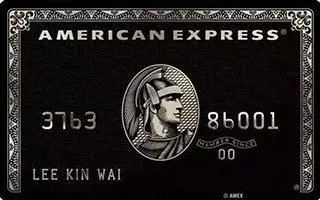

The American Express Centurion Card is one of the most exclusive and mysterious cards in the world – it's only available by invitation from American Express. It is technically a charge card, rather than a credit card, and offers valuable travel and lifestyle perks, as well as generous rewards for your spending.

It was one of the first metal cards to ever be released, originally in black anodised titanium, and now offers 2 metal designs.

What are the features and benefits of the Amex Centurion Card?

The American Express Centurion Card has become a status symbol for the elite. Informally called the "Amex black card", this card has held a high position among ultra-premium cards since its launch.

- Credit limit. This card doesn't have a pre-set credit or spending limit. As a charge card, you're required to pay the balance in full each month.

- Personal or business use. The card can be used for personal as well as business use. You can also request additional cards for family members or employees.

- Rewards points. The Amex Centurion doesn't have a publicly listed earn rate but is reported to earn 2.5 Membership Rewards points per $1 on eligible spending. In comparison, the American Express Platinum Card (which is often used as a point of reference) offers 2.25 points per $1 on eligible purchases and 1 point per $1 spent with government bodies.

- Metal card. One of the most iconic features of the Centurion Card is that it is made of metal. But you can still use it with contactless and mobile payment services.

- Travel benefits. Some of the travel benefits you could enjoy with this card include complimentary flights, a dedicated travel-booking service, airport chauffeur service, Priority Pass membership, Virgin Lounge and Qantas Club Lounge benefits and cruise company credits. You can also access the Centurion airport lounges in Dallas, Houston, Las Vegas, Hong Kong, New York, Philadelphia, Miami, Seattle and San Francisco with the card.

- Hotel perks. As well as a complimentary hotel stay and upgrades at many locations, exclusive privileges and hotel reward program benefits are available with partners including Hilton Honors, Starwood Preferred Guest and InterContinental Hotels.

- Complimentary insurance. The Amex Centurion offers a suite of complimentary insurance covers including international travel insurance, card purchase cover, card refund cover and extended warranty cover.

- Mobile contactless payments. Whether you have an Android, Apple or Samsung device, you can save time at the cash register and pay with the convenience of your smartphone with Google Pay, Apple Pay or Samsung Pay.

- Prada x Amex Centurion bracelet. You can request 2 of these contactless wearables per account, with a design from Prada that looks similar to a classic black watch strap.

How much does the Amex Centurion cost?

In Australia, the card charges a $6,500 annual fee with a one-off establishment fee of $5,000.

This means you'd pay $11,500 in the first year and $6,500 per year after that. Other American Express cards have annual fees ranging from $0 to $1,750. As the Centurion is a charge card, it doesn't charge interest but you're required to pay your balance in full each month.

How can I get an Amex Centurion Card?

This is an invitation-only card, so there are no specific eligibility criteria available for the Amex Centurion Card. But if your aim is to get this card, there are a few steps that could help you get an invitation:

- Build a relationship with Amex. American Express only sends out a limited number of Centurion invitations to its existing customers. So you can work towards getting this card by using other premium American Express products.

- Pay off your account regularly and on time. If you want an Amex Centurion invitation, you'll also need to show that you can afford to use it by making account repayments regularly.

- Make use of your current extras. The Amex Centurion is reported to have an extensive suite of complimentary extras and benefits that cater to premium card members. So using the perks available on your current card could help show American Express that you are the type of person who appreciates and benefits from these features.

- Meet the financial requirements. Although there are no official financial requirements listed for this card, it's clear that the Amex Centurion is designed for big spenders and earners. It's been said that cardholders need a five-figure monthly spending bill per month to get this card.

