Key takeaways

- Home loans with principal-and-interest repayments are the most common loan type in Australia. Principal is the money you borrow. You repay this, with interest charged by the lender on top.

- With principal-and-interest repayments you repay some of the loan amount and interest at the same time. This reduces your overall debt with each repayment.

- The less common alternative to principal-and interest-loans are interest-only loans. These have higher rates and cost more in the long run, but have lower repayments early on.

Understanding home loan principal and interest

- Principal. This is the sum of money you have borrowed in the form of a loan.

- Interest. This is a charge that lenders apply over time to money that you borrow. The amount of interest you pay on a loan is determined by the interest rate.

When you borrow money to buy a home, you have to repay it. The amount of money you've borrowed is called the loan principal (or the loan amount). You have to repay this money over time, but you also have to pay interest.

Interest is charged on top of the loan principal. The amount of interest you pay is determined by your home loan's interest rate and the size of your loan principal.

The more you borrow, the more interest you pay.

Finder survey: Are Australians paying principal and interest or interest-only on their home loan?

| Response | |

|---|---|

| Principal & interest | 61.36% |

| Interest only | 34.09% |

| Split | 4.55% |

How principal-and-interest home loans work

Here's a simple example using Finder's home loan repayment calculator:

- Property value. You buy a home for $800,000.

- Deposit. $120,000.

- Loan principal. $680,000.

- Interest rate. 5.50%.

- Loan term. 30 years.

- Monthly repayments (principal and interest). $3,861.

With this example, you're repaying $3,861 a month (assuming interest rates don't change). With interest charged on top, your $680,000 loan principal plus interest will end up costing you $1,389,948 over 30 years.

That's $709,948 in interest charges plus the original loan principal.

Why am I paying more interest and less principal at the start of the loan?

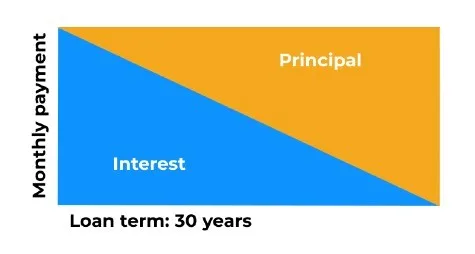

When you start making mortgage repayments, you might notice that most of your repayment is paying off the interest at the beginning of the loan. Only a small amount will go towards the principal. As you continue paying off the loan, you'll pay off more principal and less interest.

This process is called loan amortisation. It's a schedule that determines how a loan is repaid over time with regular repayments. Amortisation allows the lender to get more of their interest (and therefore profit) early in the life of your loan while keeping your repayments the same each month.

Here's a simple graph to illustrate how mortgage interest and principal are repaid together over time.

Principal-and-interest loans versus interest-only loans

Borrowers have an alternative to principal and interest repayments: interest only home loans. These loans have an initial period where the borrower doesn't repay the loan principal at all. Instead, they just pay the interest charges.

This makes their repayments smaller at first. But eventually, the loan will revert to principal and interest repayments, meaning you have to pay off the principal.

This means that interest only home loans start cheaper but end up being more expensive.

Here's an example using two loans. They are identical except that one is principal and interest while the other is interest only for the first three years.

| Details | Principal and interest | Interest only |

|---|---|---|

| Loan principal | $400,000 | $400,000 |

| Loan term | 30 years | 30 years |

| Interest rate | 2.45% | 2.45% |

| Interest only period | N/A | 3 years |

| Monthly repayments | $1,570 | $817 (during interest only period) $1,689 (after interest only period) |

| Total interest | $165,237 | $176,574 |

| Total loan cost over 30 years | $565,237 | $576,574 |

Here we can see that making interest only payments for 3 years ultimately costs you an extra $11,337 in interest.

Why do some borrowers choose interest only payments?

Interest only loans are commonly used by investors to minimise their non-tax-deductible costs (interest charges on an investment property are tax deductible but principal payments are not).

This can be beneficial for investors planning to hold an investment property for a short time in a growth market. Instead of paying off the loan, these investors plan to see a quick capital growth (the value of the property rising) and then sell the property. With this strategy, an interest only loan allows the investor to minimise their repayments.

Some owner-occupiers choose to make interest only repayments for a short time if they are struggling to make repayments or have a reduced income.

Principal and interest calculator

You can use Finder's free home loan calculator to see how the principal and interest components of a home loan work.

Just enter some basic loan details, including loan amount (the principal) and an interest rate. In the repayment type field, you can select P&I (principal and interest) or interest only.

