Key takeaways

- Many home and contents insurance policies will cover you for food spoilage as a result of a power outage.

- However, some insurers may ask for additional information as proof, such as a record of lightning in the area from the BOM.

Compare policies with food spoilage insurance

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder survey: How often do Australians compare or switch their home insurance?

| Response | |

|---|---|

| Once a year | 31.87% |

| I never compare or switch | 27.31% |

| Once every 3+ yrs | 21.85% |

| Every 2 yrs | 17.3% |

| More than once a year | 1.67% |

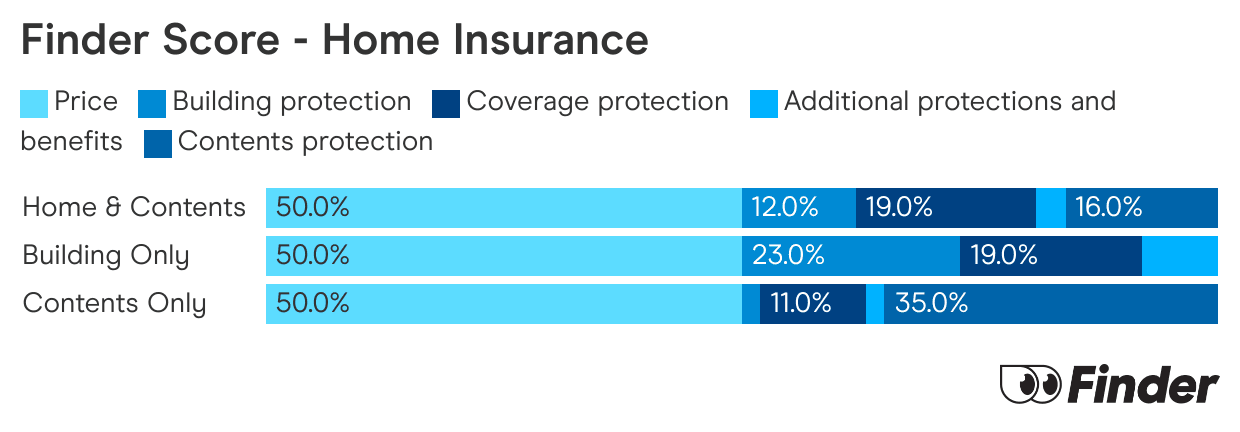

Finder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Can I claim food spoilage from a power outage?

Yes. Many home and contents insurers will cover loss or damage caused by a power outage. Generally, you'll find that it's included under the contents insurance part of your policy and covers you for situations like:

- Your freezer accidentally breaking down

- The public electricity supply failing because of an accident

- Insured events such as lightning, storms or water damage

- Electrical motor damage (in some cases and so long as it was caused by an insured event like lightning)

There are some insurers who might require additional criteria in order for your claim to be successful. For instance,

- The Bureau of Meteorology needs to have a record of lightning in your area at the time of the incident.

- You won't be covered if you leave the door ajar or you accidentally disconnect the power supply.

- Some don't cover you for the motor burning out or fusing, unless it was caused by an insured event.

What is food spoilage insurance?

Food spoilage insurance covers you for loss of or spoilage to frozen or refrigerated food, caused by an insured event such as your freezer accidentally breaking, a power outage or in some cases, electrical motor damage. Food spoilage cover is generally included in the contents section of your home and contents insurance policy because that's the part of your cover that protects the items and belongings kept at your home.

How do I get food spoilage insurance?

You'll need a policy that includes contents cover, so you can choose from either;

Contents insurance.

A contents insurance policy can help you cover the cost of lost, damaged or spoiled food if your fridge blows out. Contents insurance is usually cheaper than buying a complete home and contents insurance policy and it can also cover the other belongings you keep at home too.

Home and contents insurance.

A normal home and contents insurance policy can also cover the cost of food spoilage if something goes wrong with your fridge or freezer. This could be a good option if you want to play it safe and get cover for everything, your home and the stuff you keep inside.

What do the home insurers say?

It's similar across most home insurers, however some make mentions of how they cover you in a power outage, and if medications are included.

We looked at the product disclosure statements (PDS) of 3 Australian insurers to show you how it can differ.

When will this be handy?

Food spoilage insurance is a really handy benefit to have included with home insurance. Here are a few reasons why:

- You have expensive taste. If you're a passionate foodie then it's likely your fridge and freezer is full of good stuff. One power outage or accident and it could all be gone. Not only have you lost good food, you've wasted a lot of money.

- You have a big family. On average, a family of 4 spends $336 a week on food. That's a lot of money to risk losing and one more way home insurance can come in handy.

- You buy food in bulk. If you like to stock up on supplies, there's a lot of money in your fridge and freezer if there's a power outage. Food spoilage insurance can make sure you get reimbursed. Most policies pay you up to $500 towards food loss.

- You live in an area where power outages are common. Some parts of the country have more power outages than others. If you've experienced a power outage in the past, it's worth protecting your fridge full of goods for the next one.

- You live in an area with unpredictable weather. If the area you live in is prone to lightning, storms or other bad weather, there's an increased chance of a power outage. Food spoilage insurance could come in handy.

Do I really need food spoilage insurance?

Since we've already seen fires, storms and strong winds damage power lines and cause outages for thousands of households across Australia in 2020, particularly in bushfire-affected towns, it's wise to get food spoilage insurance included in your home insurance policy. It can reimburse you for the fridge full of food you could lose if something like a power outage or electricity supply failure occurs.

With global warming affecting Australia more severely than other countries, the chances of power outages and blackouts happening again are increasingly likely. You might not need it, but it's covered by most home insurance policies, so is it really worth the risk?

When won't food spoilage insurance cover me?

There are some situations where you might not be covered for food spoilage. These include loss:

- If the food spoilage was caused by a planned power outage.

- If the public electricity supply failed due to industrial action or civil commotion.

- If your freezer is over a certain age, usually 15 years old.

- If you deliberately cause the food to spoil.

- If your claim is related to lightning, and there was no evidence of it in your area at the time of the incident.

- If you leave the door ajar.

- If you accidentally disconnect the power supply.

- If the motor burns out, unless it was caused by an insured event.

Sources

More guides on Finder

-

National Seniors home insurance review

If you're over the age of 50 and are looking for the right home insurance policy, National Seniors could be one to consider.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

Bank of Melbourne home insurance

Review of Bank of Melbourne Home Insurance.

-

BankSA Home Insurance

Get cover for things like storms, lightning, theft and malicious acts. Choose from 3 levels of cover: essential, quality and premier care.

-

NAB home insurance review

A review of NAB's home and contents insurance policies. Find out how NAB can cover your house and possessions, giving you peace of mind and protection against the worst.

-

St.George Home Insurance review

Compare 3 home and contents insurance policies with St.George. Get a 10% discount for the first year if buying online.

-

Bendigo Bank home insurance review

Here's a detailed review of Bendigo Bank home insurance with information on 3 cover options.

-

Bupa home insurance review

Bupa Health Members may want to consider taking out a Bupa Home Insurance policy – you can get up to 15% off.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

AAMI Home & Contents Insurance Review

Compare home insurance policies from AAMI and find the right cover.