Compare other products

We currently don't have that product, but here are others to consider:

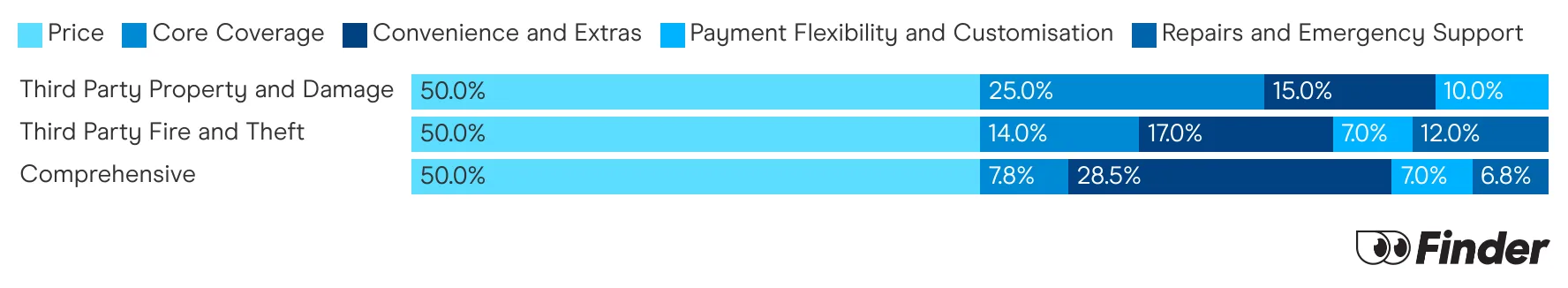

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Key takeaways

- You can insure a learner driver by taking out a separate policy or adding them onto an existing policy.

- Adding a learner to an existing car insurance policy will generally be cheaper than buying a new one.

- If you're their parent, many insurers will cover the learner driver automatically and for free.

How do you get car insurance for learner drivers in Australia?

When insuring a learner driver, there are two main ways to do it:

- Take out a separate policy. This is required if the learner has their own car is the the one who drivers it most often. This options allows them start working towards their no claims bonus but may come with a higher premium.

- Add them onto an existing policy. A learner can be added to an existing policy as long as they're not the main driver of the car. Sometimes this won't affect your current car insurance premium. The worst that can happen is if the learner causes an accident, the policyholder will be charged a young or inexperienced driver excess.

Is it better to add a learner to an existing policy or buy a separate one?

In most cases it is better to add a learner driver to your policy than it is to take out a new one just for them. Here are a few reasons why:

- It's easier. Many insurers will automatically cover learner drivers or let you add them with little fuss.

- It's usually less expensive. Adding a learner driver to your policy does not usually result in an increased premium. You're only charged extra in the form of additional excesses when it's time to claim.

- You're in control. A learner driver cannot drive without a licensed driver supervising them, even in their own car. By having them on your policy rather than their own, you have a little more control over when they can drive.

But you can't add a learner driver to your policy if they're the main driver of the vehicle.

What is the cheaper option?

We collected quotes from a few providers to figure out if it was cheaper to add a learner driver to an existing policy or for them to take our their own. Across the board, it was cheaper to add a them to an existing policy. The two exceptions were Bingle and Kogan, where the price was the same.

Keep in mind these costs are only indicative of the quotes we gathered and should only be used as a suggestion. What you end up paying will depend on your unique circumstances.

To find out more about how we got our quotes and the persona we used, read the methodology below.

| Brand | Standard cost without a learner driver | Learner driver as an additional driver | Learner driver on their own policy | Get quote |

|---|---|---|---|---|

| $1,691 | $5,223 | Unable to get cover | More info | |

| $887.74 | $2,520.91 | $2,520.91 | Get quote | |

| $1,315.51 | $6,262.41 | $6,262.41 | Get quote | |

| $1,629.66 | $3,146.19 | $3,857.48 | More info |

How do I add a learner driver to my policy?

Adding a learner driver to your policy couldn't be simpler. Some insurers will automatically cover learner drivers as long as there's a licenced driver in the passenger seat. :

- Add the driver to your policy. Phone your insurer or visit their online member portal and add the driver to your policy.

- State the driver's details. Your insurer will want to know important information about the driver including licence status and age.

- Accept any new excess. Instead of charging you an added premium to cover the learner driver, insurers will usually collect their fee on the back end by charging you an additional excess if you have to claim on this driver.

- Make sure they're supervised. You'll only be covered for the learner driver if another licensed driver is supervising from the front passenger seat.

What if it's a parent's policy? The good news, it's usually even easier. This is because learners are treated as listed drivers on a parent's policy even if they aren't technically listed on the certificate of insurance. Most policies will cover the learner drivers for free, no questions asked.

If your insurer does require you to list your learner driver on your policy, you can follow simple process above.

How much is the learner driver excess?

If you make a claim for an incident where a learner driver was behind the wheel of your car, you'll most likely need to pay one of more of an additional excess on top of the basic excess.

These can vary between insurers and may include:

- Basic excess. The standard excess will always apply, whether it's you or your child driving.

- Learner driver excess. Learner drivers often have their own excess applied.

- Young driver excess. If they're under 25, a young driver excess is applied on top of everything else.

