Does car insurance cover hail damage?

If you have comprehensive car insurance, then yes, you will be covered for hail damage. In fact, you will be covered for all damage related to storms.

Keep in mind though, you will likely have to pay your standard excess when you make a claim for hair or storm damage.

If you have a third party fire and theft or third party property damage policy, you will not be covered for hail damage.

Car insurance for cars with pre-existing hail damage

If your car has existing hail damage, it is still possible to get car insurance. Your insurer will likely just exclude your existing damage from the cover so you can’t make a claim to repair that. But any other damage that happens going forward will be covered.

How to get insurance with existing hail damage

When you’re filling in your quote form, your insurer will ask you if your car has any existing damage. At this point, you can submit the details of your existing hail damage. Based on your answers, the insurer will decide if they still want to offer you cover or not.

If you find this process confusing to do online then you might be better off calling the insurer to chat to them about your options.

Will car insurance cover my existing hail damage?

Typically, no. You’re only covered by your insurer for damage that occurs after you’ve taken out a policy. Any damage that existed before that is usually listed as an exclusion and claims .

How to make a claim for hail damage

Contact your insurer

Do this as soon as possible. If your area has been hit badly by a hail storm, it's likely there'll be thousands of other people claiming too. The sooner you get in touch, the sooner they can get started on your claim.

Gather evidence

Take photos of any damage to your car, as well as any damage in the surrounding area. Make notes about what happened, including the time and date.

Cooperate with your insurer

Provide the detailed evidence you gathered after your car was damaged. Agree to meet with any experts or claims assessors your insurance company assigns. Don't make any repairs until you have your insurer's permission.

Submit your claim

Depending on the insurer your claim options may be to submit online, via an app, mail or in-person. Your insurer will explain their preferred method.

Wait for a response

Your insurer has 10 business days to respond with their decision or to let you know if they need more time. If they do need more time, they have to let you know what else they need from you, and to give you updates on how your claim is progressing.

What should I expect in the claim process?

Although your car insurance company has 10 business days to respond to your claim, don't be surprised if it takes a little longer. This is because, when a major hail storm hits, it's usually followed by a huge influx in claims – which leads to a backlog for insurers.

Never carry out repairs to the car without your insurer's authorisation. In some cases, to allow the car to be driven immediately after an accident, your insurer may agree to essential repairs.

If your claim is accepted, your car insurer may:

- Manage the entire process on your behalf

- Appoint a repairer of their choice

- Allow you to nominate your preferred repairer (if you added the 'Choice of Repairer' option to your policy).

You can also contact the Insurance Council of Australia if you have any general inquiries about the claims process. It's likely the organisation will activate its risk and disaster response helpline - 1800 734 621 - to answer any questions people might have.

If you're unhappy with how your insurer is treating you, get in touch with the Australian Financial Complaints Authority (AFCA) on 1800 931 678.

"If your car has been damaged by a storm and you can’t drive it, you may not have to tough it out car-less while your repairs are happening. Many comprehensive car insurance policies include the use of a hire car while your car is out of action. Check the details of your product disclosure statement to know what you’re entitled to."

Compare policies with hail protection

Compare other products

We currently don't have that product, but here are others to consider:

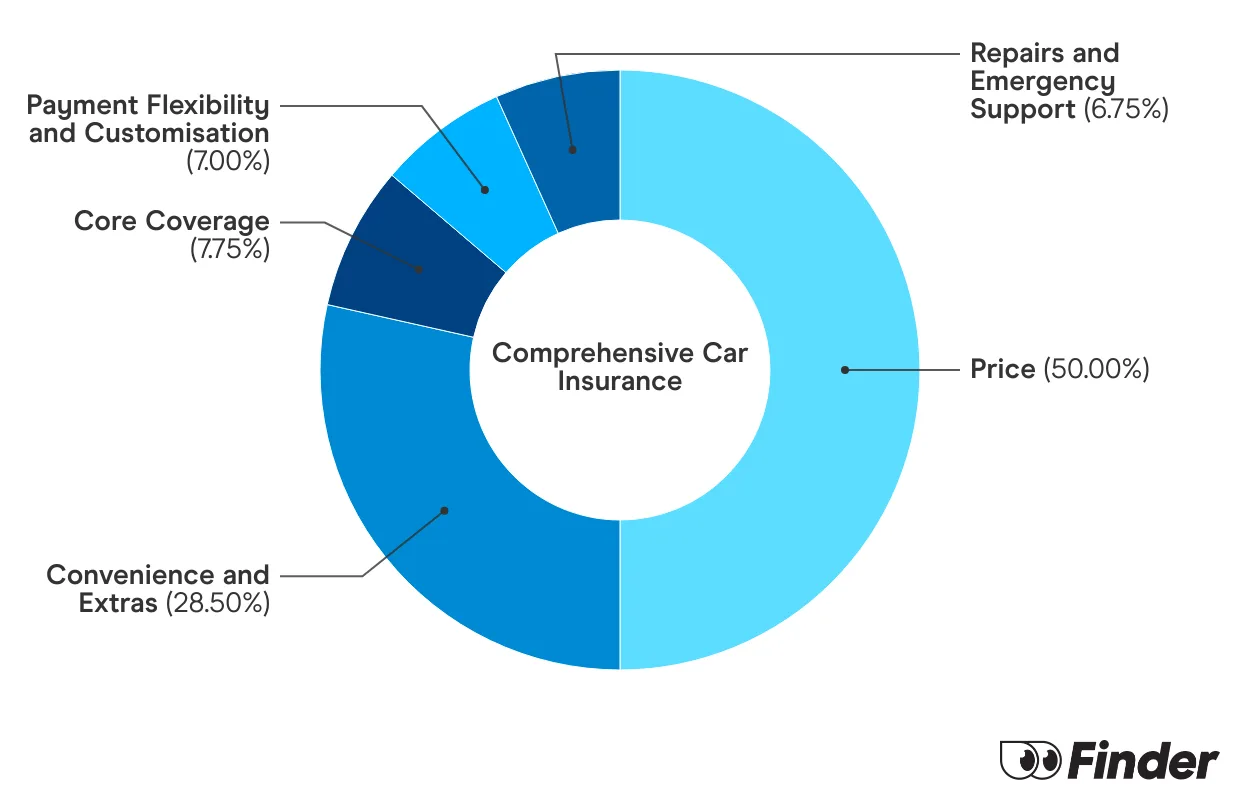

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

FAQs

Sources

Ask a question

More guides on Finder

-

Mobile phone use while driving statistics – Australia

Drivers who text are 10 times more likely to crash yet a large number of Australians still do it.

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

ROLLiN’ car insurance review

ROLLiN' is an IAG-backed car insurer offering a flexible comprehensive plan that's refreshingly free from faff.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Hume Bank Car Insurance Review

Hume Bank Car Insurance, issued by Allianz Australia Insurance Limited, provides three levels of cover, a wide range of benefits and the peace of mind that comes with 24/7 claims support.

-

Youi car insurance review

Youi specialises in offering car insurance policies tailor-made to suit the needs of different customers.

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.