Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for car insurance

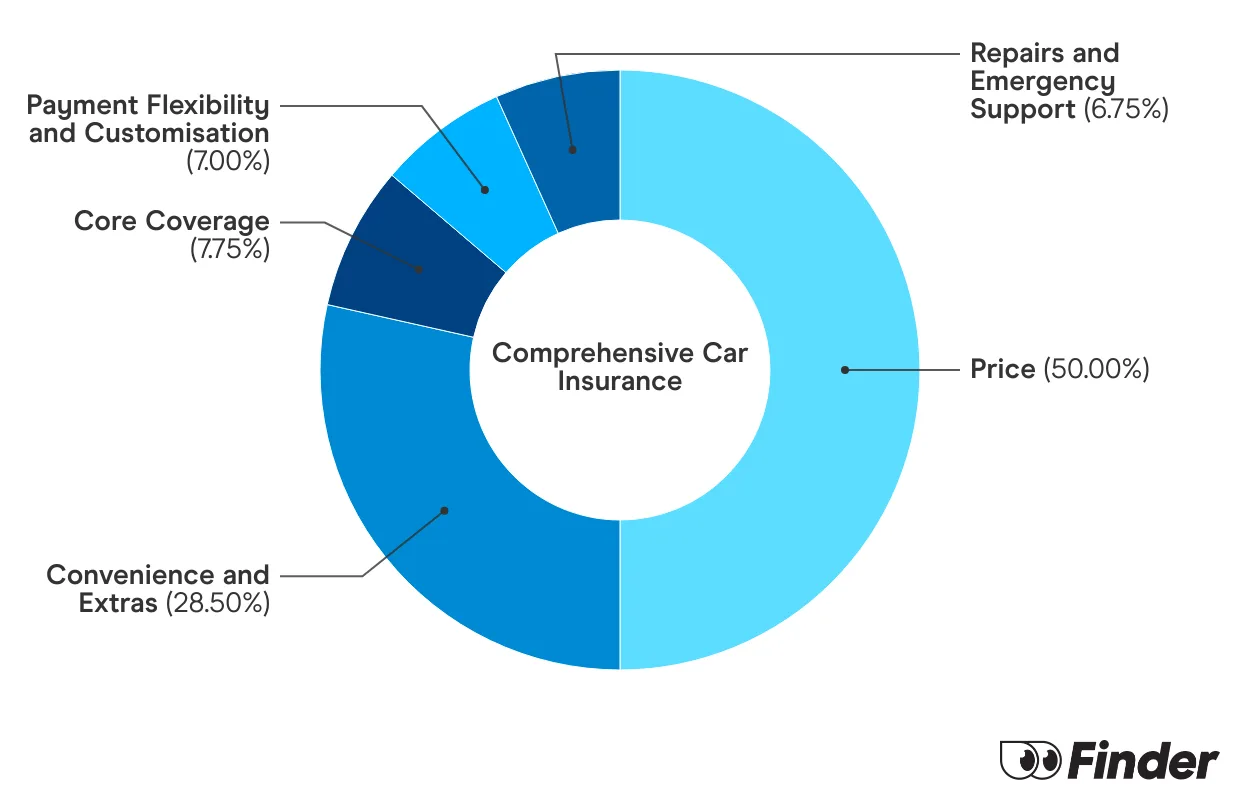

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

In many cases, standard car insurance can cover 4x4s. You generally only need to consider specialised 4WD insurance if you want to go off-road or have modified your vehicle. In that case, you’ll need to get the okay from your insurer before you start adventuring.

What is covered by specialised off-road 4WD car insurance?

Specialised off-road car insurance policies are often largely equivalent to comprehensive car insurance with a few additional features. This may include:

- Full cover anywhere in Australia

- Comprehensive cover of accessories and modifications

- Extended personal effects cover, to include items even while they are not necessarily inside the vehicle

- Cover while your vehicle is in transit, including being loaded or unloaded from boats or trains

- Includes cover of off-road recovery costs, for recovering an undriveable vehicle

- Trailer cover, often included automatically and sometimes as an extra

Before you can get a quote, you’ll generally need to discuss it with an insurer and do a more in-depth application.

This is not only because of modifications, but also because you generally need to explicitly mention to insurers that you’ll be taking it off road, what kind of driving you do and how frequently you do it.

What additional options are there?

The optional add-ons available will vary by insurer. If you go with a regular car insurer, you can expect to see the following add-ons:

- Additional hire vehicle cover: Lets you get a replacement vehicle if you are unable to drive your vehicle due to damage from an insured event.

- Excess free windscreen or window glass cover: Replacement of windscreen or window glass with no excess, following an insured event.

- Optional roadside assistance: This won’t help off road, but can still be a useful optional extra to consider.

If you opt for a specialised 4x4 insurer, the optional add-ons are a bit more tailored to off-road activities, such as:

- Additional off-road recovery costs: Lets you choose an additional cover amount for off-road recovery, like getting stuck somewhere.

- Higher benefit limits for hire car cover: This is because it’ll cost you more to hire a replacement 4x4.

- Cover for modifications and accessories: You’ll have to list what modifications and accessories you have and the insurer will let you know if they’re happy to cover you.

- Transit cover: Cover for while your vehicle is being transported, like on a boat.

Finding the best car insurance for 4x4 off-roading

Given off-roading comes with its own set of risks, it’s wise to consider insurance that accounts for this. You might like to look for policies that will:

- Cover you for beach and off-road driving. A regular car insurer may only cover you for while you’re on the road.

- Additional off-road recovery costs: A regular insurer may only cover recovery costs for accidents that occurred on an actual road.

- Accept your car modifications and cover them for a higher benefit limit: If you’ve put a decent chunk of money into modifying your vehicle, a specialised 4x4 insurer can help you make sure these modifications are properly insured.

FAQs

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

we were told on the grape vine 4×4 insurance will cover 5wheeler’s we do not take our vechile off road

Hi John,

I would strongly encourage you to speak with your insurer directly before you get behind the wheel so that you know all the types of driving your insurance will cover you for.

Best wishes,

James