What is a CVV or CVC number?

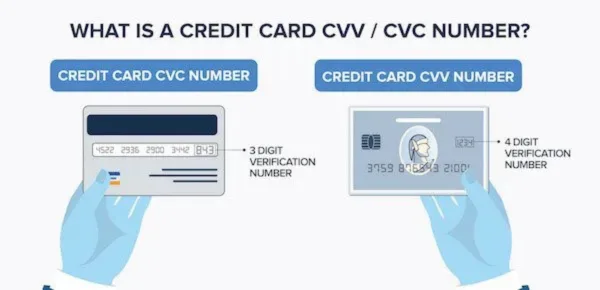

A CVV number (or card verification value) or CVC (card verification code) is a 3- or 4-digit number on your credit card or debit card that helps prevent fraud. It's used to verify transactions when you're making a payment and don't need to enter a PIN or use a card reader as you would in a store.

Where is the CVV or CVC number?

If you have a Visa or Mastercard credit card or debit card, the CVV will be a 3-digit number on the back of your card. If you have an American Express card, the CVV will be a 4-digit number found on the front of your card.

When do I need to provide my credit card CVV?

The CVV is used to verify card transactions when you're not using your card in-person (sometimes known as card-not-present transactions). Below are some of the most common situations when you could be asked for your card's CVV:

- Shopping online. Most online payment forms will ask you to provide your CVV when you're entering your card details.

- Making phone payments. If you're paying a business over the phone, you will sometimes be asked for the CVV. But it does depend on the way the business has set up its payment system (not all of them require the CVV).

- Adding a card to your mobile wallet. When you add a card to a mobile wallet, such as Google Pay, you'll need to provide the CVV along with all the other card details.

In these situations, the CVV helps protect you (and the business) from fraudulent transactions because the CVV or CVC number is printed on your actual card – which means you need to have the card to enter the number.

Card security tip

If your card is lost or stolen and you haven't reported it, anyone could use the CVV and other details on your card to make online purchases or phone payments without your permission. That's why it's important you contact your card issuer immediately if your card is lost or stolen.

How do I find my CVV code?

Your card's security code is usually found on either the front or the back of your card. If you've misplaced your card, you may be able to contact your bank issuer to confirm the code or get a replacement card.

If you only have a virtual credit card, the CVV details will be included in your account or the app.

Is a CVV or CVC number called anything else?

Different credit card companies, online payment platforms and businesses sometimes use other terms for the CVV or CVC. This includes:

- CVC2

- CVV2

- CCV

- Card Security Code

- CID

- CID2

Despite these different names, the codes all serve the same function and are used as a standardised security measure.

In the case of "contactless" cards there is generally a chip involved which supplies its own electronically generated series of codes. They are called Dynamic CVV or iCVV.

Are CVV or CVC numbers the same as my PIN?

No, your CVV number is different to the PIN that you use for in-person transactions. When you shop at a store or withdraw money from an ATM, you'll enter a PIN but never need to provide your CVV. When you shop online, it's the other way around.

Sources

Picture: Shutterstock, Infographic: finder.

Ask a question

28 Responses

More guides on Finder

-

Best international credit cards

Find credit cards that make international spending cheaper with 0% international transaction fees.

-

American Express statistics

Insights and analysis on American Express credit cards, costs, acceptance and more.

-

Instant approval credit cards

Compare credit cards that give you an outcome within 60 seconds of when you submit your application online and find out how to increase your chances of getting this type of "instant" credit card approval.

-

Introductory credit card offers for new customers

Compare introductory credit card offers that give you bonus rewards points, 0% p.a. balance transfers, interest-free periods and waived annual fees when you sign up for a new card.

-

Cashback credit cards — up to $500 back

Get a percentage of your spend back, gift cards or vouchers with a cashback credit card. Find out more and compare current offers in our guide.

-

Best Credit Cards in Australia right now

You deserve the best credit card. Let us help you find it.

