Key takeaways

- Your ability to find car insurance as a high risk driver depends on the offence, how long it’s been and the insurer’s criteria.

- We found 3 providers who said they may provide cover for those who have had a licence suspension.

- We found 11 providers who said they may provide cover for those with an at-fault accident claim.

What makes a driver considered ‘high risk’?

Largely, people are considered high risk drivers because they’ve:

- Got prior claims for an at-fault accident

- Got multiple fines for things like speeding or other forms of dangerous driving

- Been convicted of driving under the influence of alcohol or drugs (DUI)

- Had their licence suspended

- Have a criminal record for something unrelated to driving, like fraud or arson

- Done nothing wrong, they’re just younger drivers — typically under the age of 25

- Done nothing wrong again, they just drive longer distances per year and therefore are on the road more often, increasing their exposure to accidents

Can I get car insurance if I’m a high risk driver?

Most likely but it’ll depend on why you’ve been deemed a ‘high risk’ driver and how long ago any offences occurred.

In some cases, the insurer will decide you’re risky and up your premium. This is particularly true in the case of younger drivers, high mileage drivers, those with prior at-fault claims, and those with speeding fines.

In other, more serious cases, they'll decide you’re too risky and refuse to cover you. This is particularly true for those with DUIs, licence suspensions and criminal records. However, not all insurers are created equal and we’ve found a bunch who may cover you for some of these instances.

Car insurance for drivers with a licence suspension

Every month, we source quotes from 11 car insurers in Australia. We answer "yes" when asked if the driver's licence has been "cancelled, suspended or restricted" due to any driving offence(s). Of the 11, we were only able to return quotes for 3 providers.

Keep in mind, whether you'll actually be able to get cover depends on your specific offence, individual circumstances and your risk profile.

| Brand | Annual cost | Apply |

|---|---|---|

| $1,946.26 | Get quote | |

| $1,919.81 | Get quote |

Prices accurate as of February 2026

Compare these car insurers in more detail

Compare other products

We currently don't have that product, but here are others to consider:

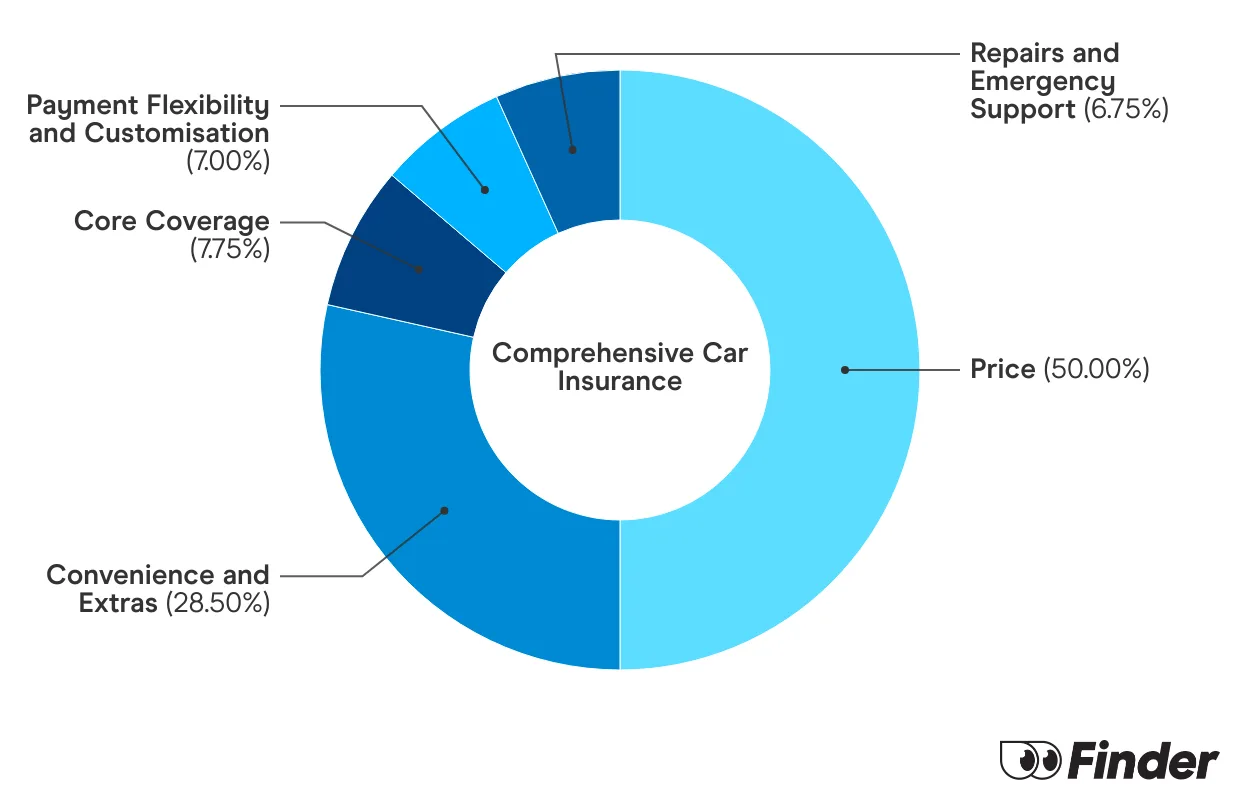

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Case study

Finder survey: How many people have accrued demerit points for a driving offence?

| Response | Male | Female |

|---|---|---|

| Yes | 56.25% | 45.59% |

| No | 41.67% | 53.26% |

| I have never driven before | 2.08% | 1.15% |

Car insurance for drivers with an at-fault accident claim

Every month, we run quotes from 10 popular car insurance providers in Australia to see who might offer cover for drivers with an at-fault accident claim. To get our quotes, we chose “yes” when asked about a past accident claim and selected "at fault".

It’s worth noting, usually, insurers asked about offences in the last 3 or 5 years. So if your at fault claim is beyond then, you won’t need to list it.

The good news is, we were able to return quotes for all 10 providers. The bad news is, it’s a little expensive.

Remember, the below should be used as a guide only. Your own risk profile will differ and your own quotes will reflect your personal circumstances.

| Brand | Annual cost | Apply |

|---|---|---|

| $1,438.35 | Get quote | |

| $1,017.33 | Get quote |

| $1,119.07 | Get quote | |

| $2,105.68 | Get quote | |

| $2,456.93 | Get quote | |

| $2,116.26 | Get quote | |

| $2,594.69 | More info | |

| $1,068.21 | More info |

| $2,225.09 | More info | |

| $2,074.87 | Get quote |

Prices accurate as of February 2026

Compare these car insurers in more detail

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseGetting cheaper car insurance for high risk drivers

As you’ll — rather painfully — know, getting car insurance when you’re deemed a high risk driver, can be expensive. Fortunately, there are plenty of ways to save that don’t rely on having a squeaky clean driving history. Here’s what you can do:

- Take advantage of sign up discounts. Many insurers offer up to 15% off —sometimes even more — your first year’s premium when you buy online. That’s over $100 in savings for anyone’s quote that lands in the thousands.

- Choose a higher excess. This can lower your premium, but you'll pay more upfront if you make a claim. Read more about car insurance excess.

Restrict who can drive your car. Excluding young drivers, such as those under 25, and naming who else will drive your vehicle are both ways you could reduce costs. - Pay premiums annually. If possible, paying premiums annually can be cheaper than paying monthly or fortnightly.

- Get quotes for both agreed and market value. Insuring your car for market value used to be a good way to lower your premium but as the second hand car market booms, this isn't always the case anymore. Depending on your car, it may be cheaper to insure for an agreed value. Getting a quote for each and weighing up the pros and cons is a good way to know your options and reduce costs.

- Shop around and compare your options. Every insurer is so different and there’s often hundreds of dollars difference in the quotes. Don’t pay more than you need to.

FAQs

Sources

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.