Ciredt cards are a fast, secure and popular payment option but when were they invented? We've pulled together some key dates and details on the history of the credit card in Australia and globally.

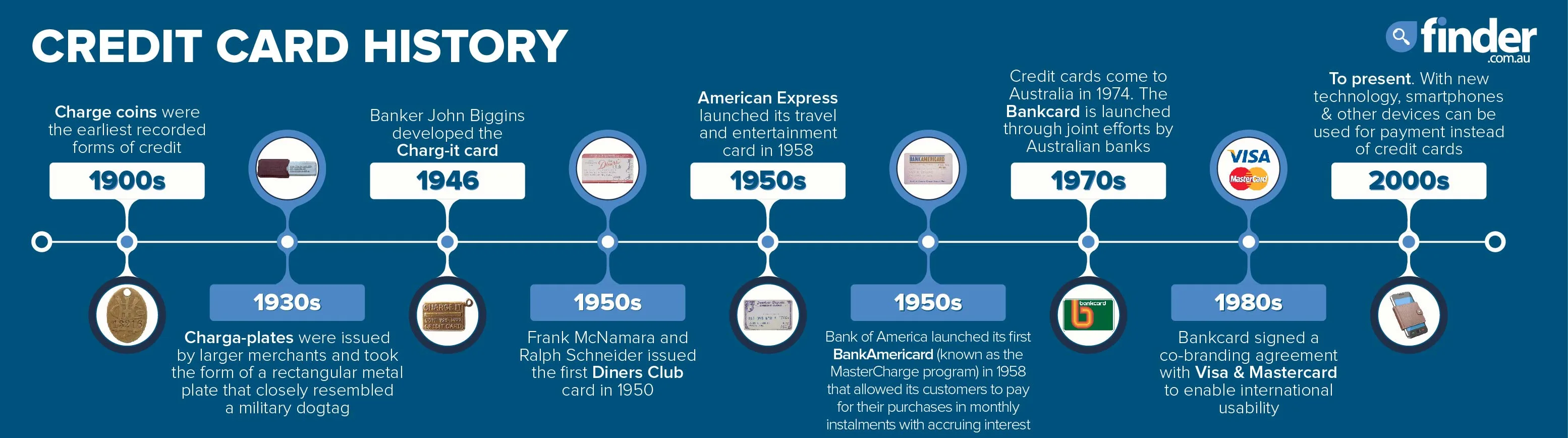

Timeline of credit card history

While forms of credit can be traced back to the dawn of civilisation, we've started at the beginning of the 20th century. This was when synthetic plastics (which helped give credit cards their nickname) were invented.

1900s to 1930s: Early forms of credit

1900s

Carried over from the late 19th century, charge coins were the earliest recorded forms of credit. Large merchants, such as hotels, department stores and petrol companies, would issue their regular customers with charge coins to use with their store charge accounts.

These coins took all shapes and forms and were made out of metal or celluloid, bearing the customer’s charge account number and the merchant’s name and logo for easy imprinting on sales slips. Since there were no other identifying marks on the charge coins, they could be easily stolen and used for fraud.

1930s

Charga-plates came next, taking the form of a rectangular metal plate that closely resembled a military dog tag.

The Charga-plate bore the customer’s name, address, account number and sometimes their signature, which was more helpful for preventing fraud. But this form of credit was still only issued by large merchants and could only be used in the issuing store.

Finder survey: Do Australians think credit card rewards are more or less valuable than 10 years ago?

| Response | |

|---|---|

| About the same | 34.41% |

| Less valuable | 26.68% |

| Unsure | 23% |

| More valuable | 15.9% |

1940s to 1960s: Charge cards and credit cards

1940s

In 1946, banker John Biggins developed the Charg-it card, which was the first attempt by a bank to issue a card that customers could use at more than one merchant store.

Issued by the Flatbush National Bank of Brooklyn in New York, customers could use this card at a range of merchants within the state and the bank would settle payments with merchants on their behalf.

