Key takeaways

- There are several VIC home insurance policies to choose from, giving you the flexibility to find the right cover for your needs and budget.

- Depending on where you live in Victoria, you may want to consider adding flood cover to your policy.

- As with any insurance policy, there are certain events that won’t be covered, so be sure to review the PDS before signing up.

Home insurance is designed to protect your home when disaster strikes. Things like fire, water damage and break-ins happen a lot more than you think. Fortunately, Victorian home owners have plenty of insurers to choose from.

At Finder, we can help you make sure you find the right policy for your property. We make it easy to compare VIC home insurance policies all in one place.

Want the best home insurance for Victoria? Start your search here.

Compare other products

We currently don't have that product, but here are others to consider:

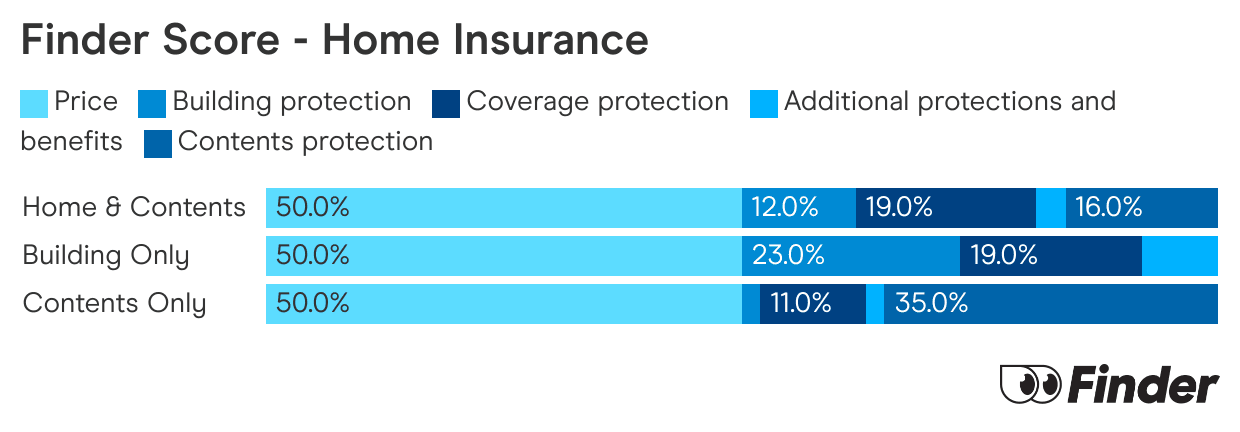

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

The Finder Customer Satisfaction Awards recognise Australia's favourite brands across a huge number of categories. We survey thousands of real Australians to understand how they feel about their recent product purchases, and use that information to reward the most popular brands.

Here are the 2025 winners in Victoria.

Most Loved Home Insurance - VIC: CommBank

CommBank was Finder’s customer satisfaction winner in Victoria for 2025. The insurer received a 4/5 from respondents, with 88% recommending the brand as a trustworthy insurer.

Top Value Home Insurance - VIC: Budget Direct

Price remains one of the biggest features Victorians look for in a home insurance policy. For cost, Budget Direct scored a 4.1/5 among respondents, providing top value across its policies.

Most Trusted Home Insurance - VIC: CommBank

When it comes to protecting your home, trust is a major concern. CommBank scored 4.2/5 in the Most Trusted category and was recommended by 88% of respondents, making it this year’s winner.

Legendary Service Home Insurance - VIC: Youi

For 2025, VIC residents felt Youi offered fantastic customer service. It scored 4.3/5 within this category and was recommended by 88% of respondents.

Easiest to Claim Home Insurance - VIC: AAMI

Filing a home insurance claim should be simple and stress-free. Receiving 4.04/5 for its claims service, AAMI took out the top position in this category.

Most Recommended Home Insurance - VIC: CommBank

An impressive 88% of respondents recommended CommBank as their preferred home insurer, making it the winner for Most Recommended insurer in VIC.

Highly Commended winners for 2025

Among the 2025 winners were several brands that came highly commended among VIC homeowners, including RACV, taking out 3 Highly Commended Finder Awards across the Most Loved, Most Trusted and Easiest to Claims categories.

What should I consider when purchasing home insurance in Victoria?

