Compare other products

We currently don't have that product, but here are others to consider:

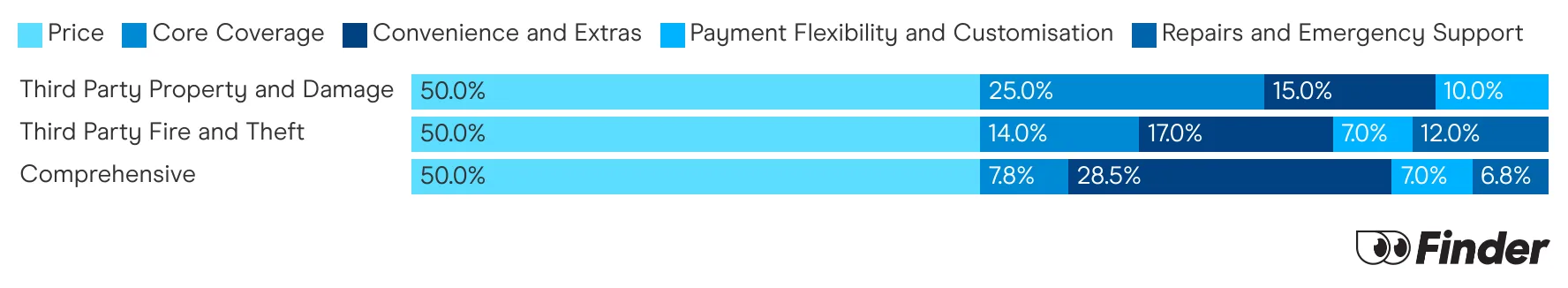

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Best car insurance for P-platers

Top Pick: Bingle

The main thing most p-platers need is an insurer that will actually give them cover. That and to save a little money. If you can get cover, it’s going to be more expensive, because p-platers are considered much higher risk.

So it’s with that lens that we picked Bingle as the best car insurance for p-platers, whether it’s their comprehensive or third party options. Not only do they not exclude p-platers from cover, like many car insurance companies do, but they are the cheapest to do so.

Finder data finds that Bingle offers the cheapest rates for the same quotes for young drivers. Actually, Bingle tends to do this for all drivers, having taken out gold in Finder’s most recent car insurance awards for the low cost category.

It’s worth noting that Bingle doesn’t have all the bells and whistles as some of the more expensive insurance companies, at least by default. But if you, like most p-platers, are prioritising affordability, then Bingle car insurance could be the best car insurance for you.

Getting car insurance as a P-plater

There are 3 main ways you can get cheaper car insurance cover as a P-plater. First, adding yourself as an additional driver to your parents' car (as long as they're still the main driver) can lower costs. If that's not an option, a third party policy could be good if you don't own an expensive car. Otherwise, think about getting cheap comprehensive cover.

How much does comprehensive car insurance for P-platers cost?

| Provider | Average cost | Apply |

|---|---|---|

| ||

|

$188

Price based on 100+ responses about their monthly premium in January 2026.

"When I was a p plater, the only insurance I was able to get was NRMA. No one else would cover me. It was actually a real pain in the bum, because the NRMA was charging an extra couple of hundred dollars a year for the same cover. I was pretty poor at the time, so the only way I could save was to take out third party property rather than comprehensive cover."

What cover option is best for P-platers?

Not sure which cover type to go for? Here's the lowdown on each cover type to help you make a decision.

Comprehensive Cover: If you want top cover, this is the option for you. It covers theft, vandalism, storms, flood, hail, fire, key replacement, emergency accommodation, hire cars, accidental damage (to name a few), plus everything covered by cheaper policies.

Best for: P-platers who want peace of mind knowing they have the highest cover available.

Third Party Fire and Theft Cover: As the name suggests, this cover type ensures you are protected if your car is stolen. It also covers you for fire damage and if your car causes damage to someone else's property.

Best for: P-platers who need a bit more cover without the pricetag.

Third Party Property Damage Cover: It's the most basic policy, providing cover for any damage you may cause to someone else's vehicle or property. However, it won't cover the expense of repairing damage your vehicle incurs as a result.

Best for: Those P-platers with cheaper cars or who are on a really strict budget.

Compulsory third party (CTP): Commonly known as greenslip insurance, CTP is mandatory for every driver in Australia. In many states, it's included in your car rego so you don't need to worry too much. It offers protection to the driver who is at fault for a motor vehicle accident which led to another person being injured.

Best for: Everyone – it's mandatory!

Expert tips for p-platers looking at their car insurance options

"If you would struggle to pay for repairs to your own car, or your parents if you’re using theirs, then comprehensive car insurance is probably your best bet as a P-plater. It will cost more than a third party policy initially but once you’ve held cover for a while, and you don’t need to claim, prices typically come down."

"As a P-Plater, every birthday you become a little less risky to an insurer, because your experience on the road translates to a lower chance of having an accident. So, make sure you shop around every 12 months and compare policies to get the best possible deal."

What other factors impact the cost of car insurance for P-platers?

There are several other factors that can affect the cost of car insurance for drivers under the age of 25:

- Your gender. Men, especially young ones, are considered more likely to engage in risky driving behaviours than women, so generally have to pay more for car insurance.

- Where you live. Some suburbs have a much higher rate of car theft than others.

- Where the car is kept. If your car is locked in a secure garage overnight, you'll pay much less for cover than if it were parked on the street.

- How often you drive. Vehicles driven frequently are more likely to be involved in an accident than those only driven occasionally.

- The excess you choose. If you have the flexibility to vary your excess, selecting a higher excess will allow you to pay cheaper premiums.

- Any discounts that apply. You may be able to take advantage of discounts to lower the cost of your premium, such as savings for buying online or discounts for insuring multiple vehicles.

Questions you might have

Sources

Ask a question

More guides on Finder

-

High risk car insurance

Learn the factors that may cause you to be considered a high-risk driver and whether you might be eligible for cover.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.