Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for car insurance

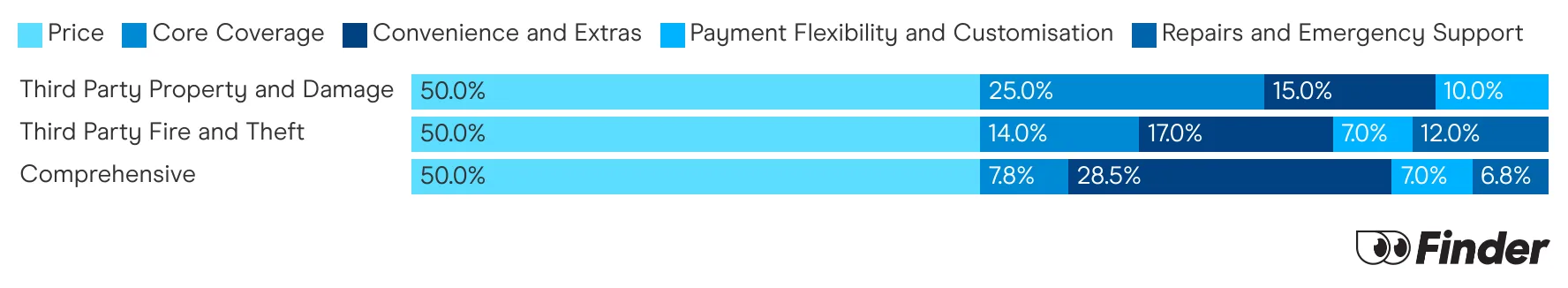

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Whether you're on a road trip to the Barossa or driving down King William Street, comparing car insurance policies in SA is essential to finding the right fit and price. However, protection goes far beyond minor accidents. With the state facing increasing risks from destructive winds, floods, and sudden, severe hailstorms you'll need coverage that's tailored to the local environment.

Car insurance costs in SA: Who has the cheapest price?

According to the most recent Finder research, car insurance in South Australia costs an average of $1,868. We've made a list of the top 10 cheapest policies below.Keep in mind, these quotes are based on a specific profile and your own quote will differ. It's best to get quotes from a range of providers to find the best car insurance for your needs.

See our methodology for collecting quotes.

| Provider | SA average | Get a quote |

|---|---|---|

Bingle | $710 | Get quote |

ROLLiN' | $1,143 | Get quote |

ALDI | $1,924 | More info |

Bank of Queensland | $1,306 | More info |

AAMI | $1,317 | More info |

To note: We researched pricing for RAA, however it was not any cheaper than many of the nation-wide providers.

What type of car insurance do South Australians need?

Compulsory third party car insurance (CTP) is the only mandatory form of car insurance that you need. It protects drivers from the financial impacts of causing injury or death in a car accident anywhere in Australia.

For South Australians, your CTP is already included in your registration fees. So provided you've organised your rego, you will have CTP already.

Keep in mind, CTP insurance does not cover damage to your car or damage you cause to other peoples property. See how this can be covered in other types of car insurance below.

Comprehensive

This is the only level of car insurance that covers damage to your own car as well as other people's vehicles and property. Additionally, you'll be covered if your car is damaged by hail, fire or storm or if it's stolen or vandalised. It can also help pay for key replacements, a hire car if yours is stolen and more.

Third party, fire and theft

This level of car insurance covers costs if you damage someone else's vehicle or property and can pay to repair or replace your car if it's damaged by fire or stolen. However, it doesn't cover you for damage to your own car due to an accident, storm or flood.

Third party property damage

This level of car insurance only covers you for costs if you damage someone else's vehicle or property. It won't cover repair costs for your car.

| Type of Insurance | Your car covered | Other person’s property or car | Theft or fire damage |

|---|---|---|---|

| Comprehensive Insurance | ✔️ | ✔️ | ✔️ |

| Third Party Property Damage | ❌ | ✔️ | ❌ |

| Third Party Fire Theft | ❌ | ✔️ | ✔️ |

Tips to Find Cheaper Car Insurance

Maximize Online Sign-Up Discounts

Many insurers offer substantial initial discounts, often ranging from 15% to 30%, simply for buying your policy online. These quick savings can easily amount to hundreds of dollars, making the digital application the cheapest route.

Negotiate with Your Current Insurer

Before switching, call your existing provider and inform them you are considering leaving due to the premium price. Insurers often have retention budgets and may immediately offer you a discount or match a competitor's quote to keep you as a customer, saving you the hassle of switching entirely.

Adjust Your Excess to Lower Your Premium

The amount you agree to pay out-of-pocket for any claim (the **excess**) has an inverse relationship with your yearly premium. By choosing a **higher excess**, you lower your premium. However, ensure the higher excess amount is something you can comfortably afford to pay immediately if you need to file a claim.

Always Compare Quotes from Multiple Providers

The most effective way to guarantee savings is through market comparison. Get quotes from at least **three to five different providers** to understand the true market value of your desired coverage. Relying on your renewal notice without comparing alternatives means you are likely missing out on hundreds in potential savings.

"Every year at renewal time, I call my insurer and ask if there's any flexibility on the price. Every time without fail, they've discounted my premium and it's ended up being the cheapest, most valuable policy of all I've researched. It takes me around 15 minutes which I think is worth the savings!"

FAQs

Sources

Ask a question

More guides on Finder

-

Mobile phone use while driving statistics – Australia

Drivers who text are 10 times more likely to crash yet a large number of Australians still do it.

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

ROLLiN’ car insurance review

ROLLiN' is an IAG-backed car insurer offering a flexible comprehensive plan that's refreshingly free from faff.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Hume Bank Car Insurance Review

Hume Bank Car Insurance, issued by Allianz Australia Insurance Limited, provides three levels of cover, a wide range of benefits and the peace of mind that comes with 24/7 claims support.

-

Youi car insurance review

Youi specialises in offering car insurance policies tailor-made to suit the needs of different customers.

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.