Key takeaways

- If you're involved in a car accident and it's not your fault, prioritise safety first before contacting police and exchanging details.

- You can make your own claim with your insurer if the other driver is uninsured or you can't get their details.

- Avoid admitting fault at the scene as liability will be determined later down the line.

What to do after a car accident that wasn't your fault

When you're involved in a car accident it's natural to feel emotion and tensions can run high. However, it's important to try and be methodical and follow the appropriate steps to stay safe and prevent future complications.

Safety first

Check everyone is okay, call for emergency services if required and, if it's safe and necessary to do so, move your vehicle to prevent further accidents.

Contact the police

Generally, it's advised that anyone involved in a car accident contact the police and file a report. This can be crucial when settling insurance claims.

Exchange information

Collect the other driver's information, including name, contact details, licence number, and insurance information.

Collect evidence

Take lots of photos of the accident scene, damage to any vehicles or property involved, and licence plates for documentation.

Speak to witnesses

If there are witnesses to the accident, collect their contact information. Their statements may be valuable in case nobody admits fault.

Notify your insurance

Even when you're not at fault, you should inform your insurance company. They can guide you through next steps, help recover damages from the other driver's insurer, or cover your costs if the other driver isn't insured.

These tips were compiled with the help of Nathan McCullum, Director of McCullum Advisory.

Should I claim on my insurance if I'm not at fault?

It depends. If the other driver has insurance, their policy should cover your damage and you don't need to claim on your own policy. If they don't have insurance, or if they prefer not to involve their insurer, they may agree to pay you out of their own pocket.

However, if the other driver isn't insured or won't pay for the damage, you may need to claim on your own insurance - particularly if the repair bill is expensive.

Regardless of whether you make a claim or not, you should always inform your insurer of an accident. They will be able to help guide you through the best steps to take.

Will a not at fault accident claim affect my car insurance premium?

If you have to claim on your own insurance because the other driver was uninsured or you were unable to get their details, it's likely your premium will be impacted.

However, if the matter is handled by the other driver or their insurer, and they cover the cost to repair any damage, your car insurance premium is unlikely to be impacted.

Read your product disclosure statement (PDS) and certificate of insurance carefully to avoid any nasty surprises.

Will making a claim impact my no-claim bonus discount?

If you weren't at fault and you provide your car insurance details to the other driver, it's unlikely that a claim will impact your no-claim bonus discount. However, keep in mind that your permiums could still go up after making a claim, even if you weren't the one the blame.

What if you don't have car insurance?

It doesn't matter. If the other driver is at fault, they should cover the cost of your repairs. They can either cover the cost themselves, or have their insurance cover the cost.

If you're having trouble hearing back from the other person, you can send a letter of demand, involve a lawyer, lodge a complaint with the Australian Financial Complaints Authority (AFCA) or take the matter to court.

What if the other driver doesn't have insurance?

If the at-fault driver doesn't have insurance, they may pay you out of their own pocket. However, if the repair bill is extensive, it can be difficult to recoup the costs.

Depending on the amount owed, you may need to lodge a complaint with the Australian Financial Complaints Authority (AFCA) or take the matter to court.

"A few years back I bought a second hand Holden Astra from a dealer. It turned out to be an oil-leaking lemon, but that's another story. A month after I got the car, I was rear-ended on Parramatta Road by an uninsured driver and my car was totalled. At first I felt devastated, thinking I had lost all my money because I only had third party insurance. To my surprise I found out that my third party insurance also covers my car if I get hit by an uninsured driver, and my insurer (Youi) was able to reimburse me the full cost of my car."

What the experts think

Compare car insurance

Compare other products

We currently don't have that product, but here are others to consider:

