What are Qantas Status Credits?

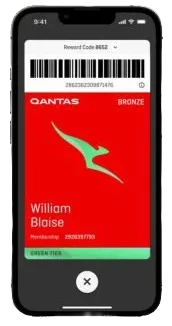

Qantas Status Credits are your ticket to Silver, Gold and Platinum membership levels and more frequent flyer perks – including more Qantas Points for flights, lounge access, extra baggage and priority check-in.

Flying with Qantas or a partner airline is the primary way you'll earn Status Credits. But you can also earn bonus Status Credits with Qantas Money Titanium credit card, the Qantas Green Tier membership and limited-time offers. Let's take a look at your options.

How to earn Qantas Status Credits with a credit card

What is the fastest way to earn status credits on Qantas? Flying is your number one strategy, and with the Qantas Money Titanium (the only credit card that offers an ongoing Status Credit benefit), you can get 20% bonus Status Credits for eligible Qantas flights you pay for using the card.

Sometimes, Qantas Frequent Flyer credit cards also have bonus Status Credits as part of their introductory offers, and these promotions can give you a way to get more Status Credits without any flights. Each offer is different, but some common requirements include:

- Promotional period. Bonus Status Credit offers are only available for a limited time – there are no credit cards that earn Status Credits on an ongoing basis.

- New customers only. Introductory offers may be available if you’re applying for an eligible credit card as a new customer.

- Spend requirements. Usually, you have to meet a spend requirement when you first get the card, or one that's based on your spending over 12 months. For example, making an eligible purchase in the first month you have the card, or $20,000 in the first year.

- Provide your Qantas membership number. To collect Qantas Status Credits with a credit card, you’d need to share your Qantas Frequent Flyer membership number at the time of applying and/or when you meet the spending requirement.

How can I get Qantas status without flying?

Qantas Green Tier was launched in March 2022 and is designed to give Qantas frequent flyer members rewards for making more sustainable choices – including a choice of 50 bonus Status Credits when you qualify.

To get Qantas Green benefits, you need to complete at least 1 activity for 5 of the 6 categories during your membership year:

- Offset your Qantas flight

- Stay at an eco-accredited hotel

- Offset your home and car or install solar panels through Solargain

- Purchase eco wine or make your delivery climate positive

- Take a quiz in the Qantas Wellbeing App to understand your impact

- Donate Qantas Points to charities supporting sustainable causes

Qualifying for Qantas Green also gives you access to other perks, including bonus Qantas Points on sustainable products and experiences through Qantas Hotels and Qantas Wine.

Finder survey: How many Australians consider access to status credits when choosing a frequent flyer credit card?

| Response | Male | Female |

|---|---|---|

| Status credits | 2.82% | 1.38% |

Can I buy status credits on Qantas?

No, it's not possible to buy Status Credits. You can buy frequent flyer points with both Qantas and Velocity, but Status Credits can not be purchased.

"Status credits help you build towards silver, gold or platinum tiers, which give you things like airport lounge access, priority access when boarding, and extra points earned on flights. If lounge access is important to you as the main perk of status, you can pay for a Qantas Club membership from $699 for 1 year, plus a one-off joining fee of $129."

Other bonus Status Credits offers

Qantas Frequent Flyer sometimes runs promotional offers that give you a way to earn Status Credits without flying.

To see if there are any new bonus Status Credit offers that you can get without flying, just check the member offers on the Qantas Frequent Flyer website, sign up for emails or log in to the Qantas app.

Loyalty bonus Status Credits

Qantas Frequent Flyer also gives you a choice of 50 Status Credits as a Loyalty Bonus if you earn 500, 1,000, 1,500 or 2,000 Status Credits on flights with Qantas or Jetstar during your membership year.

You can earn a Loyalty Bonus up to 4 times in each membership year, which means you could technically get 200 Status Credits through the bonuses – but you'd need to fly a lot to get enough Status Credits to qualify for all of them.

How many Qantas Status Credits do I need?

If you want to reach a higher Qantas Frequent Flyer membership level, you’ll need to earn a set amount of Status Credits in the 12 months from when you joined the program. For 'Lifetime' levels, the Status Credits needed are your total balance, regardless of when they were earned. Here’s what’s needed for each membership level:

- Silver. 300 Status Credits to reach Silver and 250 Status Credits each year to maintain.

- Lifetime Silver. 7,000 Status Credits

- Gold. 700 Status Credits to get Gold Qantas membership and 600 Status Credits to maintain it in each subsequent year.

- Lifetime Gold. 14,000 Status Credits

- Platinum. 1,400 Status Credits to reach the Platinum Qantas membership tier and 1,200 Status Credits to maintain it.

- Lifetime Platinum. 75,000 Status Credits

- Platinum One. 3,600 Status Credits to get and maintain Platinum One status. At least 2,700 of these credits must be earned on Qantas-marketed flights and Status Credits earned through a frequent flyer credit card won’t count towards this membership level.

You can learn more about Status Credits and membership levels in Finder's guide to the Qantas Frequent Flyer program.

Frequently asked questions

Sources

Ask a question

4 Responses

More guides on Finder

-

KrisFlyer credit cards – how to earn KrisFlyer Miles in Australia

Earn KrisFlyer miles on your everyday spending and get introductory bonus points with a credit card linked to the Singapore Airlines frequent flyer program.

-

Qantas and Velocity credit cards with no annual fee

How to pay less for your card while still earning points.

-

The best ways to spend 100,000 Velocity Points

From flights and hotel stays to travel packages, gift cards and merchandise, here’s how to make the most of 100,000 Velocity Points based on your lifestyle and goals.

-

How many Qantas or Velocity points do you need to upgrade to business class?

Discover how many Qantas or Velocity points you need to book or upgrade to a business class flight ticket.

-

Air Miles Credit Cards

Reward your spending with an air miles credit card and redeem points for your next flight.

i want to buy a flight which needed 71,200 points. I have only 71,118. Can I still somehow buy a ticket using my points and paying a little bit more cash, than needed?

Hi Anatoly,

Yes, you can book your flight by either using Qantas’s “Points Plus Pay” feature to cover the small difference with cash or by purchasing the missing 82 points as “Top-up” points; you can buy a minimum of 1,000 points for around $30-$40. Points Plus Pay lets you adjust a slider to use a mix of points and money. You could also download the Qantas app and earn small amounts of points as rewards for staying healthy. Hope this helps!

Do all credit card providers charge a overseas transaction fee for purchases when overseas?

Also, do they charge a reward program fee?

Hi George,

Thanks for getting in touch!

Do all credit card providers charge an overseas transaction fee for purchases when overseas? – not all credit cards charge an overseas transaction fee. You may refer to our list of credit cards with 0% international transaction fees. On the page is a comparison table you can use to see which card suits you.

Also, do they charge a reward program fee? – There’s no reward program fee but the perks will usually influence the annual fee.

Hope this was helpful.

Best regards,

Nikki