Apple Card is tech giant Apple's first move into the credit card space. It's available in the US and is issued by Goldman Sachs, with a virtual card that's integrated into the Wallet app and works with Apple Pay. There's also an optional metal card for in-person payments.

In the US, Apple Card became available for application on 20 August 2019. In April 2023, Apple also launched an Apple Card Savings Account in the US.

Will Apple Card be available in Australia?

As of 2023, Apple has still not announced any plans for releasing Apple Card outside of the US. We'll update this page with any updates from Apple about an Australian launch of its credit card or its saving account. In the meantime, your closest option is a credit card that offers cashback and can integrate with Apple Pay.

You could also look at other virtual credit cards and cards that offer contactless payments.

Apple Card features

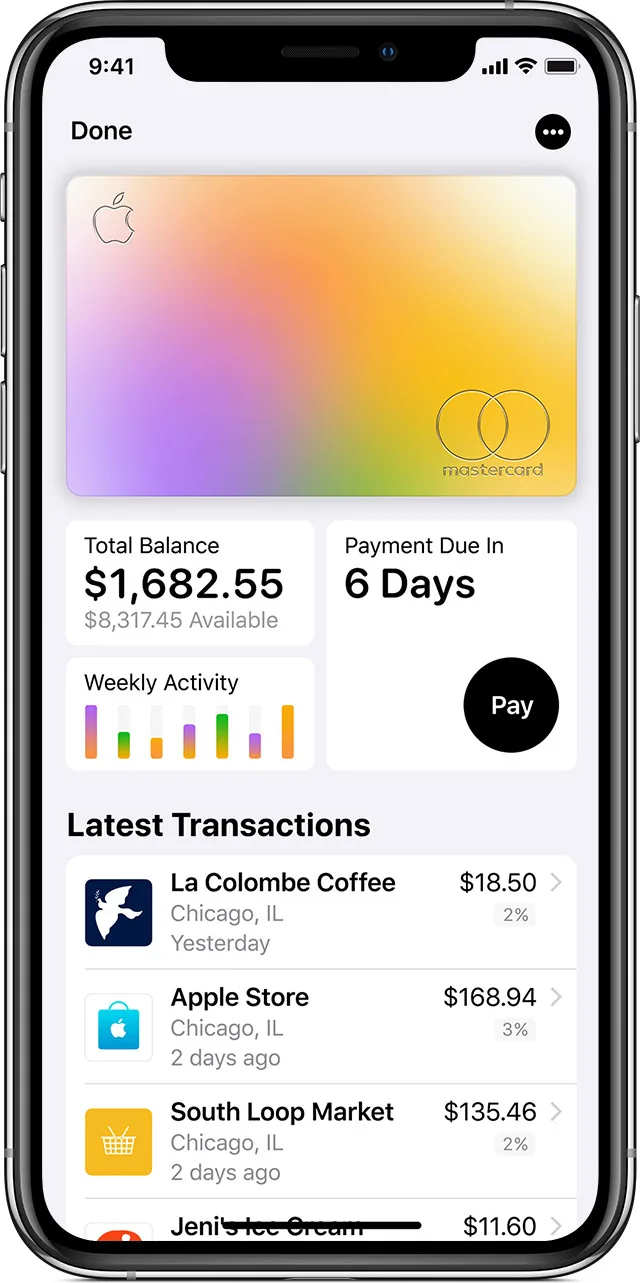

- Integrated with Apple Pay. Apple Card works via the Wallet app that lets you use Apple Pay. You can apply for the card through the Wallet app and transactions will show up in real time on your iPhone. Only devices with the latest version of iOS, watchOS, or macOS have access to Apple Card's full range of features. But you can still use it to make payments with an Apple Watch or other compatible devices with Apple Pay.

- A numberless titanium card. Cardholders can order a titanium card designed by Apple, which can be used with retailers that don't support Apple Pay. Unusually, it doesn't feature either a credit card number or CVV, which is a move designed to improve security. Instead, these details are stored in the Wallet.

- Daily Cash for cashback rewards. Apple Card offers cashback payments on every purchase you make on the card. Most purchases made using Apple Pay get 2% daily cashback. Purchases from Apple and select partner retailers earn 3%, while purchases with the physical card get 1% back. Some of the partnered retailers include Panera Bread, T-Mobile, Nike, Walgreens, Exxon Mobile and Ace Hardware. Apple Card doesn't let you earn frequent flyer points or integrate with other rewards schemes.

- No annual fee, foreign currency conversion fees or late fees. Apple is heavily promoting the "no-fees" aspect of the card. Important point: while there are no late fees as such, you will be charged additional interest if you don't make payments on time.

- Real-time interest estimates. The Apple Card shows estimates of how much interest you'll be charged, based on any payment amount you choose. This feature is similar to other credit card repayment calculators and gives you a chance to adjust your payment amount or budget for interest before it's charged.

- Spending tracker. The Apple Wallet automatically categorises all your spending and shows you where the spending happened using integration with Apple Maps.

- Instalment plans. When cardholders use their Apple Card to buy a new iPhone from Apple, they can pay it off with interest-free monthly instalments over 24 months. These instalments are subject to credit availability and minimum payments apply.

- Security features. Credit card numbers are issued per device and will need to be authorised with Touch ID or Face ID. Apple has stated that it will not be able to see what you buy or where you buy it.

As of 1 February 2024, the advertised interest rate for the US version of the card varied from 19.24% to 29.49%, based on creditworthiness. Those rates have been rising since 2023. We'd always recommend comparing the interest rates before signing up for a card, to make sure you're not paying over the odds.

Compare credit cards with Apple Pay

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseWill Apple Card work if I don't have an iPhone?

In the US, you need to have the Wallet app and an iPhone or iPad, Apple Watch or Mac. For example, you can use it with iPhones that have Face ID or Touch ID (except iPhone5s). If you don't add a compatible Apple device to your account after getting an Apple Card, you could only use it for eligible Apple purchases.

Apple hasn't announced any plans to support the card on Android and it's highly unlikely that will happen. While a physical card is also supplied for use in stores that don't directly accept Apple Pay, you need to sign into your iCloud account with a valid Apple ID as part of the application process.

Sources

Ask a question

More guides on Finder

-

Best international credit cards

Find credit cards that make international spending cheaper with 0% international transaction fees.

-

American Express statistics

Insights and analysis on American Express credit cards, costs, acceptance and more.

-

Instant approval credit cards

Compare credit cards that give you an outcome within 60 seconds of when you submit your application online and find out how to increase your chances of getting this type of "instant" credit card approval.

-

Introductory credit card offers for new customers

Compare introductory credit card offers that give you bonus rewards points, 0% p.a. balance transfers, interest-free periods and waived annual fees when you sign up for a new card.

-

Cashback credit cards — up to $500 back

Get a percentage of your spend back, gift cards or vouchers with a cashback credit card. Find out more and compare current offers in our guide.

-

Best Credit Cards in Australia right now

You deserve the best credit card. Let us help you find it.

-

Best Qantas credit cards

Compare the best Qantas frequent flyer credit cards based on bonus point offers, points per $1 spent, rates, fees and other features so you can find a card that works for you.

-

Best Velocity credit cards

Check out bonus point offers and travel perks such as lounge access and complimentary insurance with these Velocity Frequent Flyer credit cards.

-

Easy credit cards to get approval for in Australia

When you apply for a credit card online, you could receive a response within 60 seconds. Find out how you to find a card that you're eligible for and increase your chances of approval.

-

No international transaction fee credit cards

Find out how you can keep your overseas spending costs down by comparing credit cards with no foreign transaction fees and no currency conversion fees.