An important note. Whichever policy you choose, you should consider adding accidental damage insurance to your policy. Usually an optional benefit rather than a standard feature, it can cover furniture that's damaged in an unforeseeable accident. Examples could include wine or coffee spills, child-related food stains and accidental burns.

Have you splurged on furnishing your home? A lot of us have. Think about your sofa, dining table, chairs and bed. How much is all of that worth?

If something happens that damages or destroys our furniture, we have a lot to lose. Good news, then, that insurance can cover home furniture against the unexpected.

How do I insure my furniture?

There are a few different ways to insure your furniture. Which policy is right for you will depend on your living situation and the furniture you want to insure:

Contents insurance

Can give your furniture the same protection as home insurance, against the same insured events, but minus the benefit of cover for your home itself. It can be a good choice if you're renting or in a less permanent living situation. If you only have a few things you want to insure, you can also cover furniture as part of a single item insurance policy.

Home and contents insurance

Can give you the broadest possible protection by covering not only your furniture but also plenty of other things around it in your home, including the home itself.

You might not want to take out a home insurance policy if your main priority is to cover your furniture, but if you already have home insurance, check your policy to see if you already have cover. You might even take the time to compare other home insurance options.

Compare home furniture insurance and get a quote

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder survey: What extra features would influence people in choosing a home & contents insurance policy?

| Response | Female | Male |

|---|---|---|

| Temporary accommodation cover | 30% | 25% |

| High-value items cover | 19.31% | 21.43% |

| Removal of debris | 19.31% | 14.47% |

| None of the above | 17.07% | 19.17% |

| Flood cover | 17.76% | 13.16% |

| Preventative programs | 8.1% | 10.15% |

| Asbestos removal | 6.72% | 5.83% |

| Other | 1.21% | 1.32% |

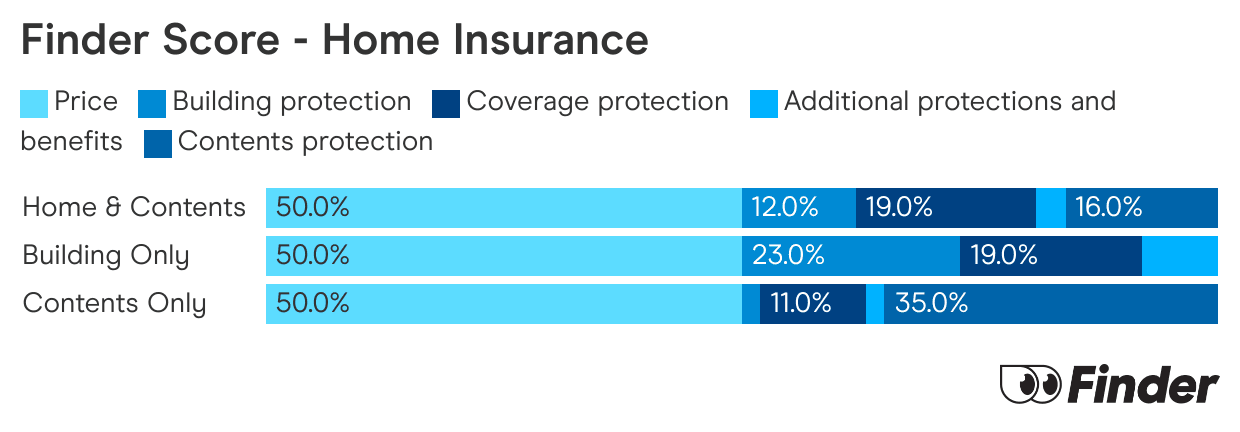

Finder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Why do I need home furniture insurance?

Between your bed and mattress, lounge or lounges, tables and chairs, wardrobes and cabinets, rugs and carpets and mirrors and lighting, the total value of your home furniture is likely higher than you'd guess.

Furniture is a common casualty when homes are damaged badly in fire, flood, storm and other events – and new and antique furniture doesn't come cheap.

