What are the Finder car insurance awards?

Finder's car insurance awards is a ratings methodology that compares both value and features across 35+ comprehensive car insurance policies. To determine our winners, we got 1,800+ quotes for 39 comprehensive car insurance policies based on 36 different profiles. This methodology has been curated to help drivers find the best car insurance policy for their needs without having to sift through all the jargon.

Why you can trust our research

Selection criteria

The criteria for Finder's car insurance awards was determined by our insights team and car insurance experts. In order to be eligible:

- It must be a comprehensive car insurance policy

- Policies must be available to buy online or over the phone

- We must be able to get quotes for at least 30 different customer profiles

- Policies must have been in the market for at least 12 months

Scoring

Metrics were scored using either the tiered scores when dealing with categorical data points, or a dynamic scoring when dealing with numeric data. Finder's dynamic scoring means a product's metric is scored in comparison to the data points of all the other competitor products.

| Metrics | Scoring method |

|---|---|

| Agreed or market value | Manual scoring |

| Child seat baby capsules | Binary scoring |

| Child seat baby capsules details | Manual scoring |

| Choice of repairer | Manual scoring |

| Emergency transport accommodation | Manual scoring |

| Emergency transport accommodation_details | Manual scoring |

| Essential emergency repairs | Manual scoring |

| Essential emergency repair details | Manual scoring |

| Fire and theft | Manual scoring |

| Floodcover | Manual scoring |

| Hire car accident | Manual scoring |

| Hire car accident details | Manual scoring |

| Hire car no fault accident | Manual scoring |

| Hire car no fault accident details | Manual scoring |

| Hire car theft | Manual scoring |

| Hire car theft details | Manual scoring |

| Key replacement | Manual scoring |

| Key replacement details | Manual scoring |

| Legal liability | Manual scoring |

| Lifetime guarantee on repairs | Manual scoring |

| Newcar replacement | Manual scoring |

| Newcar replacement details | Manual scoring |

| Personal effects | Manual scoring |

| Personal effects details | Manual scoring |

| Restricted driver option | Manual scoring |

| Restricted driver option details | Manual scoring |

| Roadside assistance | Manual scoring |

| Storm | Manual scoring |

| Towing | Manual scoring |

| Reduced excess windscreen | Manual scoring |

| Reduced excess windscreen repair | Manual scoring |

| Quotes for 20 year olds | Dynamic Scoring |

| Quotes for 30 year olds | Dynamic Scoring |

| Quotes for 60 year olds | Dynamic Scoring |

Weights

Driver profile

Our 36 different driver profiles are formed based on 3 different ages (20, 30 and 60-year-olds), 2 genders (male and female) and 6 states (NSW, QLD, VIC, SA, TAS, WA). The car used in each quote was a 2019 Toyota Corolla Ascent 4 Door Sedan. We selected an approximate $700-$900 excess for each policy.

We didn't include quotes for NT and ACT because the sample size was too small.

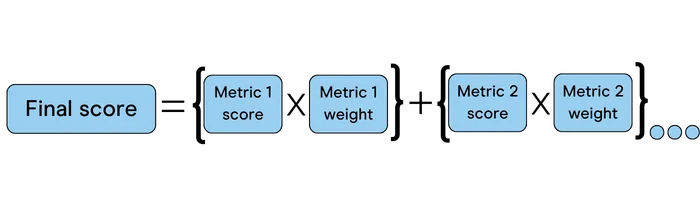

Final award score

The award score is designed to make it easier for you to compare insurance policies side-by-side. It's based on the same information we gather as part of the Finder Awards. The final award score is calculated by multiplying the score for each metric by the weight percentage and summing the weighted scores:

Finder’s 2024 car insurance methodology

The 2024 Finder Score is based on a combination of price and features. Features account for 50% of the score, price accounts for 50%. See the breakdown below.

