Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score - Home Insurance

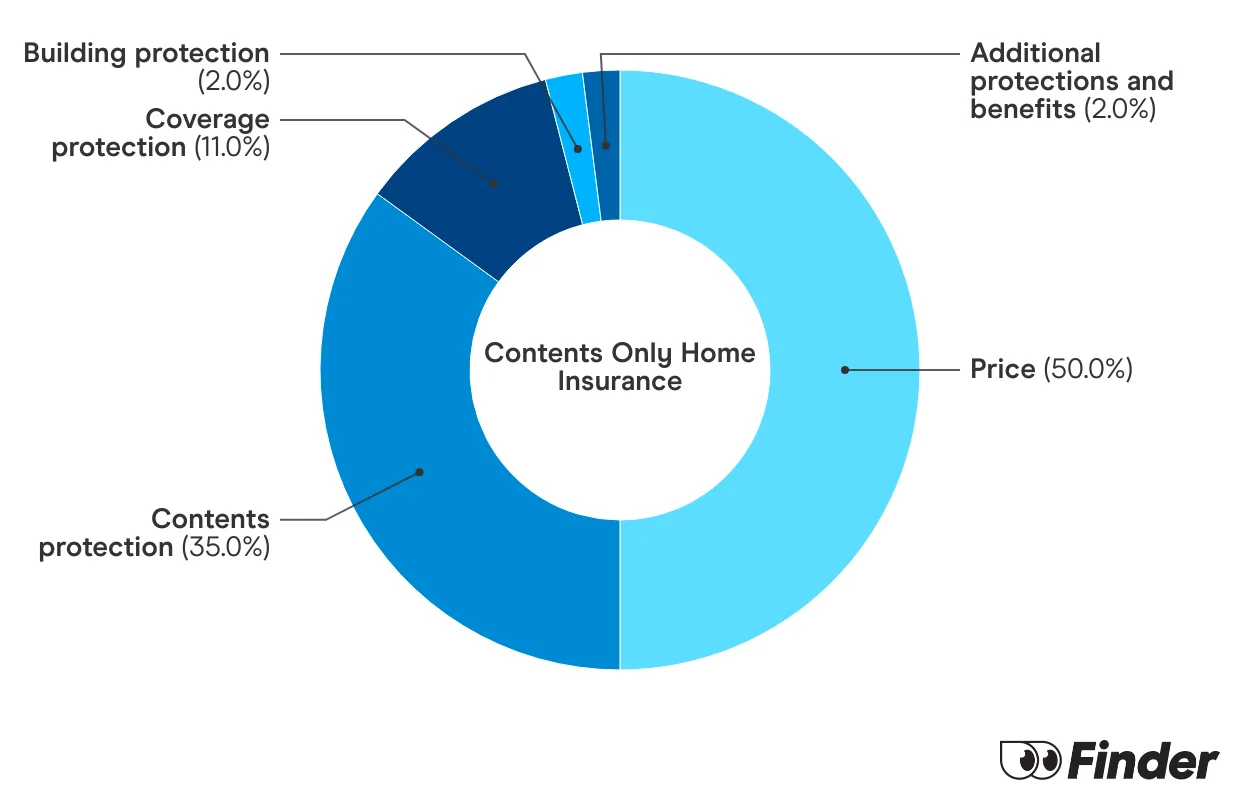

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Does contents insurance cover kitchen appliances?

Contents insurance provides cover for your kitchen appliances if they become damaged by something like fire, theft or flood. It won’t cover them for general wear and tear or if it’s just a faulty product. For that, you’ll need to contact the manufacturer of the appliance.

How does contents insurance cover kitchen appliances?

Home insurance will give you broader protection than warranties, generally including cover for the following (among other things):

- Water damage from floods and escape of liquid from your plumbing system

- Fire

- Lightning and storm damage

- Theft, attempted theft and vandalism

- Impact damage (e.g. from falling trees or branches)

When you're researching policies, check out the upper limits the insurer pays out for appliances, individually and in total, and what the appliances will and won't be covered against.

Exclusions to keep in mind

There can be exclusions to home and kitchen appliance insurance in the following circumstances:

- An appliance is over a certain age (e.g. 10 years)

- You use the appliance for business

Benefits to keep in mind when selecting your contents insurance

Most contents insurance providers offer optional extras that allow you to further tailor your insurance policy. To ensure your kitchen appliances are adequately covered, it can be worth checking the following:

- Motor burnout: This refers to when there is a surge in electricity and it results in your motor being burned out. This could be a washing machine motor or a fridge, or anything else that has the capacity to be fried by electricity.

- Accidental damage: This one is rarely included as standard but well worth looking for if you want to be covered for accidental mishaps. This could be something like accidentally smashing your glass oven door.

How to ensure you’ve got adequate insurance for your kitchen appliances

When you take out a contents insurance policy, you will be asked how much coverage you want. For many people, this is the hardest part of taking out an insurance policy because it means knowing the cost of all your contents. It’s easy to underestimate how much you actually own, so it’s helpful to do a walk through your house and tally it all up. Given we’re looking at kitchen appliances, let’s go through some of the items you might wish to insure below.

- Fridge

- Freezer

- Dishwasher

- Oven

- Microwave

- Air fryer

- Coffee machine

"Your kitchen includes many appliances and it’s important to cover each of them thoroughly. Keep in mind, when you’re taking out your contents insurance policy, the cost of your kitchen appliances is only a fraction of the costs you should be including. Your contents policy is also responsible for covering all other goods in your house too - like a vacuum, washing machine, TVs and more. Make sure you account for all of these costs to avoid underinsurance."

FAQs

Sources

Ask a question

More guides on Finder

-

Handbag insurance

Love your handbag? Handbag insurance is a good way to show it.

-

Art insurance

Find out the ins and outs of art insurance and what type of cover is right for you.

-

Watch insurance

Find out more about watch insurance and how to get cover.