Accidental scratches, spills and stains also happen. Cleaning, repair or replacement costs can be high when they do. Home furniture insurance (with accidental damage cover) can make those moments less painful.

Should I add "accidental damage" cover to my policy?

If you want to protect your furniture, you'll probably conclude, given sofas and other furniture are prone to accidents, that it's a good idea to add accidental damage cover for your policy. If you don't, you might be disappointed later on to learn that unsightly stain, scratch or chip isn't covered.

Which brands offer accidental damage cover?

| Brand | Does it offer accidental damage? |

|---|---|

| Optional |

| Optional | |

| Optional | |

| Optional |

How is home furniture insurance different to warranty?

- Warranties and product care plans focus on failures and imperfections in the design, structure and features of the product itself – for example, a manufacturing defect in a bed frame.

- A warranty generally won't cover any of the insured events a home and/or contents policy will, including water damage, fire damage, theft and so on.

- A warranty only lasts for a finite period of time after purchase, whereas insurance will last as long as your policy is active.

Will my outdoor furniture be included?

Yes. As long as it lives at the insured address, outdoor furniture can be included in either a home and contents policy or a straight contents policy. This can include things like statues and ornaments.

You just have to remember to account for your outdoor furniture when you're setting up your policy. Again, you might need to specify the value of any very-high-value items that are worth more than the upper limits the insurer pays out in a standard policy.

When will my furniture be covered?

Here are some situations where home and/or contents policies will generally cover your furniture:

- In insured events like fire, flood, escape of liquid from your plumbing system, impact damage (e.g. from a falling branch or tree) and theft.

- If fixed glass in a piece of furniture gets smashed in an insured event (depending on what happened, you might need accidental damage cover).

- If you stain your couch with food or drink (again, you may need accidental damage cover).

- Many (but not all) insurers classify rugs, and often carpets, as furniture.

When won't home furniture insurance cover me?

Every insurance policy has exclusions. Here are some furniture-related things you may not be covered for:

- Not all policies will cover "permanent" furniture like fittings, built-in wardrobes and kitchen cupboards (unless you're taking out landlord insurance), though others will.

- You shouldn't assume your insurance will cover pet damage, which is an exclusion in lots of home and contents policies and may or may not be included in accidental damage insurance. If you have an unpredictable pet that could cause havoc, check the fine print and ask the insurer.

- If you're working from home or running a business out of home, some policies will insure your (home) office furniture as a standard, while others won't. Let your insurer know about any furniture you use as part of your business, in case you need to insure it separately.

- If you have items of furniture with values higher than the relevant maximum sums insured in your policy, you might need to designate their value in a specified contents policy. Before committing to anything, be sure to cross-check the relevant values against the policy's product disclosure statement.

Frequently Asked Questions

Here's the bottom line

Whether your furniture collection is brand-new or antique, home furniture insurance that reflects its true value will quickly pay for itself in peace of mind.

Ask a question

More guides on Finder

-

National Seniors home insurance review

If you're over the age of 50 and are looking for the right home insurance policy, National Seniors could be one to consider.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

Bank of Melbourne home insurance

Review of Bank of Melbourne Home Insurance.

-

BankSA Home Insurance

Get cover for things like storms, lightning, theft and malicious acts. Choose from 3 levels of cover: essential, quality and premier care.

-

NAB home insurance review

A review of NAB's home and contents insurance policies. Find out how NAB can cover your house and possessions, giving you peace of mind and protection against the worst.

-

St.George Home Insurance review

Compare 3 home and contents insurance policies with St.George. Get a 10% discount for the first year if buying online.

-

Bendigo Bank home insurance review

Here's a detailed review of Bendigo Bank home insurance with information on 3 cover options.

-

Bupa home insurance review

Bupa Health Members may want to consider taking out a Bupa Home Insurance policy – you can get up to 15% off.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

AAMI Home & Contents Insurance Review

Compare home insurance policies from AAMI and find the right cover.