Key statistics

- A 2025 Model 3 Tesla costs an average of $3,397 to insure. Interestingly, a 2019 Model 3 Tesla is more expensive to insure at an average of $3,440.

- A 2025 Model Y Tesla costs an average of $3,039 to insure while a 2022 Model Y costs more at an average of $3,396.

- A 2020 Model S Tesla costs an average of $3,789 to insure while a 2019 Model S Tesla costs an average of $3,132 to insure.

- A 2020 Model X Tesla costs an average of $5,188 to insure while a 2019 Model X Tesla costs an average of $5,255 to insure.

- Insurance costs for the most popular Tesla, Model Y are 37% higher than a traditional petrol car.

How much does it cost to insure a Tesla in Australia?

We applied for quotes from 12 popular car insurers including AAMI, Budget Direct and NRMA. All were for comprehensive car insurance policies.

There were many insurers that refused to insure some models of Teslas and others that will insure them but for an exorbitant price.

Keep in mind that prices will differ based on your driving profile – for example, your age, driving history and where you live.

These quotes are accurate as of June 2025.

Average cost of car insurance for a Tesla

| Tesla model | Car insurance cost | |

|---|---|---|

| Model 3 | 2025: $3,397 | 2019: $3,440 |

| Model Y | 2025: $3,039 | 2022: $3,396 |

| Model S | 2020: $3,789 | 2019: $3,132 |

| Model X | 2020: $5,188 | 2019: $5,255 |

Why is a Tesla so expensive to insure?

There are a few reasons that Teslas cost more to insure than a regular car. These include:

- The parts are more expensive to produce and replace

- Some parts need be imported to Australia

- Regular mechanics might not be able to repair Teslas – they will need to go to a specialist

- Repairing and replacing damaged electric vehicle batteries is costly and time-consuming

- Some models like Model S and Model X have been discontinued in Australia

"For the first 4 years, a few things were covered under warranty – like the knobs on our steering wheel wore down and were replaced for free. But for general repairs, it's pricier. When driving on the freeway a rock flicked up and caused a 4-inch crack in the rooftop glass – the quote was $1400 to replace it. You definitely need to budget a little more for repairs."

What might impact my Tesla insurance costs?

- Your age, gender and driving history. The younger you are, the more expensive insurance tends to cost. Males also typically pay more, as do people with demerit points.

- Your home address. You will pay more if you live in a suburb with a higher crime rate or flood-prone location. It will also make a difference where you park your Tesla at night – outside on the street, a driveway or inside a locked garage.

- The model of your Tesla. More expensive or rare Tesla models tend to cost more to insure.

- Level of cover. You can choose from three levels of cover: comprehensive, third party property and theft, or third party property only. Comprehensive cover is the most expensive because it's the only policy that covers damage to your Tesla as well as other cars.

Fuel efficiency standards

The Australian government plans to introduce a New Vehicle Efficiency Standard (NVES). This would place a cap on the emissions output for new cars sold in Australia to incentivise carmakers to supply low and zero emissions vehicles. It could save you up to $1,000 in fuel and $17,000 over the life of the vehicle.

Compare car insurance for a Tesla

Compare other products

We currently don't have that product, but here are others to consider:

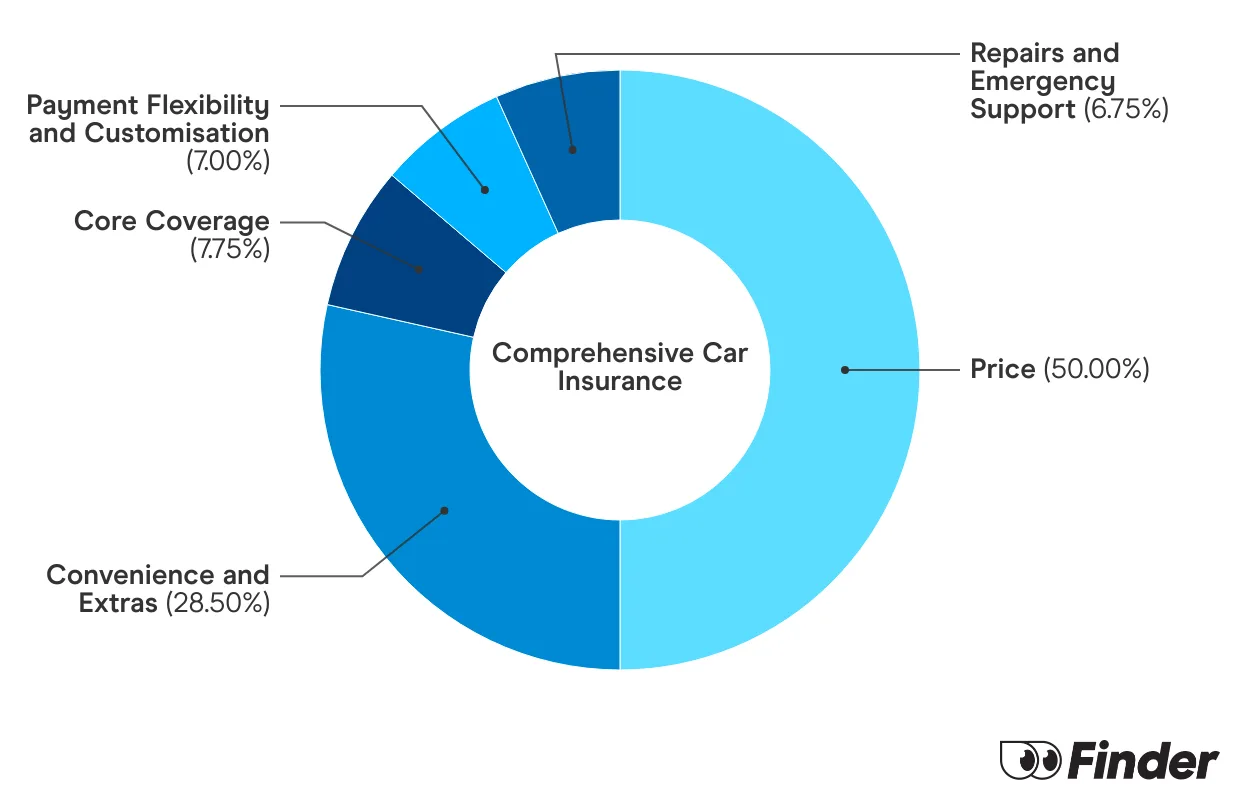

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

FAQs

Sources

Ask a question

More guides on Finder

-

High risk car insurance

Learn the factors that may cause you to be considered a high-risk driver and whether you might be eligible for cover.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.