Is it more expensive to insure an electric car?

It can be. Car insurance for an EV may be more expensive than their fuel counterparts for a couple of reasons.

- The cost of electric vehicles are typically more expensive. This means replacing them costs more too, so your insurance premium will reflect that to mitigate their own risk.

- EVs can have higher repair costs due to specialised parts and technology. As such, the insurer will inflate the premium to ensure the cost of this labor is covered.

If you’re already going to be paying a bit extra, just because it’s an electric vehicle, then it becomes even more important to shop around and compare your options.

Compare car insurance for EVs

Compare other products

We currently don't have that product, but here are others to consider:

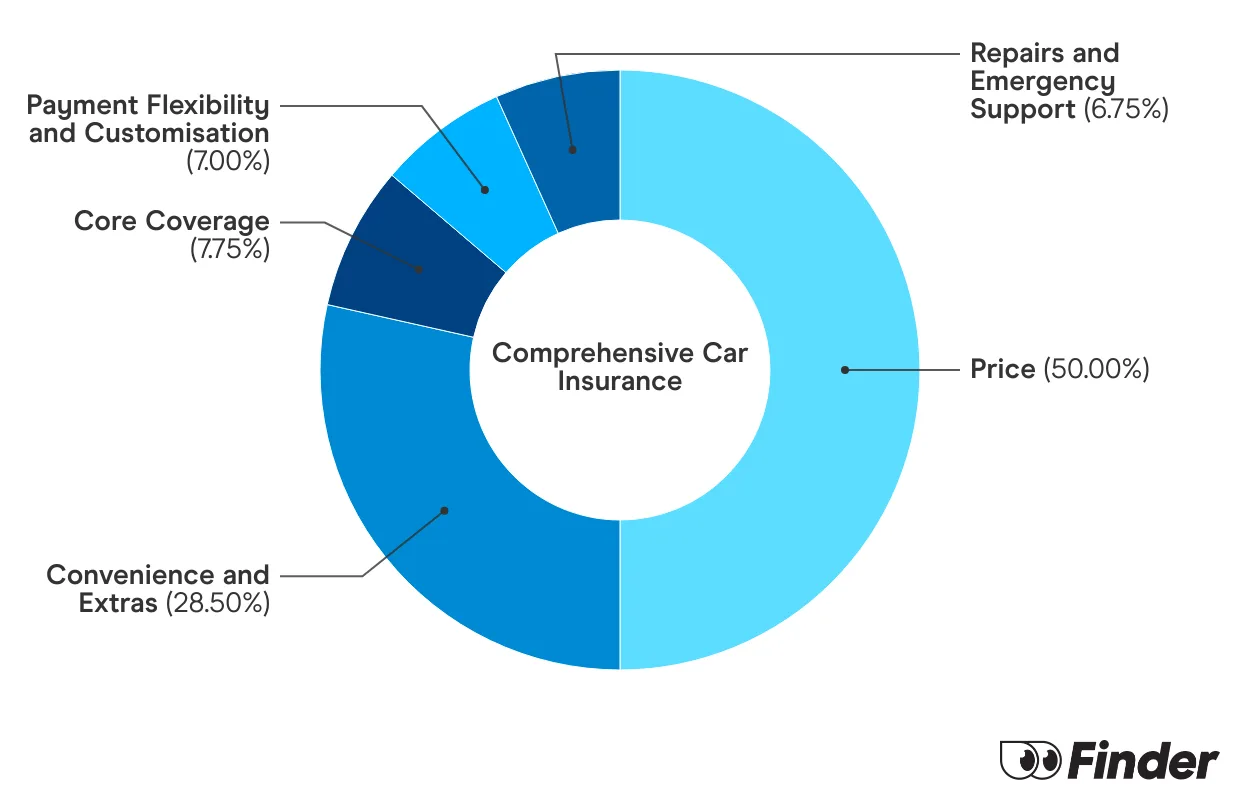

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Case study

"Every year when I get a renewal for my car insurance, I treat it like an opening offer. In the last few years especially, insurance premiums have skyrocketed. So I will always shop around when I get the renewal to make sure I’m not paying too much. The last time I received my Tesla insurance renewal, it had increased over $100 a month. So I compared and found another insurer for the same amount I was previously paying. Every insurer prices risk differently so don’t make the mistake of thinking they’re all going to be about the same. You can potentially save a huge amount of money by shopping around! "

Best insurance for an EV

The best car insurance for your electric vehicle is going to be one that covers you for all you need at a price you’re happy to pay. To find this, here’s a few key details to check for in the product disclosure statement.

Agreed or market value: This refers to the amount your insurer will pay you if your EV is written off. Because of how pricey EVs tend to be, many preference providers who offer agreed value. This is because an agreed value policy allows you to agree on the amount the insurer will pay you if your car is totalled. If you choose market value then what you’re entitled to is at the mercy of how your car is priced according to the market at the time. It’ll account for the condition of your car, the kilometres on it and more.

Charging equipment cover: Given a lot of insurers are tailored towards fuel or hybrid cars, it can be good to look for EV specific benefits like charging equipment cover, including wall mounts and wall chargers.

Battery cover: Check that your provider covers EV batteries. This is important in the event the battery is damaged or catches fire.

Choice of repairer: This benefit allows you to choose a mechanic or smash repairer of your choosing in the event your car requires repairers. This can be handy for EV owners as it may take your insurer longer to source an EV repairer from their own network.

Once you’ve compiled a list of insurers that can meet these needs, be sure to get quotes for all of them. You’ll likely find hundreds of dollars in difference.

FAQs

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

NRMA roadside assistance options compared

NRMA offers 3 levels of roadside assistance. We’ve compared the pricing and features of them all in this article.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

I do a search for the vehicle I want a quote for and the model isn’t listed. Dead end. The vehicle is a 2016 Nissan eNV200 24kWh van.

Hi Jim,

Thanks for reaching out. Although your car model isn’t listed, you can still request for a personalised quote. Simply click the Get Quote icon on this page. You’ll be directed to the insurer’s website where you can provide the details of your vehicle.

Make sure you read each policy’s Product Disclosure Statement (PDS) to make sure you’re covered for what you need.

Regards,

James