1950s

In 1950, Frank McNamara and Ralph Schneider issued the first Diners Club card. These cards were made of cardboard and could be used in participating restaurants. Cardholders paid an annual fee of US$3 while restaurants paid 7% on transaction values. This was a charge card rather than a credit card, as it didn't offer revolving credit. But it was still a key moment in the development of modern credit cards.

1958

American Express launched its travel and entertainment card in competition with the Diners Club card, while Bank of America launched its first BankAmericard in Fresno California. (It was later renamed Visa in 1976, and further developed).

While Diners Club and American Express issued charge cards at this time, Bank of America issued credit cards that allowed customers to pay for purchases in monthly instalments with accruing interest (or “carrying charges”).

1960s

Around 1965, Bank of America started licensing its Californian credit card system to banks across America. This move also led to the formation of a national bank card association for enabling nationwide use of the BankAmericard (often seen as the beginnings of Visa).

In 1966, Master Charge (renamed Mastercard in 1979) jumped on the scene as a cooperative of Northeastern banks wishing to honour cards issued by one another. These 2 card schemes have gone head-to-head ever since.

1970s: When did Australia start using credit cards?

1970s

Before 1974, only store-issued cards (which could be used exclusively in the issuing store) were used in Australia, with a small number of Diners Club and American Express credit cards accessible to the wealthy.

1974

The Bankcard credit card scheme was launched in 1974 through the joint effort of Australian banks. Working together, they had developed their own card network and implemented the technology needed for a national shared facility. Participating banks issued their own bank-branded Bankcard, with its own card regulations and customer relations.

Also this year, the passage of the Equal Credit Opportunity Act was passed; this allowed women to finally have the ability to apply for a credit card or a loan on their own, without a male co-signer.

1976

By 1976, the Bankcard was a hit. There were 1,054,000 Bankcard holders and almost 49,000 participating merchants. The first ATMs began popping up in Australia in 1977, and by 1978, Bankcards could be used across the nation.

1980s to 1990s: The global credit card market

1980

In 1980, Bankcard signed a co-branding agreement with Visa and Mastercard to enable international usability. But this was a false start, with that agreement quickly dissolving in the same year.

- 1982

The Visa Debit Card, also referred to as the Visa Payment Card, was introduced into Australia in 1982. This is a card that ran through the Visa payment processing system, but that used your own cash rather than using the credit provider's money. Therefore, no interest is charged.

1983-84

The EFTPOS system was launched in Australia, and Bankcard was successfully introduced in New Zealand. As a result, there were over 5 million cards in circulation by 1984.

At the same time, both Visa and Mastercard were launched internationally. This saw the rise of international credit cards in Australia and the beginning of Bankcard’s decline.

1990s

By 1994, the number of Bankcards in circulation was down to 3.9 million – a trend that would lead to its subsequent end in 2007.

But credit cards kept growing in popularity, helped by the invention of telephone and Internet banking in the mid-1990s and BPAY in 1997.

2000s: The rise of rewards, perks and fraud

2000s

The start of the 21st century saw the rise of the rewards credit card as people with credit cards looked for ways to get more bang for their buck.

Earning points per $1 spent and introductory bonus point offers gave people a way to get frequent flyer rewards faster, while credit card reward programs offered flexibility for travel, shopping and cash rewards. Perks like airport lounge access, complimentary travel insurance and travel or flight credit have also become popular.

Mid-2000s

Innovations such as contactless payments, mobile banking and Internet shopping have led to higher incidences of credit card fraud and scams. In particular, phishing, skimming and hacking all became significant threats that took the focus off old-school physical theft.

As a result, card companies, banks and governments have all created policies, services and tools to help keep accounts and personal information safe – including zero-liability protection, fraud monitoring services, government support services and federal investigations into criminal card activity.