-

Best Qantas credit cards

Compare the best Qantas frequent flyer credit cards based on bonus point offers, points per $1 spent, rates, fees and other features so you can find a card that works for you.

-

Best Velocity credit cards

Check out bonus point offers and travel perks such as lounge access and complimentary insurance with these Velocity Frequent Flyer credit cards.

-

Easy credit cards to get approval for in Australia

When you apply for a credit card online, you could receive a response within 60 seconds. Find out how you to find a card that you're eligible for and increase your chances of approval.

-

No international transaction fee credit cards

Find out how you can keep your overseas spending costs down by comparing credit cards with no foreign transaction fees and no currency conversion fees.

I have an American heritage credit union card, and I don’t seem to be able to even locate a cvc number on it. You know anything about that?

Hi Dom,

This is the Finder Australia website so we don’t typically cover American credit cards, but you can view details about the on the US Finder website. Based on the details on the American Heritage website, it offers Mastercard credit cards, which typically have the CVC should be on or near the signature panel. But if you can’t find it, you can contact American Heritage through its website (including a live chat option). I hope that helps.

Hi, I was asking a question about the what is CVC number for the student at high school?

Hi Grace,

Thanks for your inquiry.

Your CVV number (or card verification value) or CVC (card verification code) on your credit card or debit card is a three or four-digit number on your card. If you have a Visa or Mastercard branded credit or debit card, it’ll be a 3 digit number located on the back of your card. If you’re using an American Express issued card, the CVV will be a four-digit number found on the front of your card.

It’s the same with student credit cards. You can also have a look on this page for student credit cards that you can compare.

Cheers,

Rench

I have the card number and expiry date and my card name also I need cvv number

Hi Rolex,

Thank you for contacting finder.com.au. We are a comparison website and general information service, we’re more than happy to offer general advice.

If you have a Visa or Mastercard branded credit or debit card, The CVV number will be a 3 digit number located on the back of your card. If you’re using an American Express issued card, the CVV will be a four-digit number found on the front of your card.

I hope this helps.

Cheers,

Danielle

I activated my American Express card and my tax refund is currently on there , I went to the bank to withdraw money and it said enter a pin and they never gave me a pin . Do I use the 4 digit number on front of the card or the 3 digit on the back as my pin ?

Hi Sonicfan,

Thank you for you inquiry.

Actually, no, your CVV or CVC number is different to the PIN code you use to make ATM withdrawals or with EFTPOS transactions in-store. On the other hand, your CVC or CVV number is used for verifying online or over the phone payments when you can’t use your PIN or signature. It would be nice to coordinate with AMEX as they have the direct access to your account.

I hope this information has helped.

Cheers,

Harold

I have an online account to download games. My credit/debit card expired. I did not update my details and assumed that the company would not be able to access my funds anymore. I had free credits which I can’t use because I use an iPad now and it redirects me to the App Store and it requests payment with no option to use the credits I paid for. Which is why I did not shut down the account. I don’t get notified in my debit account about credit card payments and I can’t add my other card to the ANZ app and my money hasn’t been adding up. I have a new card and CVV is a new one also and there is no expiry date on my file with this company.

Why is someone able to take money from my credit card with invalid information and no CVV? It’s added up to around $100ish that should have been rejected. I am contacting the company in question also. It seems fraudulent to me. I thought that these were the security measures taken to ensure my online security.

Thanks.

Hi Annoyed&confused,

Thanks for reaching out.

Unfortunately, especially these days, whether we do a transaction in person or online using our debit/credit cards, we can’t really say that we are 100% safe from fraud and theft. Yes, you are correct, your card’s CVV should or hopefully protect your account from those who would misuse your credit by any means possible. So it is important that we are vigilant and extra careful whenever we use our card or enter our account and security number to make any transaction.

For any transaction on your account that you deemed fraudulent, it is a better idea to report them to your card company/bank so they could do necessary action on how to protect your account.

Cheers,

May