The most prestigious and expensive credit cards in the world

From gold plating to solid gold, rare metals to solitaire diamonds, there is a select group of credit cards that offer both luxury and extravagance. Based on exclusivity, perks and status, these prestige credit cards are top of our list:

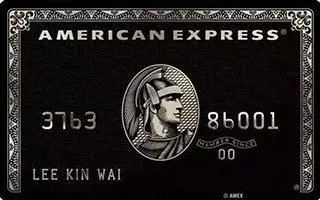

- American Express Centurion. Made of titanium, this Amex card is widely-acknowledged as the first and most prestigious, invitation-only black card in the world.

- J.P. Morgan Reserve. Formerly the Palladium card and made of metal (palladium and 24K gold), this card is also issued by invitation alone to JPMorgan's private banking wealth management and investment banking clients with investments of at least $10million USD.

- Dubai First Royale Mastercard. Trimmed with gold and embedded with a .235-carat solitaire diamond, this card is only offered to royalty and ultra-millionaires in the UAE.

- Coutts World Silk Card. This tastefully unembellished card is exclusively available to UK private bank Coutts clients.

Exclusive metal credit cards in Australia

If you're looking for a shiny card you can actually apply for in Australia, here are some of the most luxurious cards you might actually qualify for (they're still very pricy!).

- The American Express Platinum. This metal credit card is packed with Amex perks, including a yearly $450 Platinum Travel Credit, worldwide VIP lounge access and Membership Rewards that you can even transfer to Qantas Frequent Flyer. With a $1,450 annual fee, it's definitely exclusive.

- Qantas Money Titanium. No matter what status you have as a Qantas Frequent Flyer, this metal credit card will give you even more travel perks, including Qantas flight discounts up to 2 times per year, lounge invitations and Qantas Points on your spending. It has a $1,200 annual fee and is only available to people who earn at least $200,000 per year.

The American Express Centurion card

Also known as the Black Card, the exclusive American Express Centurion card has served the highest tier of American Express cardholders since 1999. Named after the iconic American Express centurion logo, this card is traditionally made of titanium and issued by invitation to the wealthiest American Express Platinum cardholders.

Features of the Amex Centurion credit card

If you’re aiming for an invitation to get the American Express Centurion credit card, here’s what you need to know about it:

- Invitation-only. Despite the mystery shrouding the Black Card, one thing is for sure – you can only get one of these by invitation from American Express. You must be a high income, high net-worth individual and hold an American Express Platinum card with a proven high annual expenditure.

- Titanium card. Crafted out of anodised titanium metal, the Black Card is laser-etched with your account information. Amex issues the Centurion with two cards so business and personal expenses can be easily separated. A plastic version of the card is also issued in some countries, for the sake of convenience.

- No limit charge card. The Black Card is technically a charge card, not a credit card. This means that you are not charged interest on purchases and are required to repay your full balance by the due date on each statement. If you don’t, you could be charged a late fee or have the card suspended. There is no stated credit limit on the Black Card, although American Express will allocate a "spend ceiling" based on past spending and repayment patterns.

- Dedicated relationship manager. Possibly the most celebrated perk of the card, you'll also have 24/7 personal concierge services for almost anything you want, including getting you a table at the most chic booked-out restaurants, arranging your last-minute travel itinerary, or buying your kid the perfect pet – whatever you need done.

- Travel benefits. The Amex Centurion gives you access to premium airport lounges and clubs worldwide, complimentary companion airline tickets on select airlines, flight upgrades and travel insurance covers. It also offers chauffeur limousine services for overseas flights and queue-skip privileges throughout the airport.

- Automatic program upgrades. With the Amex Centurion, you are automatically upgraded and enrolled into the highest-tiers of hotel rewards programs (Shangri-La Diamond, Hilton Honors Diamond), car rentals (Hertz President's Circle, AVIS President's Club) and airline rewards (Emirates Gold, Qantas Club access, Priority Pass membership).