How do I compare principal-and-interest mortgages?

When comparing loans with principal and interest repayments, the interest rate is the first thing you should look at. The lower the interest rate, the lower your repayments will be.

But there's more to it than that:

- Interest rate. The lower the better, but pay attention to the fine print. Some home loans offer introductory discount rates that are quite low but revert to a higher rate later.

- Rate type. You need to look at fixed and variable loans and decide which is better for you. Variable rates tend to offer more features and greater flexibility while fixed rates offer certainty around repayments. Learn more about the fixed versus variable decision.

- Features. Compare loan features and make sure the loan offers what you need (for example, an offset account, portability or the ability to make extra repayments).

- Loan purpose. Make sure you compare the right type of loans for your specific circumstances. If you're an investor, look at principal and interest investment loans. If you're buying a home, you will need to look at principal and interest owner-occupier loans.

- Fees. The interest rate isn't the only thing that affects your costs. Look at the fees that come with the loan, including application, settlement and ongoing fees.

- Lender. Don't forget to compare lenders. You may want the speed and convenience of an online lender or you may want to talk to a lending specialist at one of the big banks. Different lenders have different appetites for risk depending on your borrowing circumstances, so it's worth inquiring with a few lenders before submitting a full application.

How can I pay off my loan principal faster?

A big advantage of principal and interest home loans is that you're repaying the loan principal from day one. This means you're not only paying off debt, you're building equity in your home (that's the value of your property minus any outstanding debts).

And if you can repay the loan faster, you'll get out of debt sooner and pay less in interest. There are several ways you can do this, and it depends on your loan's features:

- Make extra repayments. If your loan allows you to make extra repayments, then you can repay the loan faster this way. Even paying an extra $100 a week on your mortgage could save you thousands in interest over the life of your loan.

- Use your offset account. Even better than extra repayments is if your loan has an offset account you can put some extra cash in. This mimics the effect of extra repayments by reducing your loan principal, but if you need to access the cash, it's yours (but if you do take it out of the offset account, your loan principal will increase).

- Make fortnightly repayments. Switching from monthly to fortnightly repayments gives you a slight boost. This is because there are 12 months in the year but there are 26 fortnights, giving you effectively an extra fortnight's repayment per year.

- If your rate rises, switch. If you've had your home loan for a few years, you might be surprised how high your rate is now. Yes, rates are low right now, but your lender might only be offering their best deals to new customers. Asking your lender for a lower rate or switching to a better home loan with a new lender, can save you thousands. If you get a lower interest rate but keep your repayments the same as before, then you're effectively making extra repayments immediately.

Need a home loan? Compare your options now

Frequently asked questions

Sources

Ask a question

2 Responses

More guides on Finder

-

Home loan cashback offers

Home loan cashback deals can help you refinance to a cheaper interest rate and get a lump sum cash payment. Compare the latest deals and check your eligibility today.

-

South West Slopes Bank home loans

A community credit union operating in the south west country area of NSW, helping you find the right home loan.

-

The Capricornian home loans

Compare home loan rates from The Capricornian, a credit union in Central Queensland.

-

Pacific Mortgage Group home loans

Your guide to home loan products available from Pacific Mortgage Group (PMG).

-

Greater Bank home loans

Check out home loans from Greater Bank and apply today.

-

ME home loans

ME is an online lender with a simple range of products, including the Basic Home Loan and the Flexible Home Loan. See their rates and fees here.

-

ING home loans

Thinking about getting a home loan from ING? Compare rates and learn more about this lender.

-

loans.com.au home loans

loans.com.au is one of Australia's leading online only lenders with a range of products that have great features and low costs.

-

Community First Bank home loans

Community First Bank is a credit union that offers home loans in addition to other financial products.

-

Best Home Loan Rates Australia

Learn how to compare rates to find the best home loan and start saving money on your mortgage today.

Hey do banks tag on the interest charged on to the principal amount in a home loan

So if the interest is $400 on the loan and the repayments are $1800 in total

The 1400 is off the principle but the $400 is then added to the principle

I always see in my statement that the interest charged is put directly on to my outstanding principle so the banks are charging interest on the interest they charged! Compound interest I understand but can you clarify?

Hi Patrick,

This one is a tricky one to answer and you could probably email your lender and ask them for a breakdown in case they calculate it differently. But basically your lender charges interest on top of the principal and you pay back both over time. But it’s lopsided. You pay mainly interest up front and more off the loan principal over time. This is called an amortisation schedule.

I hope this helps.

All the best,

Richard