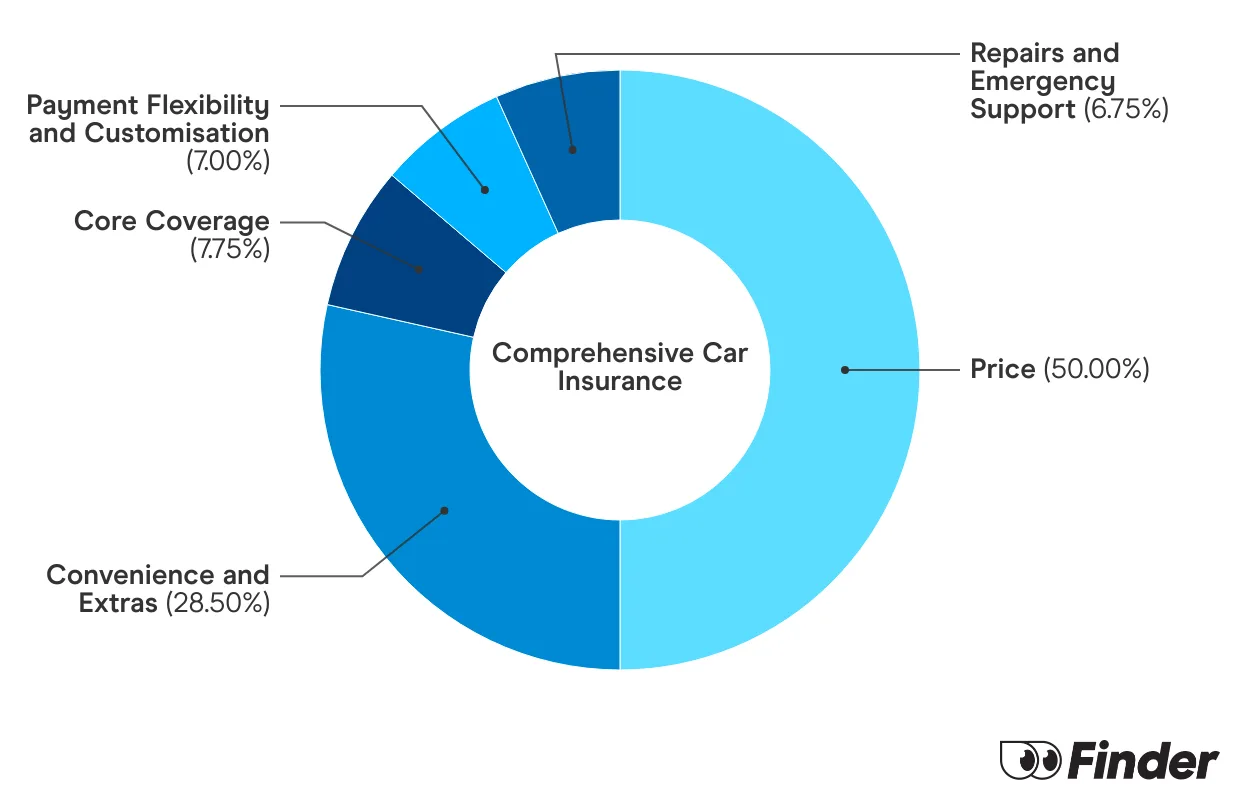

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Frequently asked questions

Sources

Ask a question

8 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

If your car was considered as salvage from the party that was at fault insurance company and gave you the cost of your car so that you can go buy another car but you still want to keep the car that was wrecked it still runs how does that work out?

Hi Jennie,

Thanks for getting in touch with finder. I’m sorry to hear about your car involved in an accident. I hope nothing serious happened to you.

If an insurer decides to write off your car, you have two options. One is accept it and two is challenge it. Typically, if you accept the insurer’s decision to write off your car, they will most likely bring it to the junk shop and try to earn something from it. Thus, you wouldn’t be able to salvage it anymore.

On the other hand, if you’re unhappy about your car being written off, and believe it can be repaired economically, you can challenge the insurer’s decision but you’ll have to act fast since, within days, the decision can become final.

To learn more, you can also discuss your question with the insurer. Perhaps, they can also advise you about the best course of action to take.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers,

Joshua

My son crashed his motorcycle in a roundabout after he braked to avoid a taxi that had entered the roundabout from his left without giving way, which he would of hit if he didnt brake. The taxi driver has admitted fault but as there was no collision between motorcycle and taxi who pays the insurance?

Hi Kartman,

Thanks for getting in touch with finder. I hope all is well with you. :)

I’m sorry to hear about the accident of your son. I hope your son will get well soon.

Regarding your question, there are a few things you can do. First, you can file a personal injury claim against the taxi driver. In this case, you might need the help of a lawyer.

Second, the taxi driver can also make a claim with their insurer and get your son covered for the injuries and property damage incurred.

Third, you may check with your insurance as well if your son is covered as well. Some insurers have a special insurance for those clients who aren’t able to get cover from the at-fault party.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers,

Joshua

If someone drove my car and it was out of rego and got hit by another car from behind and smashed my car does the driver at fault still responsible to fix the damages

Hi Maty,

Thank you for getting in touch with finder.

That’s really a tough situation. YES, the driver who drove your car is also at fault knowing that the car was out of rego. Each state has its own traffic rules and regulations so it is best to check what’s the best thing to do with your local authority. If your car is insured, kindly contact your insurer regarding this situation to seek further advice/help.

I hope this helps. Please feel free to reach out to us if you have any other enquiries.

Thank you and have a wonderful day!

Cheers,

Jeni

I was in a car accident not my fault (third-party insurance accept liability), the car has been at the repair shop for 3 weeks 4 days, the car is under ‘finance’. Do I still make repayments for a car I don’t have in my possession/use? Also been informed by repairer it could take another 2 weeks to complete repair (if parts arrive on time). So maybe 2months in loan repayments. Hope you can assist me in this. Thanks

Hi CB,

Thanks for reaching out to us.

If I got you’re inquiry correctly, you’re asking if you still need to pay your loan repayments for your car even though it’s not in your possession or not in use? In this case, you’ll still need to make your loan repayments with your lender to also avoid late payment fees. I suggest contacting your lender to explain your situation and inquire.

Best regards,

Rench