- Hotel benefits. This card also offers hotel upgrades and free additional nights at participating hotel chains globally. Most enviously, it also offers 12pm check-in and 4pm check-out.

- Shopping benefits. The Amex Centurion entitles you to your own personal shopper, exclusive luxury brand sales, advance tickets to exclusive events, and VIP access to practically anything money can buy.

J.P. Morgan Reserve Card

Made of metal and literally minted with palladium and 24K gold, this is one card you can't take with you through the metal detectors. Although previously available by application, this charge card is now only offered by invitation to clients of JPMorgan's private banking wealth management or investment banking arms.

Dubai First Royale Mastercard

Embedded with a white .235-carat solitaire diamond and trimmed with gold, this elaborate card is the Dubai Group's exclusive offering to UAE royalty and the region's top millionaires. You need more than money to have one of these – Dubai First actively seeks out its prospective cardholders among the ultra-high-net-worth folk.

The qualification and fee details of this card are almost as elusive as the card itself. Rumour has it the fee alone is AED7,000 (approximately AUD$2,500). This could be the world's single most exclusive credit card. But it's impossible to know for sure.

Coutts Silk Card

The prestigious Silk Card offered by the Royal Bank of Scotland-owned UK private bank is exclusive to Coutts clients only – including the Queen. The Silk Card has no annual fee and doesn't charge a fee for transactions in non-Sterling currencies.

According to the bank, "Silk opens doors to a world of privileges and benefits. Silk can be tailored to your lifestyle, offering the ability to order additional cards with tailored spending limits and varying benefits."

It's a charge card, so there's no interest rate. But you have to pay the balance in full each month.

Finder survey: What annual fee would Australians of different ages be willing to pay for a rewards credit card?

| Response | Gen Z | Gen Y | Gen X | Baby Boomers |

|---|---|---|---|---|

| Up to $100 | 8.99% | 9.78% | 11.51% | 13.92% |

| Up to $200 | 3.37% | 4.62% | 2.63% | 1.99% |

| Up to $400 | 3.37% | 2.45% | 0.66% | 0.28% |

| $0 | 2.25% | 6.79% | 10.86% | 14.2% |

| More than $500 | 1.12% | 0.54% | ||

| Up to $300 | 1.12% | 3.8% | 1.64% | 0.85% |

| Up to $500 | 0.54% | 0.33% | 0.57% |

Looking for more high-end cards? Compare premium and black credit cards in Australia.

Frequently asked questions

Sources

Ask a question

6 Responses

More guides on Finder

-

Platinum credit cards — time to upgrade your plastic?

If you want to get more rewards, higher credit limits, complimentary insurance and many other perks, here's how a platinum credit card could work for you.

-

High Credit Limit Credit Cards

If you want to buy big-ticket items or consolidate debt with a credit card, compare high credit limit options and weigh up the pros and cons here.

-

Visa Platinum benefits

From entertainment offers, concierge and travel services to travel insurance and more, cardholders can enjoy many different platinum perks. Read on to find out all about the benefits of being a Visa Platinum cardholder.

Hi! I have a black card with Westpac.

I was wondering if they also do a metal/steel version of the card ?

Their plastic black are very bad quality

Hi Eran,

Thanks for your inquiry.

You can view our comparison of Black credit cards to see available designs and versions. You can press the “Go to Site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific enquiries.

A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Ally

Is it possible to get the visa black, or any other metal credit card in Australia besides the centurion?

Hi Tom,

Thanks for your inquiry.

Yes, you can apply for a Black credit card as long as you meet eligibility requirements from credit card providers. You may compare a range of Black credit cards. You can press the “Go to Site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific questions. A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan

Thanks Jonathan,

I have the Citi bank – visa infinite card but was wondering if there are any metal credit cards, besides the centurion available in Australia.

Hi Tom,

Thanks for your response.

You may want to view this page for a comparison of prestigious credit cards. You can select the “Go to Site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific questions. A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan