Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseHow can a balance transfer help me save money?

A balance transfer credit card is designed to give you more breathing room to pay off your debt without any interest for a promotional period. Depending on the size of your debt and the interest rate you're currently paying, this could save you tens, hundreds or thousands of dollars. Below we've explained how balance transfers work and how the different features can help you save.

Promotional balance transfer rate

Most balance transfer credit cards in Australia boast a 0% interest rate for a promotional period. Compared to the standard purchase rate (which can range from 8.99% on a low rate card to around 22% on a premium card), you can take advantage of the interest-free period to clear your debt without the burden of compounding costs.

At the end of the promotional period, a higher revert rate will apply to any remaining debt from the transfer. To make the most of your balance transfer card, you should aim to pay your debt in full before this revert rate kicks in.

Length of introductory period

The length of the 0% balance transfer offer will vary from around 6 to 24 months. The longer the interest-free period, the more you can space out your repayments and generally the more you can save on interest costs. You should also consider other factors like the annual fee, any balance transfer fee and revert rate to decide which option is right for you.

Ideally, you should pick a balance transfer card that gives you enough time to pay off your entire balance in full before the revert interest rate applies. For example, let's say you have a debt of $5,000 and are looking at a card with 0% p.a. on balance transfers for 18 months. You'd need to allocate $278 each month to clear your debt in the first 18 months.

If you don't think you can afford this much each month, look for a card with a longer interest-free period to spread out and reduce your monthly repayments.

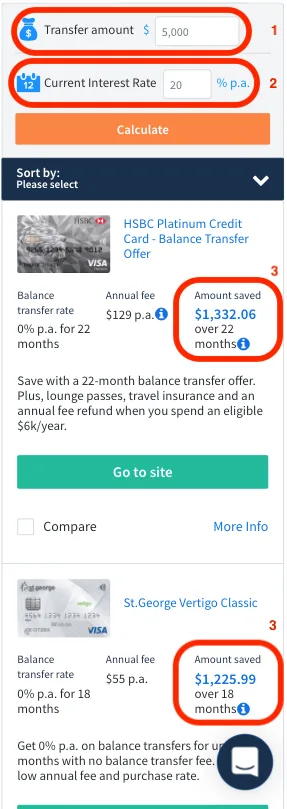

How to use the balance transfer calculator in 3 easy steps

Now that you know how a balance transfer can help you save money, you can use the table above to compare which credit cards offer you the biggest savings in 3 easy steps:

- Step 1. Enter the total debt/outstanding amount you would like to transfer

- Step 2. Provide the interest rate that you are paying on your existing debt (if you don't have your interest rate on you, the average is around 18-20%)

- Step 3. See the 'Interest Saved' column to find out which credit cards will save you the most money

If you want to find out more about a particular credit card, click the ‘More info’ link for a full review on the features and benefits.

A balance transfer credit card can be a useful debt consolidation tool when you pick the right card and pay off your balance in full. As there are many 0% balance transfer credit cards on the market, make sure to compare your options before you apply.

Sources

Ask a question

13 Responses

More guides on Finder

-

What is a balance transfer credit card?

Balance transfer credit cards can help you reduce your credit card debt. This guide explains how they work, their benefits, and what to watch out for.

-

Can I transfer Zip Pay funds to a bank account?

Find out what balance transfer credit card options you can use to consolidate debts from Zip Money, Zip Pay and other interest-free accounts.

-

Can I transfer my credit card debt to another bank?

Balance transfers are not allowed between certain credit card brands. Read on for a list of lenders that do and don’t allow a balance transfers between them.

-

Which credit cards let you balance transfer personal loan debt?

Use this guide to see which providers accept balance transfers from a personal loan to a credit card and discover how you can repay your debt faster with 0% balance transfer offers.

-

Balance transfers for existing customers

Here's how to get more value out of your credit card with exclusive promotions, offers and perks available to existing customers.

-

Credit card debt settlement

Is it worth paying a debt settlement company to help you deal with credit card debt, or can you do it on your own?

-

Balance transfer limits — a simple explanation

If you're considering a balance transfer, compare which credit cards can accept your debt based on the balance transfer limits.

-

Can you do a balance transfer to someone else’s credit card?

Get details of what credit cards may be available when you and your partner are looking for a way to balance transfer debt between you.

-

Stoozing, the 0% interest rate credit card hack

Learn about the concept of making money from credit cards with stoozing and the downfalls you should look out for.

Can you transfer more than one credit card balance to a new card?

Hi Jade,

It depends on the card you transfer to. Some card issuers will allow you to transfer from 2 or 3 cards into one new card, provided the total amount transferred is no more than 90% of your new credit limit.

Hope this helps!

Have booked a trip to India; can you pls advise which travel card from Australia I should obtain? Thanks.

Hi Kersi,

Thanks for getting in touch with Finder. I hope all is well with you. 😃

We do have a list of travel money cards for India. You may refer to our comparison table to help you find the card that suits you. You can compare based on fees, features, and descriptions. When you are ready, press the ‘Go to site’ button to apply.

Please make sure though to read the eligibility criteria, features, and details of the card, as well as the relevant PDS/ T&Cs of the card before making a decision and consider whether the product is right for you.

I hope this helps. Should you have further questions, please don’t hesitate to reach out again.

Have a wonderful day!

Cheers,

Joshua

Myself and my partner have had an application denied and we didn’t even get to submit any of our personal financial details so we requested that re-assessment of the application with the payment details and we can’t work out why we have been denied. All they told us is we don’t meet their requirements. We currently have a credit card that we want to transfer the balance to a period of interest free. We have only applied the once. Do you have any suggestions on how we go about getting a credit card, without getting marks against our credit rating if we were to get further denials ?

Hi Rachael,

Thanks for your inquiry.

It would be best to directly visit a bank branch for credit inquiries. Please see our guide credit card application tips and recommendations on improving your chances on main credit criteria. It may also be beneficial to request a copy of your credit file.

Cheers,

Jonathan

If you balance transfer from an existing credit card do you have to close it down or can you continue to use that card?

Thanks

nick

Hi Nick,

Thanks for your question.

You aren’t required to close your previous credit card account, whether or not you close it will be up to you.

I hope this has helped.

Thanks,

Elizabeth

People need to remember that if they take a balance transfer from a card that also has normal purchases on it and they are unpaid, the lender credits payments to the interest free amount first while the balance of purchasers continue to accrue interest.

So the benefits may not be as much as they would hope for.