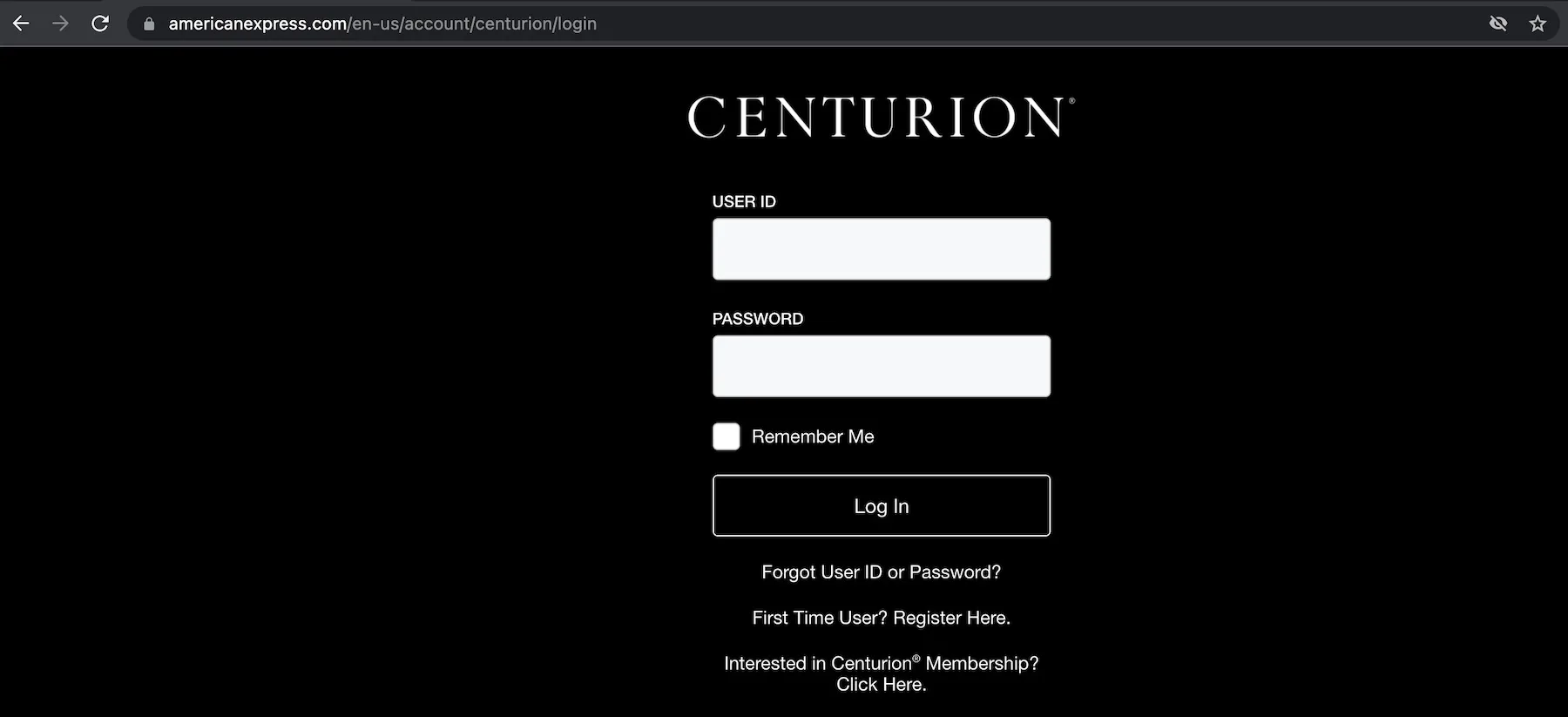

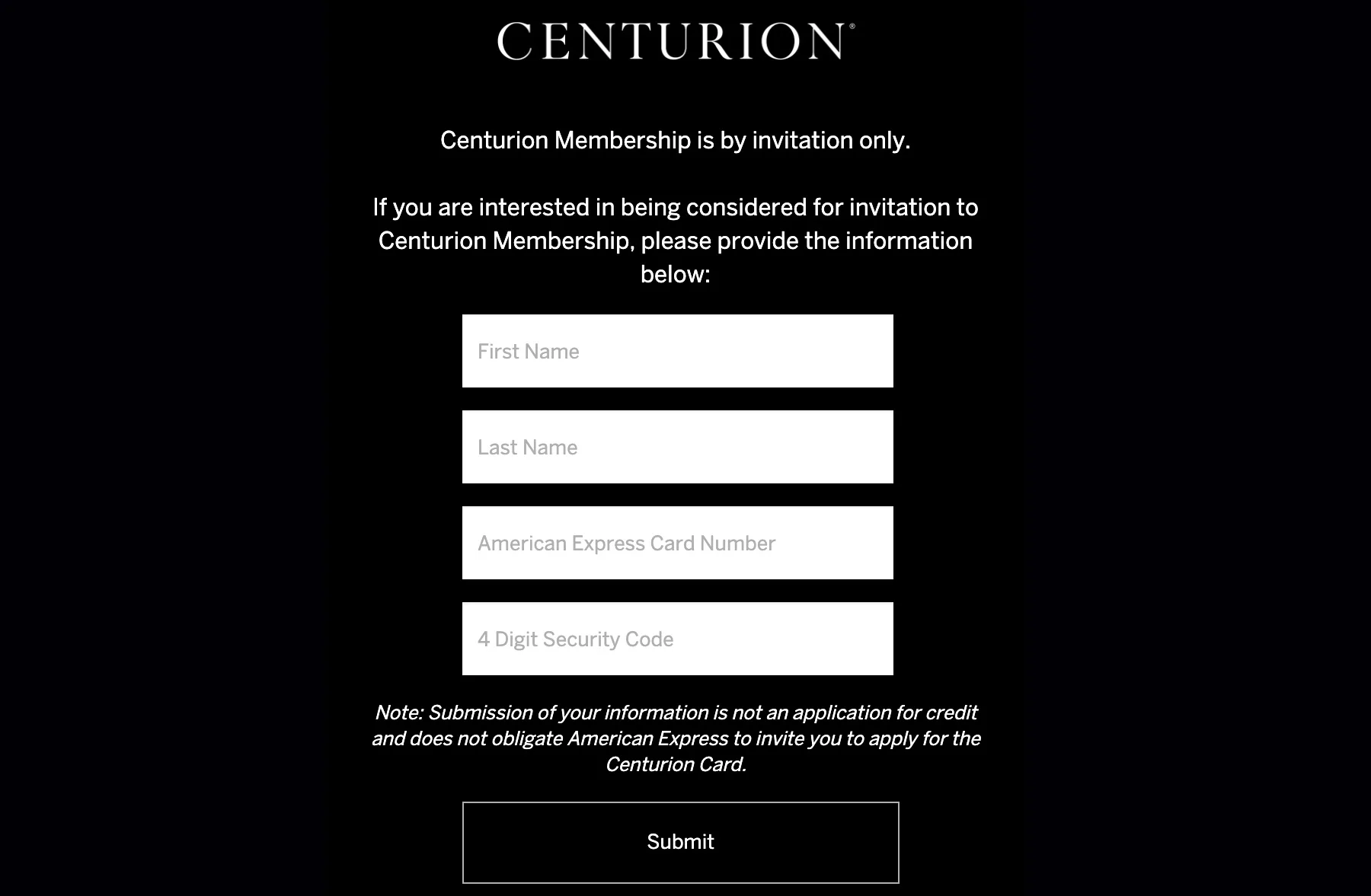

Can I register my interest for the Amex Centurion?

While this card is by invitation only, the US American Express Centurion login page has an option for people to submit their details to Amex for consideration.

As this is a US website, there's no guarantee it would work for someone in Australia and the website notes that submitting your information "is not an application for credit and does not obligate American Express to invite you to apply for the Centurion Card."

Compare other credit cards from American Express

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFrequently asked questions

Sources

Ask a question

More guides on Finder

-

American Express Essential Rewards Credit Card

Bonus points and low card fees are two of the features that set the American Express Essential Rewards apart from the other rewards credit cards - find out more about it here.

-

American Express Corporate Platinum Card

With a 350,000 Membership Rewards Bonus Points offer, lounge access and management tools, is this Amex account right for your company?

-

American Express Qantas Corporate Platinum Card

This charge card offers expense management tools and is linked to both Qantas Business Rewards and Membership Rewards.

-

American Express Qantas Business Rewards Card

The American Express Qantas Business Rewards Card offers 170,000 bonus Qantas Points, no pre-set spending limit and perks including complimentary insurance.

-

American Express Explorer Credit Card

The Amex Explorer offers Membership Rewards Bonus Points, lounge passes, a $400 travel credit and complimentary insurance covers – here's how its other features add up.

-

American Express Velocity Business Card

The American Express Velocity Business Card earns points per $1 spent and offers complimentary travel insurance and two complimentary Virgin Australia lounge passes each year.

-

American Express Velocity Platinum Card

A platinum card offering up to 100,000 bonus Velocity Points, up to 100 Velocity Status Credits per year, and up to 2.25 points per $1 spent

-

American Express Platinum Business Card

From Bonus Membership Rewards Points to savings on first, business and premium economy class flights, this charge card is packed with features to help you manage business spending.

-

American Express Platinum Card

How does the huge bonus points offer, $450 annual travel credit and other platinum perks stack up against the Amex Platinum card’s annual fee?

-

Qantas American Express Ultimate Card

The Qantas American Express Ultimate Card earns up to 2.25 Qantas Points per $1 spent, a yearly $450 travel credit and additional premium travel features.