When you take out a car insurance policy, you get to choose between insuring your car for market value or agreed value. Market value means the figure of what your car is worth is decided on the day that you make a claim, based on what your insurer estimates your car is worth — this could be in line with what you think it's worth, or you might get a nasty surprise. For those who love known outcomes, you can choose agreed value, where you and your insurer agree on a a specific amount. Sounds great, right, so what's the catch? Your premiums are likely to cost more for an agreed value policy.

Compare policies with agreed and market value

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for car insurance

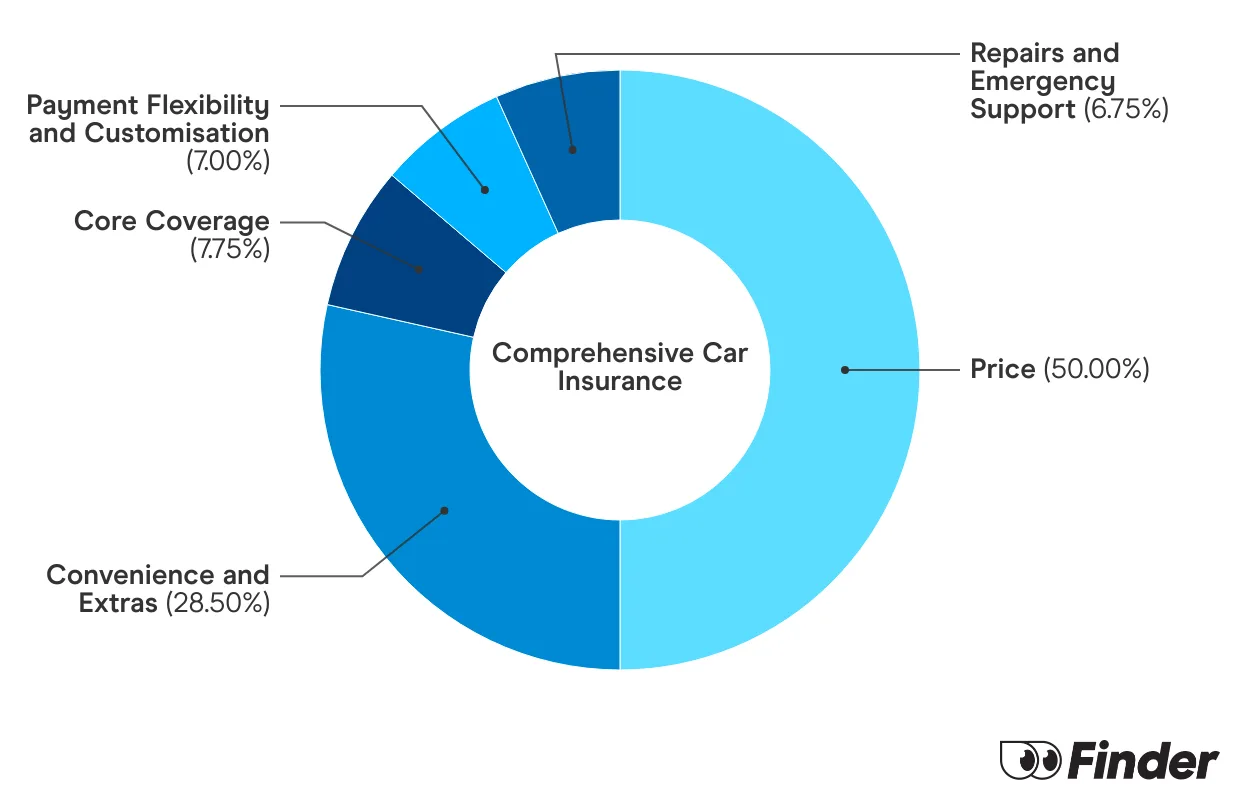

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

How do they compare on price?

Agreed value policies tend to cost more for 2 reasons:

- The agreed value sum insured is typically higher than the market value sum insured. A larger sum insured comes at an additional cost.

- Your agreed value will stay the same over the 12-month policy, while the market value will typically decrease with every day that passes.

The pros and cons of market value car insurance

Pros:

- The policy premium is usually cheaper than agreed value.

- Your sum insured is automatically updated to the standard market value.

- You avoid paying more than you need to.

Cons:

- Your vehicle’s market value might be less than you think.

- A well-maintained car might be undervalued according to the market value.

- In the event of a claim, your payout may be considerably lower than an agreed value policy.

