Hologram Credit Card

Etsy

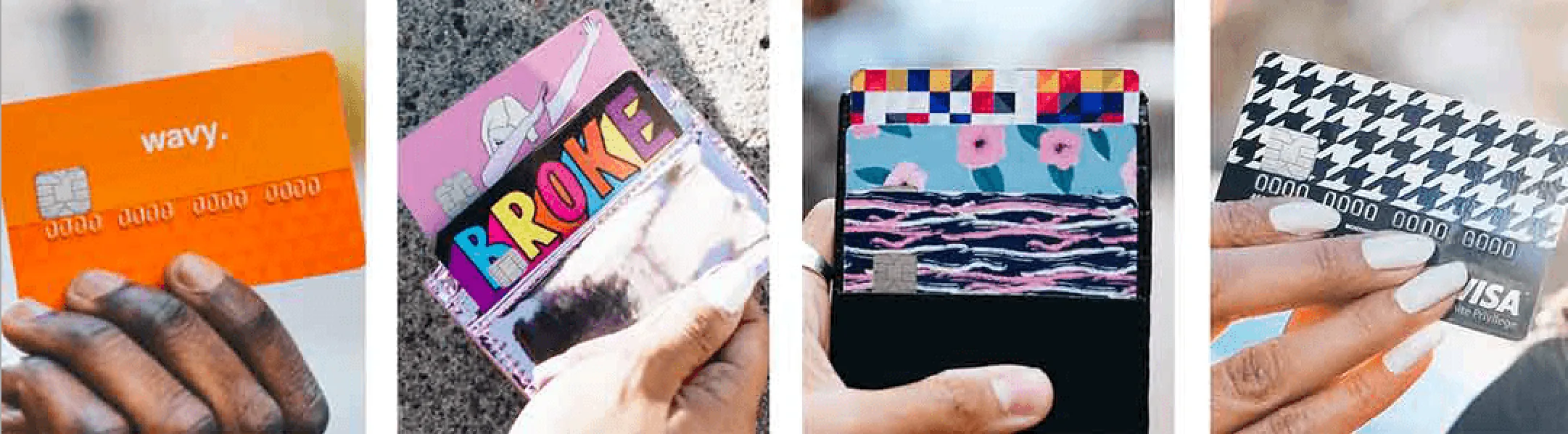

While banks don't provide them, you can get credit and debit card covers and stickers as the easiest way to create a custom design. In most cases, you can just place the sticker on the front of your credit card and keep paying with it as usual.

Plenty of designs leave space for the embedded microchip and the card numbers that are usually printed on the front of the card, and you'll be able to peel the cover off if you decide you don't want it any more.

Here's a look at some of the companies and websites that offer these credit card covers, stickers and sleeves.

CUCU makes removable covers for credit cards, debit cards, gift cards and even transport passes. It offers thousands of designs in categories including animals, anime, gaming and motivation – plus official partnerships with brands including Hello Kitty and the NBA.

You can also design your own and have a choice between a full cover or a half cover for the front of your card. CUCU is based in Toronto, Canada, and prices are typically under AUD$10 for a full cover (although this may vary with exchange rate changes).

Online marketplace Etsy has credit card covers, decals and stickers from sellers in Australia, as well as overseas – including CUCU covers. You can set filters for price, location, delivery speeds and more. Plenty of sellers also offer personalisation such as choosing colours, words, fonts or different prints.

Prices typically range from $1 to $10 or more depending on the seller and the type of sticker or cover you choose. Remember to check shipping costs as well.

There is a range of eBay sellers that offer covers, decals and stickers you can use to customise your credit card. As eBay has a huge mix of sellers, your search results could also include credit card holders and wallets.

You can use filters or try different search terms to help narrow down the results. You can also contact a seller to ask a question or find out if they have more ways to customise your credit card design.

When you're looking at ways to design your own credit card, just remember that you should always be able to see (or easily access) the following features on your card for security and identity reasons:

Most companies that offer custom credit card stickers or other options use the universal measurements for cards. You can also trim designs to make sure all the key details are visible.

Another option is to go digital by adding your credit card details to Google Pay, Samsung Pay or another digital wallet. It's not exactly a visual type of customisation, but it does mean you won't have to even think about the physical design of your credit card (if that's what you want).

Picture: CUCU

Find credit cards that make international spending cheaper with 0% international transaction fees.

Insights and analysis on American Express credit cards, costs, acceptance and more.

Compare credit cards that give you an outcome within 60 seconds of when you submit your application online and find out how to increase your chances of getting this type of "instant" credit card approval.

Get a percentage of your spend back, gift cards or vouchers with a cashback credit card. Find out more and compare current offers in our guide.

You deserve the best credit card. Let us help you find it.

Compare the best Qantas frequent flyer credit cards based on bonus point offers, points per $1 spent, rates, fees and other features so you can find a card that works for you.

Check out bonus point offers and travel perks such as lounge access and complimentary insurance with these Velocity Frequent Flyer credit cards.

When you apply for a credit card online, you could receive a response within 60 seconds. Find out how you to find a card that you're eligible for and increase your chances of approval.

Find out what your credit card options are, whether you're employed casually or get Centrelink payments as your main source of income.

Find out how you can keep your overseas spending costs down by comparing credit cards with no foreign transaction fees and no currency conversion fees.