Key takeaways

- Handbag insurance can cover the bag itself, but rarely the valuables inside it.

- You can insure your bag using contents or portable contents insurance.

- You'll typically be covered for events like fire, theft, flood and damage.

What is handbag insurance?

Depending on the type of policy, handbag insurance can cover the value of your handbag and, in some cases, also what’s inside if it's stolen, damaged, or lost. This can include when your handbag is at home or on the go.

Most policies include cover against theft, natural disasters, and vandalism, while accidental damage is typically an extra. You’ll generally find things like pet damage, wear and tear, or damage from someone who shares your home excluded from policies.

Every policy has its own inclusions and exclusions, so it’s always good to check the fine print to understand what’s covered before making a decision.

How can I insure my luxury handbag?

There are two main ways to insure handbags in Australia:

- Contents insurance or home and contents insurance

- Adding portable contents insurance to your home or home and contents insurance policy

Home contents insurance for handbags

A contents insurance policy can cover your handbag if it's in the home. However, it's not perfect – coverage is often limited and doesn't extend to when you take your handbag outside. If something happens to your handbag, what's inside usually isn't covered unless it's listed in your contents policy.

Contents insurance will typically have a per-item limit for items like handbags, which won't always cover the full cost of a replacement if your handbag is quite pricey. Also, when you make a claim for your handbag, you may have to pay the same excess as you would for any other items in your policy.

What's covered?

- Your handbag at home.

- Some types of damage like fire & flood.

- Certain incidents like theft, vandalism, and loss.

- Accidental damage is usually added as an extra, increasing your premium.

What's not covered?

- Damage or theft outside the home.

- Wear and tear & neglect.

- Illegal ownership.

Who's it for? Contents insurance is a great option if you want to insure a variety of items, including your handbag since it covers everything under one policy. But if you want to cover just your handbag, it might be an unnecessary purchase. The standard excess starts around $100 and can be as high as $5,000, so depending on the details of your policy, it won't always be worth it to make a claim.

Keep in mind, handbags are designed to be taken with you while you're out. So if you're looking for cover while you're on the go, it's worth considering adding portable contents cover if you already have a contents insurance policy.

Add portable contents insurance to your home contents policy

Portable contents cover is an optional extra to a home & contents or contents policy that protects your handbag against damage, theft, or loss while you're on the go. For most policies, this means anywhere in Australia and sometimes New Zealand. If you're thinking about going overseas with your handbag, it might make more sense to look into travel insurance instead.

If you choose to add portable contents cover, what it covers and the cover limits will be similar to your contents insurance policy. It will cost you a higher premium, however, and many insurers will have a separate excess to pay if you make a claim. Insurers such as Huddle, which charges a flat $100 excess, can offer cheaper rates than standard contents excess, though this isn't always the case. AAMI, for example, requires you to pay the higher of the two excesses if you make a claim.

What's covered?

- Your handbag at home and on the go.

- Some types of damage like fire, theft, & flood.

- Accidental damage can be added as an extra, but it'll increase your premium.

What's not covered?

- The contents of your handbag, unless those items are also considered personal effects (also known as valuables) by your insurer.

- It may not cover the entire cost of repair or replacement.

- If your handbag is used for business or to make income.

- Wear and tear & neglect.

Who's it for? It's a simple way to add some on-the-go cover to your handbag if you've already bought a home & contents or contents insurance policy. You'll likely be getting the same level of coverage as your contents insurance policy. So, if you want to insure a particularly expensive designer handbag, you'll be paying even more on your premium to increase your cover limits.

You should always weigh the cost of your premiums with your needs. If the extra cost of adding portable cover seems high compared to the value of your handbag, it might be better to go with just contents insurance.

Compare handbag insurance

Compare other products

We currently don't have that product, but here are others to consider:

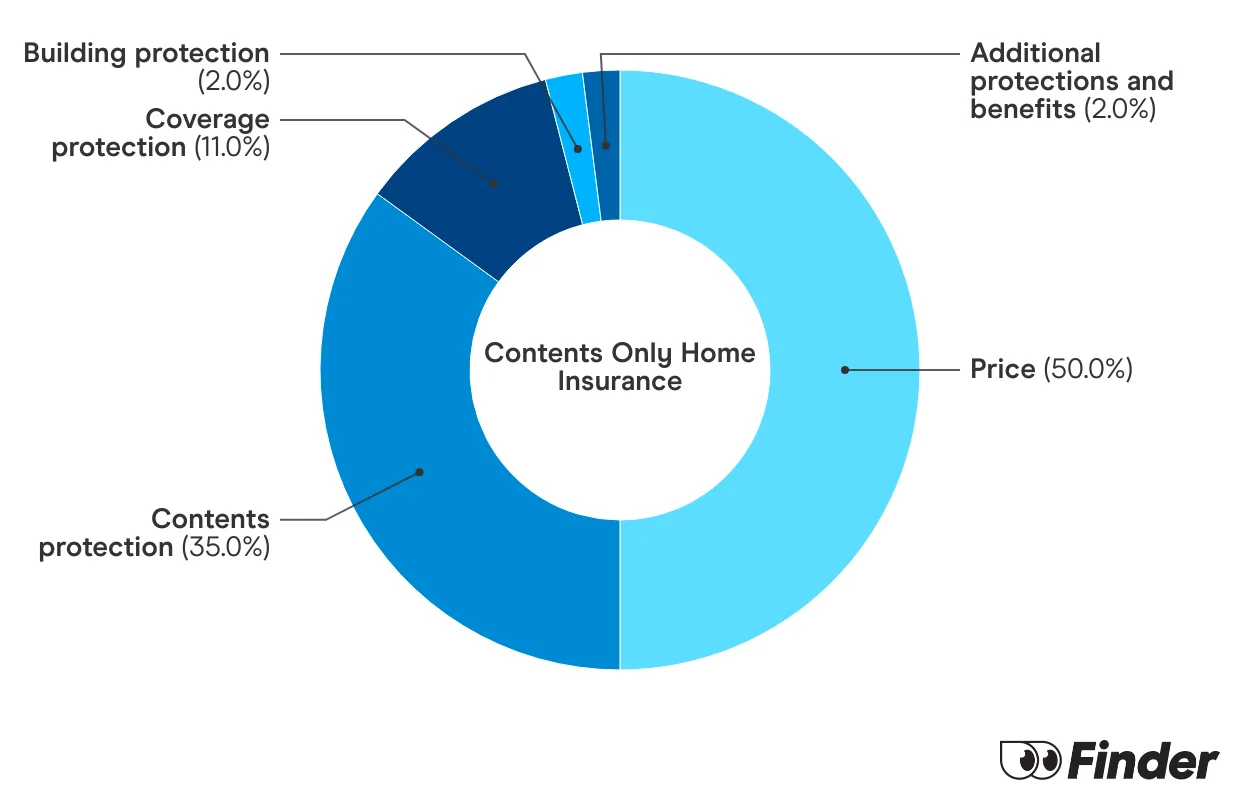

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How do home insurers in Australia cover handbags?

Most home insurers cover handbags under personal effects or personal valuables, which include things like clothes, bicycles, and jewellery.

If something happens to your handbag, you'll typically get compensation for the cost of repairing or replacing it. Most home insurers don't cover the contents of your handbag, but some, like Youi, will consider it if you've added accidental damage coverage to your portable contents policy.

Handbags will usually have the same per-item cover limit as other items that are considered 'personal effects'. So, if you have a high-value handbag, you might need to specify it in your policy to increase the cover limit it's insured for. Youi, for instance, covers unspecified items worth up to $15,000. Anything over that needs to be specified, and this will increase your premium.

As always, you should check what you'll be covered against and to what extent in the relevant parts of a policy's Product Disclosure Statement (PDS). Here are some examples of how brands explain cover in their PDS.

Table last updated October 2024.

How to know if you should insure your handbag

"If you're on the fence about whether or not you should insure your handbag, ask yourself some clarifying questions. How much did you pay for it, and could you afford to replace it out of pocket if it were stolen? Is the cost to replace the handbag vastly more expensive than the insurance to protect it? Does the insurance you're looking at actually cover the biggest threats you're likely to face? For example, accidental damage to the bag. Handbags are expensive, but insurance for them doesn't come cheap either. Be sure to compare multiple options to help you know if it's something you want to bother with."

FAQs

Sources

Ask a question

More guides on Finder

-

Are kitchen appliances covered by contents insurance?

Get protection for your high-value electronics and whitegoods with home and kitchen appliance insurance.

-

Art insurance

Find out the ins and outs of art insurance and what type of cover is right for you.

-

Watch insurance

Find out more about watch insurance and how to get cover.