"When picking between agreed or market value, it's good to know how the second hand car market is for your car model. For example, when the production of cars was low during lockdowns, second hand cars were selling well above the normal price because new cars were so hard to come by. This made the market value of cars pretty high, which meant that selecting this cover could actually be more expensive than agreed value. However, this can change with the market. If you want to know for sure what your car is insured for, agreed value is the way to go. Personally, the market value of my car would cover what's remaining on my loan so I've gone with market value cover. "

The pros and cons of agreed value car insurance

Pros:

- You know exactly how much you are insured for in the event of a claim.

- You're able to set the amount to be higher or lower than the suggested amount, to get a policy price that suits your needs and your budget.

- You can choose your own level of cover to properly reflect the importance and value of your car.

Cons:

- It typically costs more than a market value policy.

- The risks of a total write-off are lower than a regular claim for repairs, so you're paying more for car insurance and you may not even make a claim.

- Restrictions may apply to the age, value or type of car that can be insured at agreed value.

So which option is best for me?

The right policy for you depends on your situation and you should always consider the benefits and drawbacks of each policy in line with your own needs.

In a general sense: agreed value can be a great idea if you want to know the exact level of cover you have, and it gives you peace of mind knowing what that payout figure is if you have to make a claim. Market value can be a great idea if you want to keep your premiums affordable and the payout would cover your loan in the event of a claim.

If you’re having trouble deciding, try considering the following situations:

- Do you own a rare, vintage, modified or classic car? You probably want agreed value, as it'll be much more accurate in reflecting of how much these kinds of vehicles are worth, including modifications and aftermarket extras.

- Was your car expensive? If your car was a major investment, then agreed value makes sense. With market value you may only be able to recover a fraction of the amount you paid in the event of a total loss.

- Do you plan on getting a new car soon? Hopefully you won’t have to make a claim before then and you can save time and money by opting for market value.

- Is saving money your top priority? If so, a cheap car insured at market value might be the right type of cover for you.

- Do you absolutely need a car? Is your car absolutely essential for getting to work, or is it more of a convenience? If it’s a necessity, then agreed value means you know you’ll be able to afford a new one if your current car is written off. Market value may not provide you with enough of a claim payout for a suitable new car.

Compare policies from Australian brands

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

Can an insurer write-off and cancel the licence on a vehicle without advising the owner?

After hitting a kangaroo, we checked car, all well safety wise, bar both headlight glass broken lights still good. bonnet bent but still locks , tracks straight , stops straight.so drove over 300 kms home. The repair cost was within a few hundred dollars of their write-off amount. We were still contesting their payout amount & driving the car, as vast distances are involved.

On the 1/03/2018 in the mail, we were informed by Department of transport that on 21 /02/2018 the licence had been cancelled, and unbeknown to us, we had been driving a unregistered vehicle.

We did agree to have the car repaired at no extra cost to the insurer on the 1/03 /2018 after a phone conversation with the insurer, Cash Settlement to be made, vehicle to be left REGISTERED. We keep salvage of said vehicle.

Is there anything we can do to have the insurer have the car registered so we can have it repaired? We are 900 kms from a major city , to licence a written-off vehicle we will need to have the car carried to an inspection point that is accredited by dept. of transport to pass inspection , as there is no accredited repairers for written off vehicles anywhere near us.

Hi John,

Thanks for reaching out to Finder.

I’m sorry to hear that you were taken by surprise that your vehicle was registered as a repairable write-off and that the registration was cancelled. The Motor Vehicles Regulations 2010 didn’t specifically state whether the insurer needs to notify the owner before it gives notice to the Registrar in relation to the vehicle’s assessment. They are, however, mandated to notify the Register within 7 days from when the determination is made by them to write off the vehicle. Time constraint could be a factor why you weren’t informed beforehand. You can ascertain the exact reason from your insurer directly. You can also call VicRoads on 13 11 71 to discuss your concern about the vehicle written-off process.

As to re-registering your car, you need to have it repaired and assessed as roadworthy during the VIV inspection first before you can register it again. You can reach out to VicRoads Vehicle Fitness Section on 1300 360 745 to discuss the technical requirement of the VIV inspection. You might also find VicRoads’ written-off vehicles FAQs informative.

Now, regarding the repair costs and settlement, it’s a good idea to have those in writing just in case you will need them along the process. Moreover, you can also seek professional advice on the matter.

I hope this information helps.

Cheers,

Liezl