2010s: Credit card reforms, cardless payments and Afterpay

2010

The Australian Securities and Investment Commission (ASIC) became the sole regulator for credit law, following the National Consumer Credit Protection Act (2009). This marked the start of a series of updates to credit card regulations, including the following:

- Key Fact Sheets for all cards

- Restricting unsolicited offers for credit or credit limit increases

- Repayment allocation requirements

- Credit limit requirements

- The option to reduce your credit limit or cancel a card online

2016

Australians were quick to adopt tap-and-pay technology built into credit cards and debit cards. In 2016, Australians were the global leaders on contactless payments according to research firm RFi Group, which had found 59% of all Aussies had made a contactless payment.

But cards were still king, with RFi research at the time showing only 10% of Australians said they used a mobile wallet and only 24% would consider it in the future.

2018-19

As newer smartphones came onto the market and mobile wallet apps like Apple Pay, Google Pay and Samsung Pay became more popular, Australia saw a surge in mobile payment adoption. By 2019, contactless payments from smartphones, smartwatches and other mobile devices made up 8% of all in-person card payments, up from just 1% in 2016 according to data from the Reserve Bank of Australia.

Mobile and contactless payments have continued to grow as apps make it easier to pay both in-person and online (and following initial health concerns around card payments when the coronavirus pandemic began).

2018

Afterpay was launched in Australia and kickstarted the buy now pay later (BNPL) trend. At the time, BNPL was not seen as a direct competitor to credit cards, but now it's common to see them compared side by side.

2020s: Current credit card trends

In December 2024, the average credit card balance in Australia was $3,423. There are around 12.08 million credit cards in circulation and a national debt of $19.55 billion accruing interest (you can read more stats here). Current card trends include the following:

- Credit card debt is increasging. Credit card debt had been on a decline since 2020 but spending picked back up in 2023. Finder Analysis shows a noticeable increase in the average credit card balance from $2,721 in January 2022 to $2,993 by August 2023 – before reaching $3,423 by December 2024.

- Bonus offers and cashbacks abound. With so much competition from BNPL, credit providers are getting competitive. Bonus points and 0% interest offers have been popular for a long time, but a more recent trend is one-off cashback offers of up to $250, alongside other credit card perks.

- More no interest credit cards. Now on the market for about 5 years, these cards don't charge interest and have a flat monthly fee when you use them or carry a balance. No interest credit cards are designed as an alternative to buy now pay later and combine features of both BNPL and traditional credit cards.

- Virtual credit cards are the norm. The widespread use of mobile wallets has seen plastic credit cards make way for virtual ones. While it's common to have a plastic card as well as a digital one, some credit card providers are starting to offer instant virtual and virtual-only options, such as the PayPal Rewards Card and MONEYME Freestyle Virtual Card.

Sources

Images: Shutterstock

Ask a question

2 Responses

More guides on Finder

-

Zip Plus

A buy now, pay later account offering spending limits up to $8,000, low interest for higher balances, and no overseas transaction fees.

-

Best international credit cards

Find credit cards that make international spending cheaper with 0% international transaction fees.

-

American Express statistics

Insights and analysis on American Express credit cards, costs, acceptance and more.

-

Australian credit card statistics

Discover exactly how the average Australian uses their credit card.

-

Instant approval credit cards

Compare credit cards that give you an outcome within 60 seconds of when you submit your application online and find out how to increase your chances of getting this type of "instant" credit card approval.

-

Introductory credit card offers for new customers

Compare introductory credit card offers that give you bonus rewards points, 0% p.a. balance transfers, interest-free periods and waived annual fees when you sign up for a new card.

-

Cashback credit cards — up to $500 back

Get a percentage of your spend back, gift cards or vouchers with a cashback credit card. Find out more and compare current offers in our guide.

-

Best Credit Cards in Australia right now

You deserve the best credit card. Let us help you find it.

-

Best Velocity credit cards

Check out bonus point offers and travel perks such as lounge access and complimentary insurance with these Velocity Frequent Flyer credit cards.

-

Credit card repayment calculator

Calculate how much you're paying in interest based on your current credit card repayments and discover how much you should pay each month to meet your financial goal.

When did credit cards first come to Australia and what was the card called?

Hi Kari, As this guide notes, Bankcard, which launched in 1974, was the first “credit card” as we understand them now in Australia, though we’d had store cards and charge cards before that.