The right type and level of cover for you may vary substantially depending on where you live in Victoria.

One of the biggest risks facing rural properties in Victoria is bushfire, while some towns on the banks of the mighty Murray River face an increased risk of a flood. If you’re the owner of an apartment in the CBD, you might be more likely to face theft and break-ins or water damage if your upstairs neighbour has plumbing problems and your apartment is flooded.

You’ll need to consider a wide range of factors when deciding on the best home insurance policy for your needs. First, you’ll need to consider whether you want standalone home or contents cover, or whether you want to combine the two and enjoy the benefits of comprehensive cover.

Next, think about your specific cover requirements. How much cover do you need? What risks do you need to protect your property and possessions against? How much would it cost to replace everything you own if it were completely destroyed?

By taking your unique risks into account, you’ll be able to find a policy that matches your needs.

What type of home insurance can I get in Victoria?

There are three home insurance options available to Victorian homeowners:

Home insurance

Also known as building insurance, this type of policy protects your physical building from loss or damage caused by fires, storms, impacts, theft and a variety of other risks.

Contents insurance

Contents insurance protects your furniture and possessions against loss or damage due to an extensive range of events.

Home and contents insurance

Combining all the cover of the two policies listed above, a home and contents insurance policy provides a high level of protection for your building and possessions.

How much does home insurance cost in Victoria?

Home insurance premiums will differ between homes. So while we can't give you an exact number, we got a bunch of quotes so you can have an idea.

The table below shows how different insurers will charge different premiums. This is why it's so important to compare.

- Building & Contents. For a building worth $500,000 and contents valued at $100,000.

- Contents only. For contents valued at $100,000.

- Building only. For a building worth $500,000.

| Brand | Building & Contents | Contents only | Building only | Apply |

|---|---|---|---|---|

| $133.29 | $39.51 | $122.78 | |

| $142.08 | $38.78 | $128.37 | More info | |

| $147.78 | $30.51 | $117.26 | More info | |

| $134.53 | $39.77 | $124.09 | ||

| $145.72 | $54.27 | $107.61 | ||

| $214.79 | $75.48 | $187.11 | |

| $145.72 | $54.27 | $107.61 | ||

| $134.55 | $39.75 | $123.99 | More info | |

| $110.57 | $22.41 | $91.71 | ||

| $189.15 | $47.31 | $165.48 | More info | |

| $179.76 | $44.88 | $157.36 | ||

| $177.00 | $45.00 | $151.00 | |

| $151.32 | $44.13 | $138.85 | |

| $157.75 | $40.01 | $140.27 | More info |

| $100.12 | $25.73 | $86.77 |

Learn more about our methodology

- Quotes were obtained for the same 3-bedroom home in Eltham, Victoria owned by a family of two.

- Building replacement costs for all quotes were $500,000, with an excess of $500.

- Contents were valued at $100,000.

- Quotes were obtained in November 2021 and were for a combined home and contents insurance policy, a contents insurance policy and a building insurance policy.

- Home owning family of two who moved into their property in 2019.

- Three bedroom, 1 story freestanding house on flat ground with brick veneer walls, terracotta tiled roof, no verandas and built in 1980.

- Windows secured by deadlocks, with no security devices.

What insurers can I access in Victoria?

Most home insurance providers are not state specific and provide cover for homes all around Australia. finder.com.au’s panel of home insurers features some of Australia’s leading home insurance providers that offer cover in Victoria:

Are there any exclusions and additional costs I should be aware of in Victoria?

Before you choose a home insurance policy, make sure you’re aware of any general exclusions that apply. The following are some common home insurance exclusions:

- No cover if your home is used for illegal or criminal activity.

- No cover if you leave your home for an extended period of time, such as 60 continuous days.

- No cover if you fail to maintain your home in good condition.

- No cover for bushfires within 72 hours of cover starting.

- No cover if you fail to take reasonable steps to secure your home.

Finally, when you do take out home and contents insurance in Victoria, make sure you’re aware that a 10% duty charge will be included in your premium. An additional Fire Services Levy used to apply to all policies, but this was scrapped in July 2013.

FAQs

Sources

Ask a question

More guides on Finder

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

Bendigo Bank home insurance review

Here's a detailed review of Bendigo Bank home insurance with information on 3 cover options.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.