Key takeaways

- St George has 3 different home insurance policies to choose from.

- It's underwritten by Allianz which is good for those who prefer well-known insurance providers.

- You should compare quotes from multiple insurance providers to help find the right fit for your home.

Compare other products

We currently don't have that product, but here are others to consider:

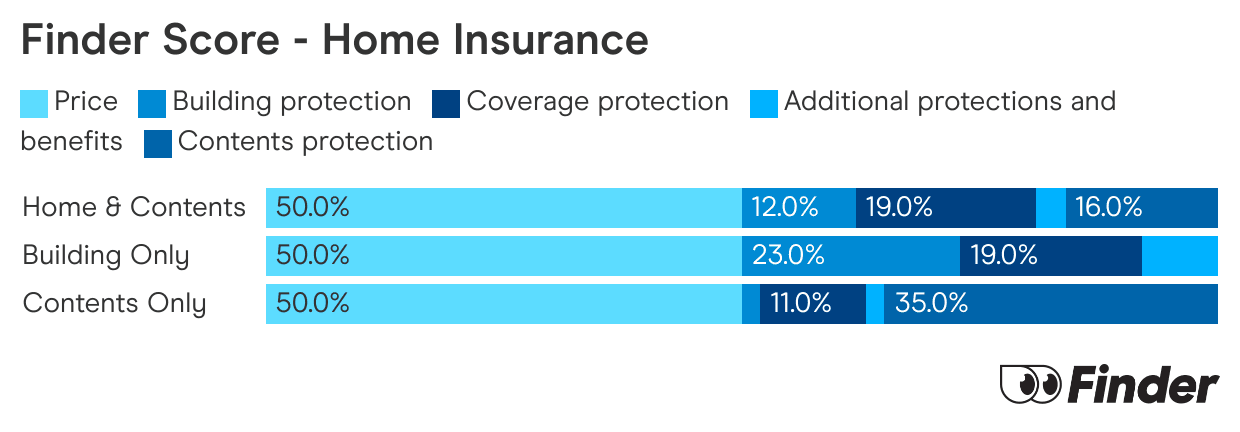

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

What does St.George Home Insurance cover?

St.George has 3 home insurance policy options: Home and Contents Insurance, Building Insurance and Contents Insurance. You can also choose from 3 levels of comprehensiveness: Essential Care, Quality Care and Premier Care.

Here are some of the main insured events you'll be covered for by a St.George Home Insurance policy.

All policies come with a basic excess of at least $100, which you need to pay whenever you make a home insurance claim, and a cooling off period of 14 days. If you cancel your policy within this timeframe, you can receive a full refund.

Here's a breakdown of St.George Home Insurance features

Standard features

Here are some of the standard inclusions you'll get with a St.George Premier Care Home Insurance policy:

- Sum insured safety net

- Malicious acts and unrest

- Electrical motor burnout

- Accidental loss or damage

- Storm, flood, fire, lightning, earthquake, impact, explosion

- Accidental glass breakage

- Emergency accommodation

- Theft

- Escape of liquid

- Legal liability cover

Optional add-on

St.George Home Insurance has loads of inclusions, so this is the only optional add-on available:

- Personal valuables cover

Exclusions

St.George will not pay your claim for any of the following reasons:

- Events covered by a warranty, guarantee or service contract

- Defects

- Wear and tear

- Landslide

- Damage by vermin or insects

- Unlawful acts

- Tree roots

- Loss or damage if your home is unoccupied for more than 60 days

Our verdict

- St.George offers competitively priced home insurance policies, according to our research.

- St.George's 25% saving when you buy online is one of the best sign-up discounts available on Finder, compared to 7 other policies.

- St.George's $20,000,000 legal liability limit is probably more than enough for most but some, like QBE, offer more.

St.George Home Insurance complaints

Allianz Australia, the brand that underwrites St.George home insurance, was the subject of 765 home insurance complaints and 138 contents insurance complaints in the 2024/25 financial year. However, Allianz Australia is categorised as a "very large" insurer. AAI, another "very large" insurer, received 1,584 home insurance complaints and 384 contents insurance complaints in the same time period.

Here's the bottom line about St.George Home Insurance

St.George seems to be competitively priced and offers one of the best sign-up discounts in the market. Just make sure the policy is right for your home and your lifestyle.

If you're still not sure, you can compare St.George Home Insurance against other home insurance companies.

Frequently asked questions

Sources

Leave a St.George Home Insurance review

If you've held or currently hold a St.George Home Insurance policy, we'd love to hear from you. Your reviews help other Australians decide if St.George is right for them. Some reviews are from a survey commissioned by Finder.

Ask a question

2 Responses

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.

Which insurers cover termite damage

Hi VA,

Termite damage is not typically covered by home insurance. Learn more here.