Key takeaways

- Adding a driver to your car insurance is simple, but it can cost you extra.

- Sharing your car insurance is fine, as long as you're honest with your insurer.

- If a driver who isn't listed on your insurance gets into an accident, they'll likely have to pay an unlisted driver excess.

- It's possible to add someone to your policy for a short term period.

How to add a driver to your car insurance

Adding a driver to your car insurance can be done in a few simple steps.

- Get in touch with your insurer. This can usually be done over the phone or via email. Some insurers have an app or online portal where you can manage your account.

- Let them know that you'd like to add a driver to your car insurance. They'll ask you a bit about the driver; name, gender, date of birth, driving and accident history.

- With that information, they'll decide how much extra to charge you for adding that driver. You'll either pay over the phone, online or receive a separate bill for this.

- Once paid, your insurance will be updated to cover that additional driver.

Cost of adding a driver to your insurance

| Provider | Cost with 1 driver | Cost with additional driver | Price difference |

|---|---|---|---|

| $1,317.97 | $1,322.02 | $4.05 |

| $1,723.27 | $1,964 | $241.06 |

| $1,757.47 | $2,011.28 | $253.81 | |

| $715.09 | $802.59 | $87.50 | |

| $2,159.01 | $2,578.68 | $419.67 |

This table is accurate as of January 2025.

Sharing car insurance with another person

Allowing someone else to drive your car is fine but there are a few things you should be aware of.

If they're a listed driver: If you've already listed this person as an additional driver on your insurance policy, then you've got nothing to worry about. If they're a listed driver then you're technically already sharing your car insurance with them.

If they're not a listed driver: If the person who's driving your car is not listed on your car insurance policy then you may have to pay an unlisted driver excess. This cost varies hugely between insurers but can typically be in the ballpark of $600 - $3,000. It will be higher if the driver is under 25 years old.

Adding a driver to your car insurance policy, short term

It's possible to add a driver to your car insurance policy, even if you only want them there for a limited time. You'd follow the same steps as adding a regular driver and when you no longer want them on the policy, you'd call to remove them. If you've already paid a higher premium in advance, then you'll likely receive a refund.

Does car insurance cover other drivers?

Car insurance can cover other drivers who drive your car. There are two ways for this to happen:

- You list them as an additional driver on your policy and they'll be covered.

- You don't list them and then if they happen to have an accident, you pay an unlisted driver excess. This is typically between $600 - $3,000 on top of your normal excess.

How car insurers deal with other drivers

This is accurate as of January 2025

Finder survey: How many Australians share their cars with other drivers?

| Response | |

|---|---|

| No | 56.06% |

| Yes | 38.77% |

| Doesn’t apply | 5.17% |

What happens if a driver is not listed on your car insurance?

You will generally have to pay an additional excess if they are involved in an accident, which can be more than $2,000. Typically, there's also an age excess charge if they're under 25. You may have to pay a higher excess if the young driver wasn't listed on your policy.

If someone plans to use your car regularly, then the best option is to list them as an additional driver; that way, you don't need to worry about the huge excess. But keep in mind, some insurers will charge you an additional excess regardless of whether they are listed or not.

Some will refuse to cover unlisted drivers altogether. So, it pays to know if this applies to you. Be sure to read your product disclosure statement (PDS) to be aware of any policy exclusions.

Does Compulsory Third Party (CTP) car insurance cover additional drivers?

While CTP car insurance provides protection regardless of who is driving your car, some will only cover the drivers nominated on your policy. Some unlisted driver exclusions include no cover for damage, loss or liability arising out of the use of your car:

- By any household member not listed on your car insurance certificate

- If your car has an age restriction to help reduce your premium

- By anyone driving your car without your permission, unless reported to the police

You should always check with your provider, or read your policy's Product Disclosure Statement (PDS) as to how listed and unlisted drivers are taken into account.

Do I need to list everyone that drives my car?

If someone plans to use your car frequently, it's wise to add them to your insurance. That's so that if they ever get into an accident, you're not stuck paying a hefty unlisted driver excess.

Keep in mind, if the person you're looking at adding is the main driver of the car, then you have to add them to your policy - it's insurance fraud not to. You must be truthful about who the main driver of the car is.

But if they're not the main driver and just an additional driver, it's up to you if you wish to add them.

