Art can be covered under home contents as long as it's under a certain value. If you have fine art or unique collections, you might want to look into a specialist policy.

Many insurance providers insure art, but the type of art insurance you'll need will depend on the art's value and the kind of coverage you're looking for. Unless you own fine art, your home and contents insurance may be able to provide the protection you need.

What is art insurance?

Art insurance is a type of insurance that provides financial protection in the event that a piece of art or an art collection that you own is damaged, lost or stolen. In most cases, there are two different ways that you can insure art.

What are my art insurance options?

- Contents insurance. Getting contents insurance is a clever way to cover your precious artworks from theft and accidental damage.

- Home and contents insurance. If you have home and contents insurance, your art may already be covered. Home and contents insurance looks after all of the belongings in your home, as well as the building and property itself. It provides cover for theft, weather events, accidental damage and more. However, most policies usually have a specific limit for how much they'll cover you for individual items. So if you have valuable art — of say, more than $12,000 — you may need to call your insurer and let them know you'd like to increase your cover amount for those items. Most insurers will let you do this, depending on how expensive the art is. In exchange, you'll pay a slightly higher premium.

- Specialist art insurance. If you have an expensive art collection or fine art, you may want to opt for an insurer that specialises in high-value artworks. This type of coverage is suitable for art dealers, collectors, artists and galleries and can cover you for loss or damage, burglary and theft, including while in transit. These types of companies generally specialise in fine art and so know what kind of protection it needs.

Cover your art with contents insurance

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score - Home Insurance

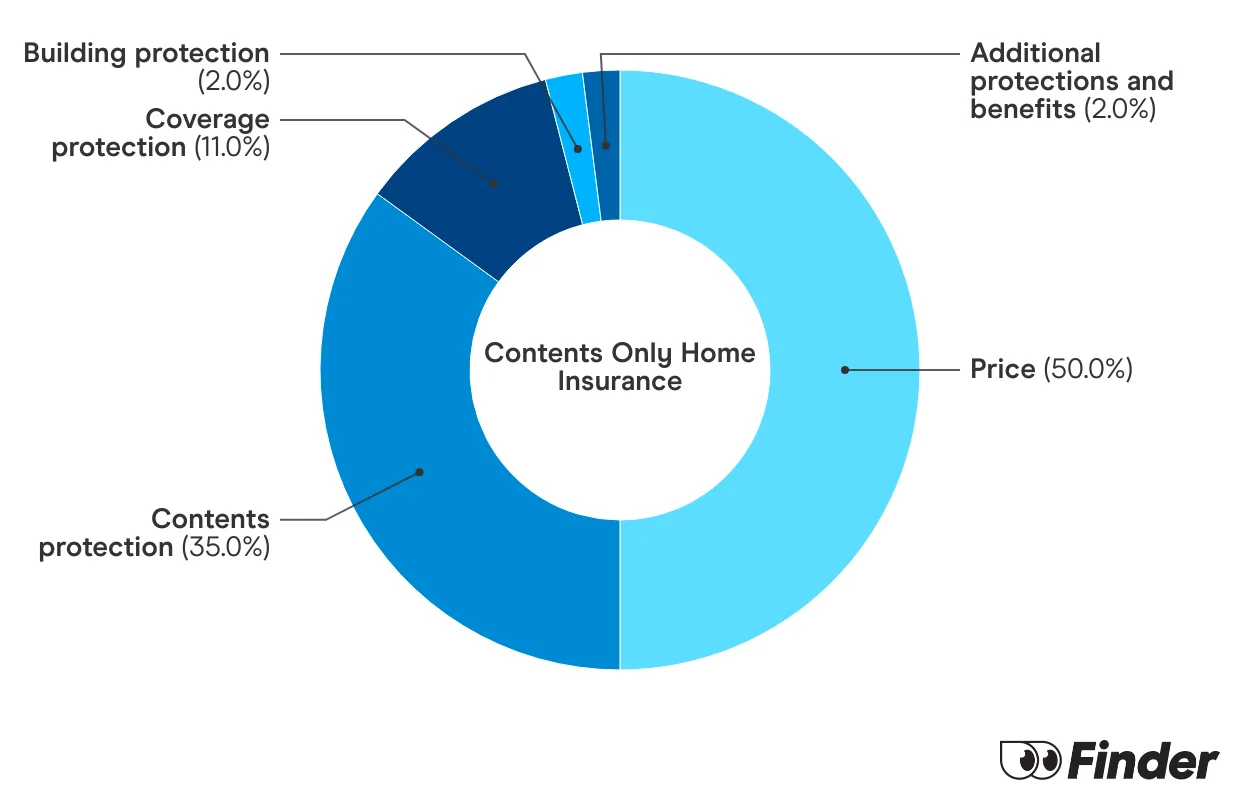

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Which home insurance companies cover art?

The table below outlines which home insurance companies on Finder cover art, as well as their specific limits. If you need higher limits for your art, most provide additional cover — you'll just need to pay slightly more for your premiums.

This information is accurate as of February 2026.

What does art insurance cover?

If you buy art insurance from a specialist provider, you can usually have the policy tailored to your needs. You can generally get cover for:

- Fire

- Natural disasters

- Theft

- Accidental damage

- Damage done at home and during transit

- Loaning your art, e.g. for display at exhibitions

- Restoration

- Replacement

- Lost value, e.g. if a repair reduces the market value of the artwork

- Expenses incurred due to defective title

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

Handbag insurance

Love your handbag? Handbag insurance is a good way to show it.

-

Are kitchen appliances covered by contents insurance?

Get protection for your high-value electronics and whitegoods with home and kitchen appliance insurance.

-

Watch insurance

Find out more about watch insurance and how to get cover.