If your car insurance policy is set to expire soon, it's a good time to think about renewing.

Whether you’re looking for a better deal or thinking about how you can renew, we’ve made an easy guide to navigate the important details.

How to renew your car insurance

You’ll likely get a renewal notice a few weeks before your policy is due to end. How you go about renewing policy will depend on the options available with your insurer and how you originally took out cover.

- Auto renewal. Your policy will automatically continue after the current policy period. This means you won’t have to do anything and your premiums will continue to be directly debited.

- Online. Most insurers allow you the option of renewing your policy through a member portal or through a direct process where you enter your policy number, post code and banking details.

- Phone. If you prefer to speak to a person, many providers have representatives that can help you renew your policy over the phone.

- BPAY. Your renewal notice will generally include your insurers biller code and reference, which you can use to pay with online banking.

What to do before renewing your car insurance

You’re going to want to find out how much your premiums are going up before you decide to renew.

Depending on the type and age of your car, your claims history, and whether or not you have a no claims discount, your new premium could be a lot more expensive than you expected. If you no longer feel like you’re getting the best bang for your buck, it might be time to find a new provider.

Our research found that there was a variation in average annual costs of almost $400 for comprehensive car insurance when looking at 37 different Australian insurers. Finding a good deal can save you a lot of money, but it’s important to understand what your current policy covers so you can easily compare apples to apples when you shop around.

What to do if your renewal has been declined

If you’ve missed premium payments or violated the terms of your car insurance policy, there’s a chance your renewal will be declined. In that case, you have a few options to help you get coverage:

- Contact your insurer to understand the specific reason you’ve been refused. If it’s something correctable like your payment or claims history, see if there’s a way to address these concerns and potentially renegotiate reinstatement.

- Shop around for a new car insurance policy from other providers. Even if your current insurer has declined your renewal, others may still offer you coverage.

- Improving your risk profile can be done by doing things like changing your driving behaviour, parking your vehicle in a safer location, or removing other listed drivers from your policy, especially if they’re younger or most risk prone.

- Talk to a professional like a insurance broker or agent if you need further help in finding new coverage.

Compare and switch

Compare other products

We currently don't have that product, but here are others to consider:

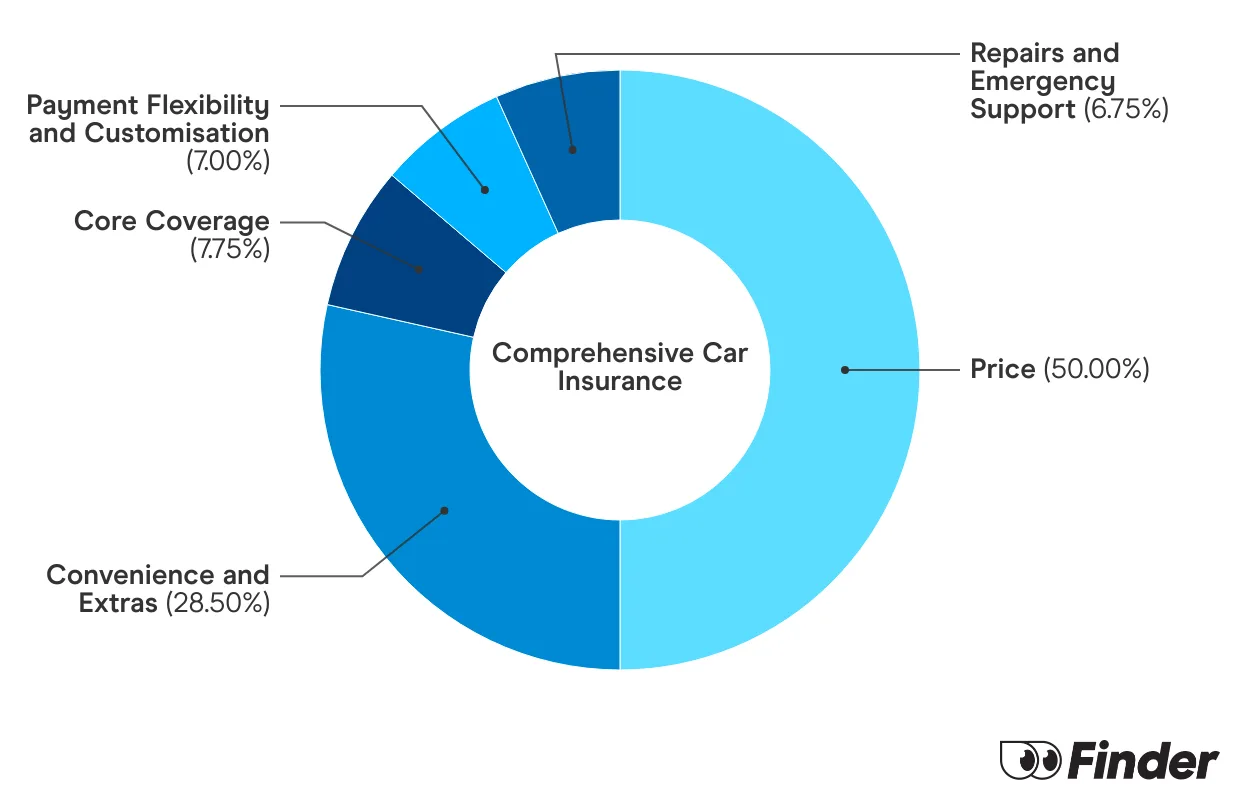

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

FAQs

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

NRMA roadside assistance options compared

NRMA offers 3 levels of roadside assistance. We’ve compared the pricing and features of them all in this article.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

My son’s car renewal insurance has been declined, is there another insurer we can use for insurance.

Hi Susan,

I’m sorry to hear that.

You can compare a range of insurance providers here.

Before applying, please remind your son to read a policy’s Product Disclosure Statement (PDS) so that he’s aware of what he’s covered for, along with any exclusions or restrictions.

I hope this helps.

Regards,

James