Compare car insurance policies now

Compare other products

We currently don't have that product, but here are others to consider:

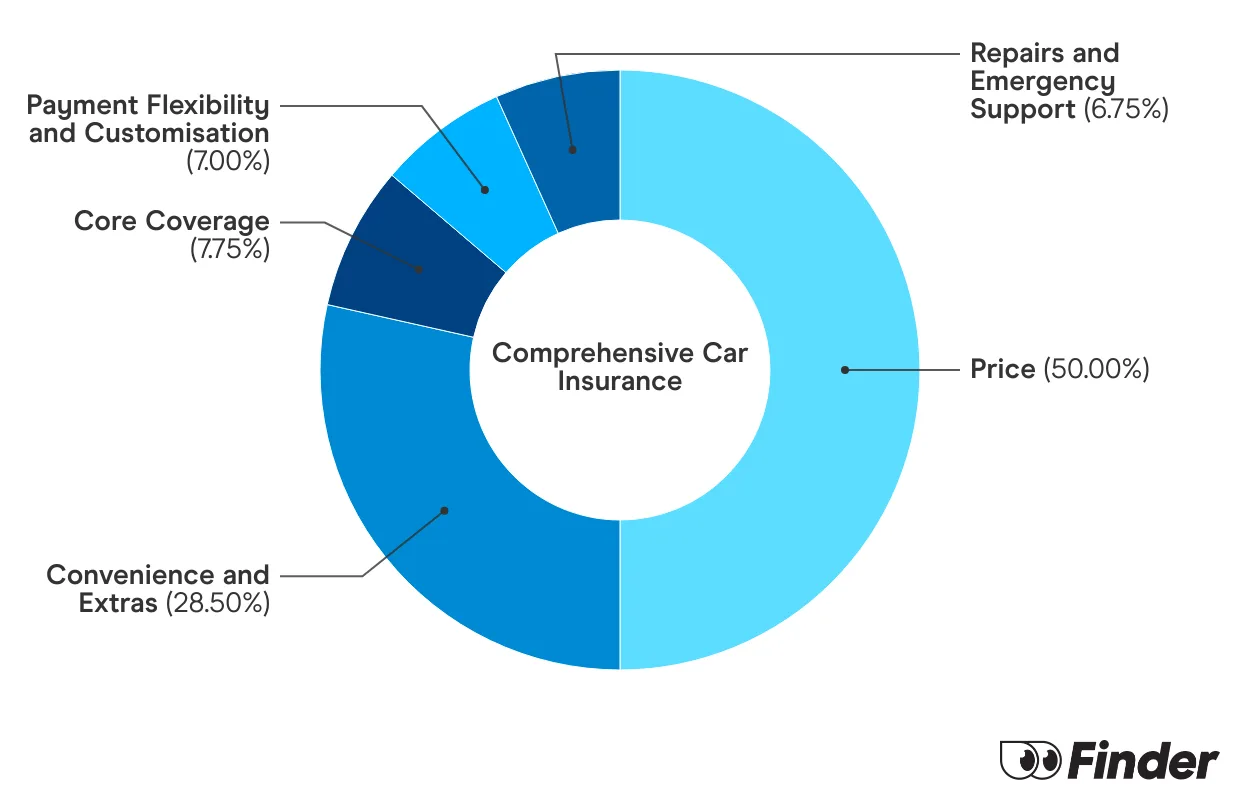

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

FAQs

Sources

Ask a question

4 Responses

More guides on Finder

-

NRMA roadside assistance options compared

NRMA offers 3 levels of roadside assistance. We’ve compared the pricing and features of them all in this article.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.

My listed driver had accident at his fault. Is it effected my driving history and my insurance premiums

Thanks

Gamini

Hi Gamini,

There’s a chance this could affect your insurance premiums in future but this will vary between insurers and likely depend on who the listed drivers are on your next policy. Typically, they’ll ask if you or any listed drivers have been in an accident and you must answer honestly. When it comes time to renew or switch your car insurance, it could be worth getting in touch with the insurer to see what your options are.

We assisted our son to purchase a vehicle (we paid some & he took a loan for balance), the deal is it’s both of our vehicle. Can we list him as a driver if he took out a part loan on it?

Hi Jude,

When it comes to listing drivers for car insurance, it’s important to list whoever will be the main driver of the car, regardless of who paid for it. Some insurers will also ask you to list all additional drivers who may drive the car too. If you’re unsure about who to list, it might be worth calling your insurer to discuss your circumstances so they can help you know who is the best person to list as a driver.

Thanks,

Peta