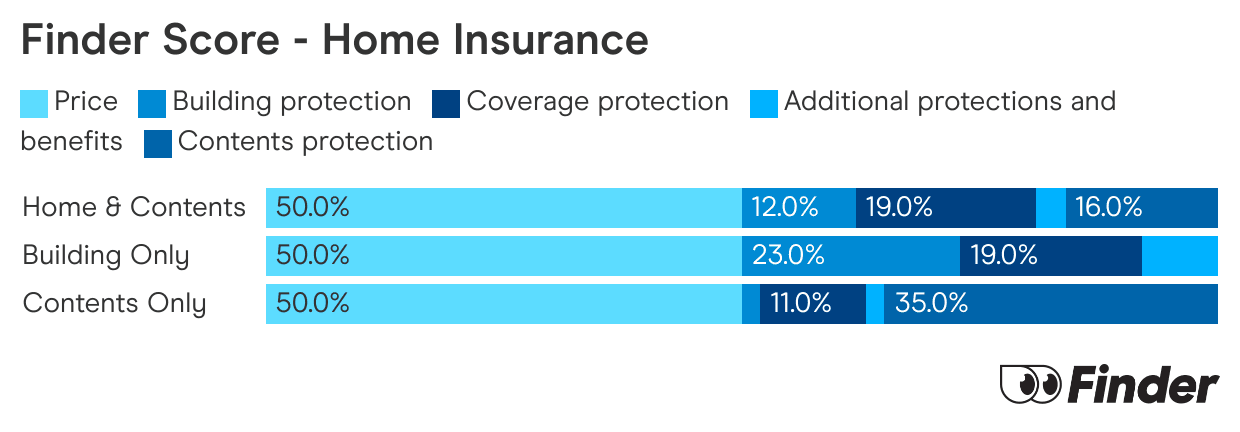

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

What kind of water damage is covered by home insurance?

Home insurance for water damage is usually split into three separate types of cover:

Flood cover is often an optional extra you may need to pay extra for – so if you live in a flood-prone area, be sure to check you're covered. Below is a table of some insurers that include water damage cover for all three services.

| Flood | Storms and rainwater | Escape of liquid | |

|---|---|---|---|

| Optional | ||

How to make a water leak insurance claim in Australia

To file a successful claim for water damage through your home insurance, follow these steps:

Contact your home insurance provider as soon as there is damage.

Give them as much information as possible. Document the value of all the items you can think of that have been damaged and take as many photos as possible.

If possible, make an effort to control the leak and dry out your home to prevent further damage.

Your insurer will probably send someone to take stock of the damage.

Obtain at least three independent estimates from qualified general contractors to work out how much the damage has cost.

If your claim is approved, your insurer will talk to you about making necessary repairs to your home as well as replacing damaged contents.

What's considered water damage?

Water damage can include sudden or accidental damage as a result of water, most commonly from a burst pipe, water overflow, flood or storm.

Home insurance providers usually only cover you for sudden and accidental damage; that is, water damage that occurred quickly and unexpectedly. Gradual water damage, on the other hand, is usually not covered by most home insurance policies.

Common claims can include the following:

- Burst taps or pipes, e.g. your kitchen sink pipe bursts suddenly

- Damage caused by a storm or a flood

- Broken kitchen or bathroom appliances that cause water damage

- Sewer backup and overflow

Does home insurance cover leaking pipes?

Yes, home insurance covers leaking pipes if the damage was caused by escaping water that occurred suddenly and without warning.

A burst pipe generally comes under "escape of liquid or water" and can cover you for a sudden and immediate leak (not something gradual that you were well aware of) as a result of the following:

- Appliances, such as a washing machine, dishwasher etc

- Fixed items, such as showers, baths, sinks and toilets

- Fixed systems, such as drainage or sewage systems

- Water-filled items, such as aquariums and waterbeds

If you don't know where the leak is coming from, some home insurance providers will pay the reasonable costs up to a certain price to locate the source of the problem.

Does home insurance covers storms

Yes, standard home insurance policies generally cover storms. Storm cover can include damage caused by:

- Storms

- Lightning

- Wind

- Hail

- Snow

- Stormwater overflow from roof gutters and downpipes.

Frequently asked questions about water damage

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Home Insurance Victoria

Be ware of the unique risks faced by Victorian homeowners. Discover how to find a home insurance policy that gives you the cover you really need with this handy guide.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.