- Undeclared driver excess. If you're keeping your premiums down by not listing the learner driver on your policy, an additional excess may apply.

- Optional excess. If you've opted for an extra excess to lower your premiums, this will be added on as well.

- Inexperienced driver excess. This generally applies to learner drivers over the age of 25.

- Car excess. An additional excess may be applied based on the age of your car or its type.

Here's how excesses stack up between 4 underwriters

| Underwriter | Driver under age 21 | Driver aged 21-24 | Inexperienced driver | Unlisted driver |

|---|---|---|---|---|

Auto & General | $600 | $500 | $500 | $600 |

Insurance Australia Group | $800 | $450 | $400 | No excess |

Suncorp | $400 | $400 | $400 | $1,400 |

Hollard | $1,200 | $800 | $800 | $1,600- $2,000 |

How to get car insurance for a learner driver with their own car

If you can't avoid a separate policy for the learner driver, you'll need to help them take out a Compulsory Third-Party (CTP) insurance. This is mandatory cover all cars on the road must have and helps pay for any medical costs for anoyone the driver injures in an accident. In some states this comes automatically with your car registration.

On top of that, you can choose to add a comprehensive car insurance or a third party car insurance policy for added protection.

Save on car insurance for learner drivers with their own car

If you have to take out a separate policy for your learner driver, you'll want to save wherever you can. Here are a few tips to help you do just that:

- Choose a safe and reliable car. The safer and more reliable the car is, the lower the risk and the lower the premiums. Think sedan vs. sports car.

- Choose an inexpensive car. An inexpensive car that wouldn't bankrupt you if you had to replace it would allow you to take out a lower level of insurance, like third-party property damage. Even with comprehensive cover, having a cheaper car would also translate to cheaper premiums.

- Promote safe driving skills. If you can help your learner keep a clean slate over a few years, their premiums will eventually begin to drop.

- Think about security. If you park your learner's car in a locked garage and make sure its anti-theft systems are up to scratch, your insurer will likely charge you less.

- Choose a higher excess. Most insurers will let you choose a higher excess in order to lower your premiums. However, this is usually only available on comprehensive policies. Just be careful with learner drivers: claims can get expensive since they will also attract an a young or inexperienced driver excess.

- Drive less. Insurers will often adjust your premiums based on how many kilometers you say you drive. You can keep you premiums down by limiting the kms your learner puts on the car every year and you can even consider a pay as you drive policy.

- Look for discounts. Car insurers will often offer discounts, including discounts for buying your policy online or for insuring multiple cars with them.

- Shop around. Compare car insurance quotes from a range of companies to find the best value for money.

What is the best learner driver insurance?

The best policy will be one that offers and the learner driver the appropriate amount of cover based on your individual needs. Here are a few situations where you might benefit from different types of car insurance:

You're getting them a separate policy

Here's how to find the best policy for your needs and the learner's needs based on your situation:

- The learner drives a hand-me-down. If the learner drives a used car that you can easily replace if damaged, the best policy would be a third-party property policy. This will cover damages to others' property, but you won't be wasting money on premiums to protect a car you can replace anyway.

- The learner driver drives an expensive car. If it would be difficult for you to replace the car, a comprehensive policy will be best since it protects the car from almost every type of damage including damage the learner causes. Just be aware that this will probably have a hefty price tag.

- You or the learner owes money on the car. If you owe money on the car, your lender will probably require you to have comprehensive car insurance. Since you'll have no choice in the matter, comprehensive will be the best one in your case!

You're adding them to your policy

You'll want a policy that easily covers them and doesn't break the bank. Look for something does the following:

- Automatically cover the driver for free. The best policy will automatically cover learner drivers so you don't have to list them on your policy or pay any extra on your premiums.

- Keep the excess low. Everything else being equal, the best policy will have the lowest young or inexperienced driver excess. This excess can differ by as much as $800 based on the policy and if the learner gets into an accident you'll have to eat this extra cost.

How many demerit points do learners have?

Any learner driver will have to keep a keen on their demerit points. Compared to a full licensed driver, will learners generally have much less leeway before they lose their license.

Each state and territories rules and demerit threshhold varies. To give you a better idea, we've broken down how many demerits are too many below.

| Learners: # of demerits to lose your licence | Full licence: # of demerits to lose your licence | Learners: Penalty | |

|---|---|---|---|

| NSW | 4 in a 3-year period | 13 in a 3-year period | 3 months suspended licence |

| VIC | 5 in a 12-month period OR 12 in a 3-year period | 12 in a 3-year period | 3 months suspended licence |

| WA | 4 for the entire time you hold a learner's licence until the end of the 1st year of holding a provisional licence | 12 in a 3-year period | 3 months suspended licence |

| SA | 4 for the entire time you have your learner's and/or provisional licence | 12 in a 3-year period | 6 months suspended licence |

| TAS | 4 in a 1-year period | 12 in a 3-year period | 3 months suspended licence |

| QLD | 4 in a 1-year period | 12 in a 3-year period | 3 months suspended licence |

| ACT | 12 in a 3-year period | 12 in a 3-year period | 3 months suspended licence |

| NT | 5 in a 1-year period OR 12 in a 3-year period | 12 in a 3-year period | 3 months suspended licence |

Frequently Asked Questions

Sources

Ask a question

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.