| Benefit | Finder score |

|---|---|

| Loss or damage | 9% |

| Storm damage | 2.25% |

| Flood cover | 2.25% |

| Legal liability | 2.25% |

| Windscreen damage | 2.25% |

| Repairs & assistance | 15% |

| Choice of repairer | 2.25% |

| Lifetime guarantee on repairs | 2.25% |

| Essential emergency repairs | 2.25% |

| Towing | 2.25% |

| Roadside assistance | 6.00% |

| Personal items | 6.75% |

| Personal effects | 2.25% |

| Key replacement | 2.25% |

| Child seat and baby capsules | 2.25% |

| Hire car & replacement | 6.75% |

| Hire car after theft | 2.25% |

| New car replacement | 2.25% |

| Hire car after accident | 2.25% |

| Other features & benefits | 12.50% |

| Agreed or market value | 3.25% |

| Emergency transport and accommodation | 2.25% |

| Restricted drivers option | 4.00% |

| Pay monthly at no extra cost | 3.00% |

| Price | 50% |

| Average price | 50% |

What are the Finder customer satisfaction awards?

The Finder customer satisfaction awards recognise Australia's favourite brands across a huge number of categories. We survey thousands of real Australians to understand how they feel about their recent product purchases to help you make a decision about what product to get. It's an independent awards program calculated by our data and insights team. Commercial partnerships do not influence the results in any way.

In total, we gave out awards to 7 different car insurance brands:

- Customer satisfaction: NSW

- Customer satisfaction: VIC

- Customer satisfaction: QLD

- Customer satisfaction: SA

- Customer satisfaction: WA

- Customer satisfaction: National

- Roadside assistance customer satisfaction: National

Finder car insurance customer satisfaction awards methodology

- The recency period varied between 3 months and 3 years.

- We got a minimum of 35 responses for each car insurer for 5 different states (NT, TAS and ACT were not included because the sample size was too small).

- Respondents were asked whether they would recommend the car insurer to a friend. This result was scored out of 5 as a percentage. For example, if 80% of respondents said they would recommend a product, it received a score of 4 out of 5.

- Customers were asked how they would rate each car insurer overall on a scale between 1 and 5 and in terms of:

- Customer service

- Features and benefits

- Ease of application

- Value for money

- The overall score for NSW, QLD, WA, VIC and SA was calculated as an average of the 5 metrics outlined above.

- To determine our national winner, we calculated the average score from the top ranking brands from each of the 5 states we looked at.

Our research in numbers

Total number of responses for NSW: 1,199

Total number of responses for VIC: 1,339

Total number of responses for QLD: 1,281

Total number of responses for WA: 941

Total number of responses for SA: 1,027

Total number of responses for roadside assistance: 626

Finder's third party insurance research

Our team gathered 228 quotes for third party property damage car insurance and 198 quotes for third party fire and theft car insurance.

We used 3 different age profiles, 1 gender and 5 different states across Australia.

- Ages: 20, 30, & 40 year-olds

- Gender: female

- States: NSW, VIC, QLD, WA, SA

The car model used was a white 2007 Mazda 3 Neo BK Series 2 Auto 5DR hatchback.

A total of 426 quotes were collected from 20 different insurers across 15 different driver profiles.

How we determined our market list of car insurers

To get our market list of car insurers in Australia, we looked at products in the Finder database and Find An Insurer, a referral service run by the Insurance Council of Australia (ICA) that provides a list of general car insurance products available in Australia.

We then used ahrefs, a software company that monitors search engine traffic, to see which insurers were the most popular.

We considered it to be a popular car insurer if it had 500 or more monthly searches. This landed us at a list of 30 car insurers.

We then also excluded any specialist car insurance providers and single state providers from our list.

Out of the final list, there were only 3 car insurers we hadn't analysed.

Keep in mind that we haven't assessed every single car insurance provider in the market. We only assessed the most popular car insurance providers in the market.

Frequently asked questions

More guides on Finder

-

High risk car insurance

Learn the factors that may cause you to be considered a high-risk driver and whether you might be eligible for cover.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.